Last Update 09 Dec 25

MTCH: Share Repurchases And User Monetization Will Support Balanced Future Returns

Analysts nudged their price target on Match Group slightly higher to approximately $37.32 from about $37.32, reflecting marginally lower discount rate assumptions while maintaining steady expectations for revenue growth, profit margins, and future earnings multiples.

Analyst Commentary

Recent Street discussions around Match Group reflect a balanced mix of optimism on execution and user monetization, alongside caution about competitive intensity and macro driven volatility in discretionary spending.

Bullish Takeaways

- Bullish analysts point to stable revenue growth assumptions and resilient margins as support for maintaining valuation multiples near current levels, despite only marginal changes in discount rates.

- There is confidence that product innovation, including enhancements to matching algorithms and premium feature bundles, can sustain payer growth and average revenue per payer over the medium term.

- Some see room for upside if management executes effectively on international expansion and cross platform monetization, which could justify a rerating of earnings multiples from current levels.

- Supportive cash generation and a relatively asset light model are viewed as key strengths that can fund buybacks or selective M and A, providing an additional lever for shareholder returns.

Bearish Takeaways

- Bearish analysts caution that the current price target already embeds solid execution, leaving limited room for error if user growth slows or competitive offerings pressure pricing power.

- There is concern that ongoing macro uncertainty, particularly around consumer discretionary spending, could weigh on conversion to paid tiers and slow top line momentum.

- Some remain wary that elevated marketing and product investment, needed to defend share across dating platforms, could cap margin expansion and constrain upside to earnings forecasts.

- Questions persist about the durability of long term growth as the online dating market matures, with downside risk if new products fail to meaningfully expand Match Group’s addressable user base.

What's in the News

- Match Group completed a major share repurchase tranche, buying back 6.69 million shares in the latest period and 18.77 million shares in total. The company retired roughly 7.6% of shares outstanding for about $602.6 million under its December 2024 authorization (Key Developments).

- The company issued fourth quarter 2025 guidance calling for revenue of $865 million to $875 million, implying 1% to 2% year over year growth, with projected net income attributable to shareholders of $159 million to $164 million (Key Developments).

- Tinder rolled out its Face Check facial verification feature in the U.S., making liveness and photo matching mandatory for new users in seven countries and in California. The company plans to expand to more states after early data showed over a 60% drop in exposure to potential bad actors and more than a 40% decline in bad actor reports (Key Developments).

Valuation Changes

- Fair value estimate is effectively unchanged at about $37.32 per share, indicating no material shift in the intrinsic value outlook.

- The discount rate has fallen slightly from roughly 9.70% to about 9.59%, reflecting a modestly lower perceived risk profile or funding cost.

- Revenue growth is essentially unchanged at approximately 5.07% annually, signaling stable expectations for top line expansion.

- The net profit margin is effectively flat at about 20.69%, suggesting no meaningful revision to long term profitability assumptions.

- The future P/E has edged down slightly from around 11.66x to about 11.62x, implying a marginally lower multiple applied to forward earnings.

Key Takeaways

- AI-driven innovation, safety enhancements, and alternative payments are set to boost engagement, retention, and profitability across Match Group's brands.

- Focused global expansion and shifting cultural trends help diversify users and revenue sources while strengthening growth beyond mature core markets.

- Declining user metrics, overreliance on Tinder, increased competition, regulatory costs, and user trust concerns threaten Match Group's long-term revenue growth and profitability.

Catalysts

About Match Group- Engages in the provision of digital technologies.

- Accelerated product innovation-especially at Tinder and Hinge with new AI-powered features, personalization, trust/safety enhancements, and lower-pressure connection options for Gen Z-should revitalize user growth, increase engagement, and support higher payer conversion rates; this is likely to drive sustained top-line revenue and margin expansion as new features mature.

- Strong international expansion plans for Hinge and other brands, targeting markets like Europe, Mexico, Brazil, and broader Asia, position Match Group to capture growth from increasing smartphone and internet adoption worldwide-expanding the addressable user base and diversifying revenue beyond more saturated U.S. markets.

- Growing societal acceptance and normalization of online dating, reinforced by product improvements focused on safety and authenticity (e.g., face check and bot detection), should reduce friction to adoption, broaden the user demographic, and support elevated ARPU and payer conversion, positively impacting long-term revenue and earnings.

- Successful rollout and optimization of alternative payment options (particularly on iOS), building on early test results of >30% transaction shift to web and >10% net revenue uplift, offer substantial potential for margin improvement and higher adjusted operating income (AOI)/free cash flow, with an estimated $65M AOI saving opportunity in 2026.

- Data-driven organizational and cultural turnaround (with flattened teams, rapid product cycles, and cross-brand AI/model sharing) increases efficiency and positions Match Group to leverage its large data set to improve user retention and stickiness-contributing to higher lifetime value and healthier net margin trends over the medium to long term.

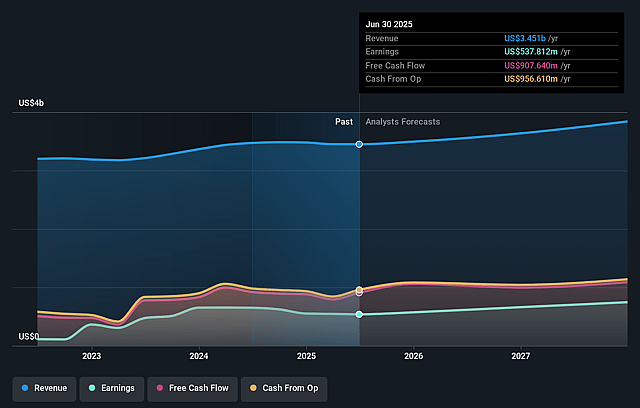

Match Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Match Group's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.6% today to 20.3% in 3 years time.

- Analysts expect earnings to reach $811.8 million (and earnings per share of $3.56) by about September 2028, up from $537.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, down from 17.1x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 4.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.94%, as per the Simply Wall St company report.

Match Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent year-over-year declines in Match Group's core user metrics-such as new account registrations, monthly active users (MAU), and payers-highlight demographic headwinds, competition, and product fatigue, which, if not fully reversed, could pressure long-term revenue growth and earnings.

- Overdependence on Tinder as the primary revenue driver presents significant risk, as Tinder direct revenue declined 4% year-over-year (and payers are down 7%), indicating potential market share loss or saturation, which could undermine revenue and net margins if product turnarounds do not succeed.

- Intensifying competition, including proliferating free and AI-powered dating options, may erode Match Group's pricing power and user engagement, resulting in higher customer acquisition costs and downward pressure on both revenue per payer and profitability.

- Increased regulatory scrutiny, evidenced by penalties such as the $14 million FTC settlement and ongoing need for compliance with data privacy and digital payments regulations, may elevate costs and limit monetization strategies, compressing long-term net margins and earnings.

- Ongoing user concerns regarding trust, safety, and digital burnout-alongside Match Group's need to continually enhance moderation and safety features-could dampen user growth and engagement, leading to higher operating expenses or reduced monetization potential, ultimately impacting overall revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.474 for Match Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $49.0, and the most bearish reporting a price target of just $31.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $811.8 million, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 8.9%.

- Given the current share price of $38.21, the analyst price target of $38.47 is 0.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Match Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.