Last Update01 May 25

Key Takeaways

- Easing of FCC restrictions and strategic refinancing may enhance operational efficiency, reduce debt, and boost earnings through consolidated growth and improved net margins.

- Strategic focus on women's sports broadcasting and investment in EdgeBeam Wireless JV are positioned to increase advertising revenue and unlock new future revenue streams.

- Heavy reliance on political advertising and debt load poses risks to revenue stability and financial flexibility amid declining traditional revenue sources.

Catalysts

About E.W. Scripps- Operates as a media enterprise through a portfolio of local television stations, national news, and entertainment networks in the United States.

- The anticipated easing of FCC ownership restrictions may allow for network consolidation, providing E.W. Scripps with enhanced operational efficiencies and potential revenue growth through economies of scale.

- Ongoing debt refinancing efforts are expected to reduce leverage significantly, which would improve net margins by lowering interest expenses.

- Scripps’ strategic move into women’s sports broadcasting, especially with entities like the WNBA, is generating significantly higher advertising revenue compared to non-sports programming, impacting overall earnings positively.

- Successful debt refinancing is expected to keep interest rate increases minimal, allowing for strategic allocation of operating cash flow to further reduce debt, enhance financial stability, and potentially increase earnings.

- The company’s investments in the EdgeBeam Wireless JV to leverage broadcast spectrum are poised to unlock new revenue streams in the future, potentially boosting earnings as the market develops.

E.W. Scripps Future Earnings and Revenue Growth

Assumptions

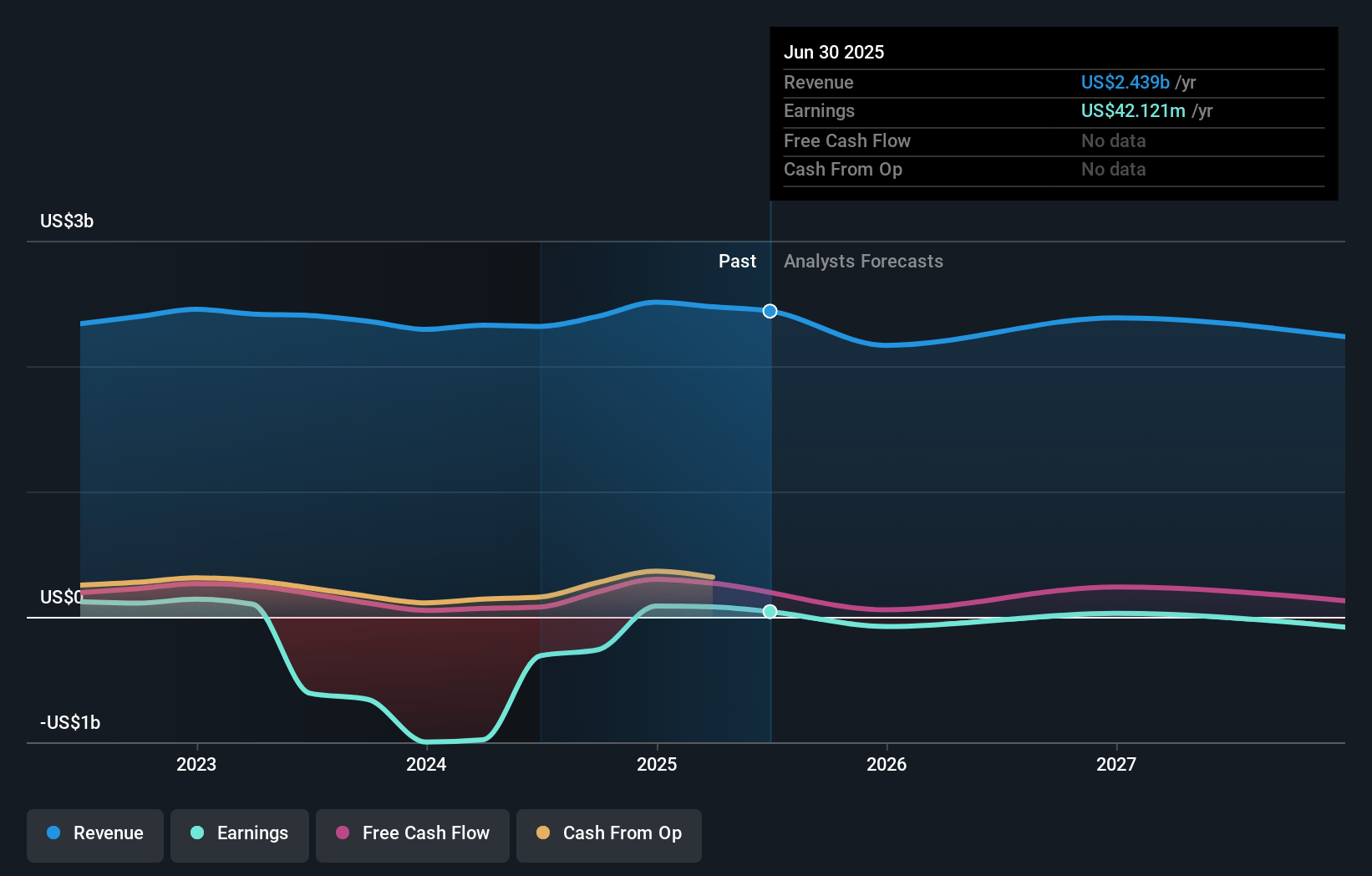

How have these above catalysts been quantified?- Analysts are assuming E.W. Scripps's revenue will decrease by 3.9% annually over the next 3 years.

- Analysts are not forecasting that E.W. Scripps will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate E.W. Scripps's profit margin will increase from 3.5% to the average US Media industry of 8.5% in 3 years.

- If E.W. Scripps's profit margin were to converge on the industry average, you could expect earnings to reach $189.9 million (and earnings per share of $2.11) by about May 2028, up from $86.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.6x on those 2028 earnings, up from 2.2x today. This future PE is lower than the current PE for the US Media industry at 16.8x.

- Analysts expect the number of shares outstanding to grow by 1.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

E.W. Scripps Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on political advertising revenues, which can be volatile and inconsistent, poses a risk to stable revenue streams during non-election years, impacting overall revenue stability.

- The expected decline in core advertising revenue by low to mid-single-digit range in the Local Media division, influenced by economic factors such as consumer hesitation and delayed spending, highlights underlying market uncertainties that could pressure revenues and margins.

- The anticipated decrease in network affiliation fees due to changes in the pay TV ecosystem could reduce revenue from traditional sources, negatively affecting net margins if not offset by growth elsewhere.

- The company's heavy debt load, with total debt at $2.6 billion, could limit its financial flexibility and ability to invest in growth initiatives, potentially affecting long-term earnings growth and shareholder value.

- The potential risks associated with executing the FCC's regulatory changes and the uncertainty in achieving economies of scale through consolidation may hinder expected improvements in operating performance and failed market assumption could adversely impact revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.45 for E.W. Scripps based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.2 billion, earnings will come to $189.9 million, and it would be trading on a PE ratio of 3.6x, assuming you use a discount rate of 11.4%.

- Given the current share price of $2.23, the analyst price target of $5.45 is 59.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.