Last Update07 May 25Fair value Decreased 0.29%

Key Takeaways

- Accelerated recycling and portfolio shifts toward high-value, low-carbon businesses are expected to improve margins, support premium revenue, and strengthen long-term earnings growth.

- Investments in innovation and global diversification enhance operating efficiency, revenue stability, and shareholder returns amid dynamic end-market and regulatory environments.

- Overcapacity, regulatory shifts, and aging assets are straining margins and cash flow, while slow innovation in sustainability could erode future competitiveness and revenue.

Catalysts

About LyondellBasell Industries- Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

- LyondellBasell’s rapid expansion into advanced and circular recycling, particularly through investments in commercial-scale chemical recycling facilities like MoReTec-1, is positioning the company at the forefront of the accelerating shift towards recycled and sustainable plastics. As regulatory mandates and brand owner commitments to use recycled content increase in Europe and globally, this is expected to unlock premium revenue streams and higher margins, enhancing long-term earnings growth.

- The company’s strategic move to reshape its asset portfolio—including the exit from refining, the closure of European assets, and a focus on high-value and low-carbon businesses—is set to deliver more than $1 billion in recurring EBITDA and substantial fixed cost reductions. These actions are anticipated to drive a step-change in net margin and mid-cycle EBITDA, with management projecting mid-cycle margins rising above 21 percent compared to the historical 18 percent for the company.

- LyondellBasell continues to invest in innovative, higher-value projects such as Flex 2 and the planned Saudi Arabia joint venture with Sipchem. These capitalize on cost-advantaged feedstocks and proprietary technology to lower operating costs and expand into specialty, lightweight polymers used in automotive, infrastructure, packaging, and clean energy markets. The resulting revenue and EBITDA growth will be propelled by rising global demand for durable plastics in sectors benefiting from population growth, urbanization, and electrification.

- Ongoing operational excellence through disciplined capital allocation, digitalization, energy efficiency improvements, and aggressive working capital management is driving strong free cash flow conversion. This supports both growth investments and attractive cash returns to shareholders, including a long-standing track record of increasing dividends, bolstering investor confidence in future earnings stability and resilience.

- The company's robust global supply network and geographic diversification provide resilience against trade policy disruptions and cyclical downturns, enabling agile response to shifting global demand flows and feedstock price dynamics. This strategic flexibility, paired with a leading position in markets tied to essential consumer goods and infrastructure, is expected to support revenue stability and reduce earnings volatility over the long run.

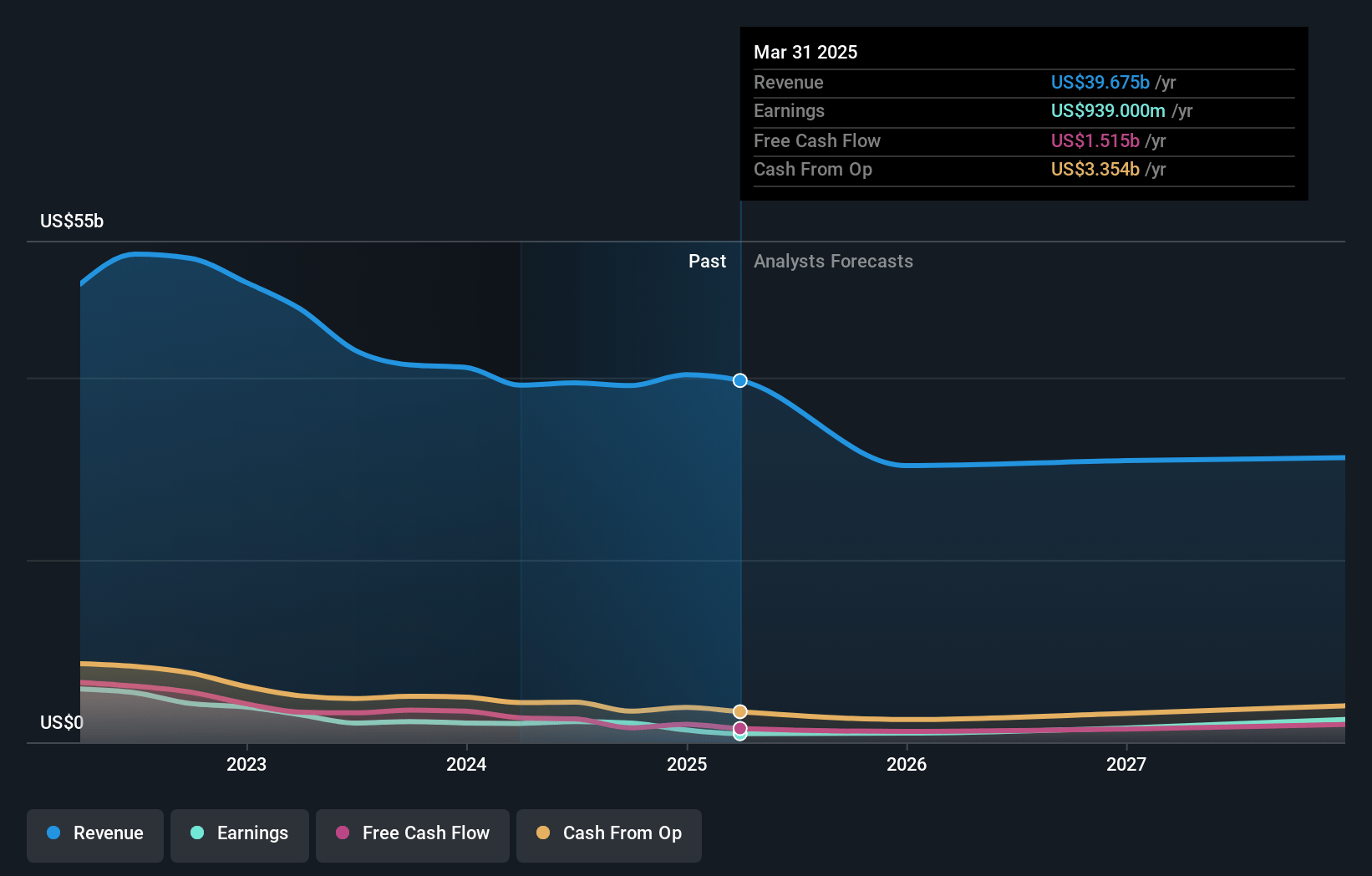

LyondellBasell Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on LyondellBasell Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming LyondellBasell Industries's revenue will decrease by 4.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.4% today to 10.2% in 3 years time.

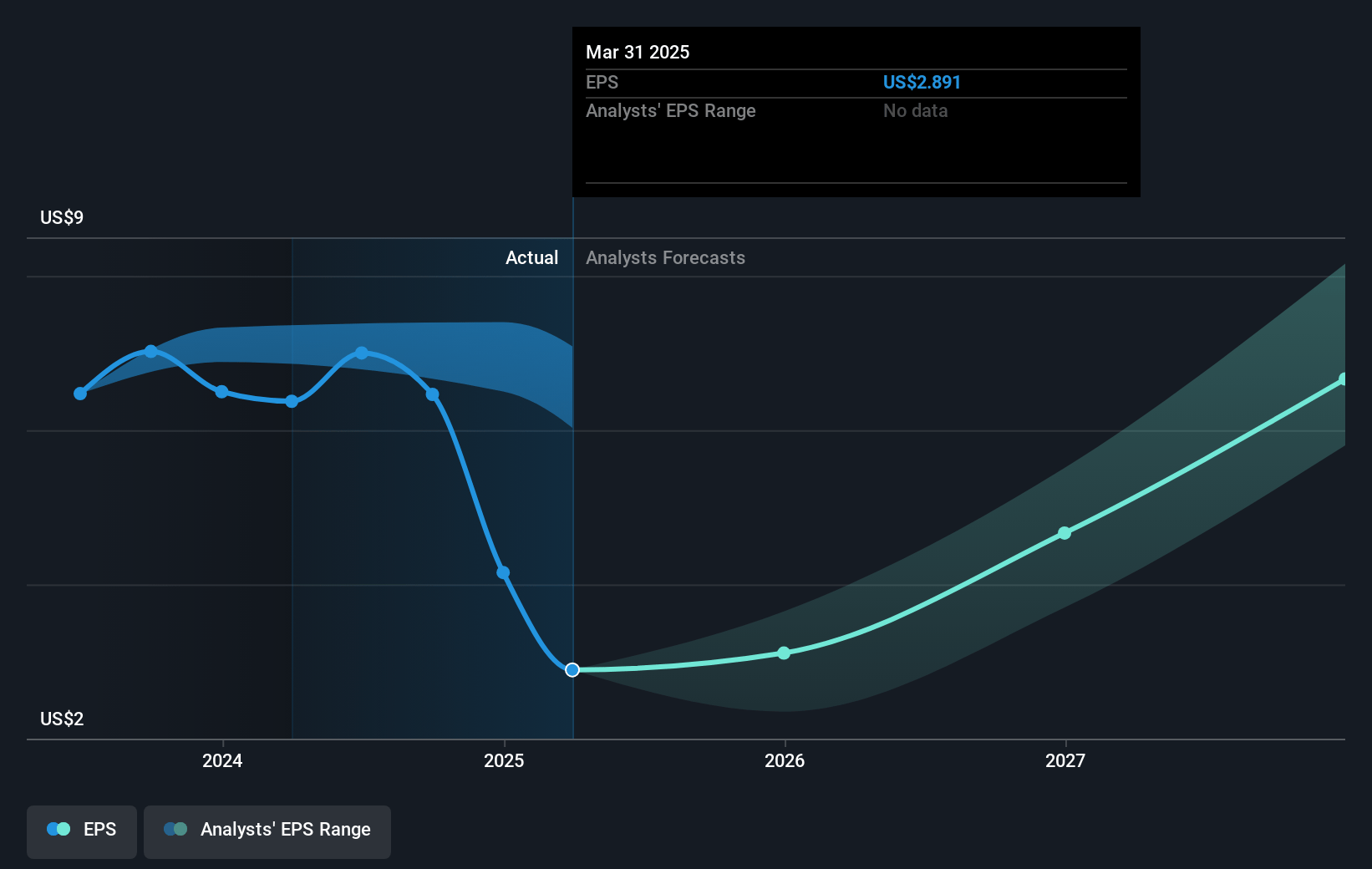

- The bullish analysts expect earnings to reach $3.5 billion (and earnings per share of $11.0) by about May 2028, up from $939.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.9x on those 2028 earnings, down from 19.1x today. This future PE is lower than the current PE for the US Chemicals industry at 20.2x.

- Analysts expect the number of shares outstanding to decline by 1.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.14%, as per the Simply Wall St company report.

LyondellBasell Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- LyondellBasell faces persistent structural overcapacity and slow global growth in basic chemicals, particularly in Asia and the Middle East, resulting in sustained pricing pressure that is likely to depress revenue and compress profit margins for the foreseeable future.

- Escalating global regulatory action against single-use plastics, combined with accelerated ESG investment preferences, is shifting demand away from LyondellBasell’s traditional fossil-based polymer products, potentially undermining revenue growth and access to lower-cost equity capital in the long term.

- The company’s high dependence on legacy oil and gas feedstocks exposes it to both feedstock price volatility and the increasing costs associated with carbon pricing and environmental compliance, which could materially erode net margins and reduce long-run earnings.

- LyondellBasell’s large, aging asset base demands significant reinvestment and incurs higher maintenance costs relative to competitors with newer, more efficient facilities, straining free cash flow and generating downward pressure on net income over time.

- Weak innovation and slower-than-necessary investment in advanced recycling and circular solutions places LyondellBasell at risk of falling behind customers’ and regulators’ low-carbon requirements, jeopardizing future market share and impeding the company’s ability to sustain or grow future revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for LyondellBasell Industries is $98.95, which represents two standard deviations above the consensus price target of $69.2. This valuation is based on what can be assumed as the expectations of LyondellBasell Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $34.8 billion, earnings will come to $3.5 billion, and it would be trading on a PE ratio of 10.9x, assuming you use a discount rate of 8.1%.

- Given the current share price of $55.89, the bullish analyst price target of $98.95 is 43.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives