Last Update07 May 25Fair value Decreased 9.11%

Key Takeaways

- Volatile trade policies and market uncertainties threaten revenue growth and net margins through asset sales and deferred projects.

- Trade barriers and supply chain issues risk compressing long-term earnings and international competitiveness.

- Strategic cost reduction, disciplined capital allocation, and investment in growth projects enhance LyondellBasell's financial resilience, profitability, and market competitiveness.

Catalysts

About LyondellBasell Industries- Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

- LyondellBasell Industries is experiencing volatile trade policies and market uncertainty, which could prolong the current downturn and negatively impact future revenue growth.

- The company has been closing and selling off assets in an attempt to navigate market challenges, potentially signaling a lack of growth opportunities and leading to a decline in net margins over time.

- Planned reductions in capital expenditures could hinder future growth projects, possibly resulting in lower revenues as critical growth initiatives are deferred.

- Persistent trade barriers and tariff risks threaten the company's cost advantages and international competitiveness, potentially compressing earnings over the longer term.

- Despite efforts to improve operational costs and efficiencies, global supply chain issues and economic constraints in key markets could negatively impact sales volumes and earnings per share projections.

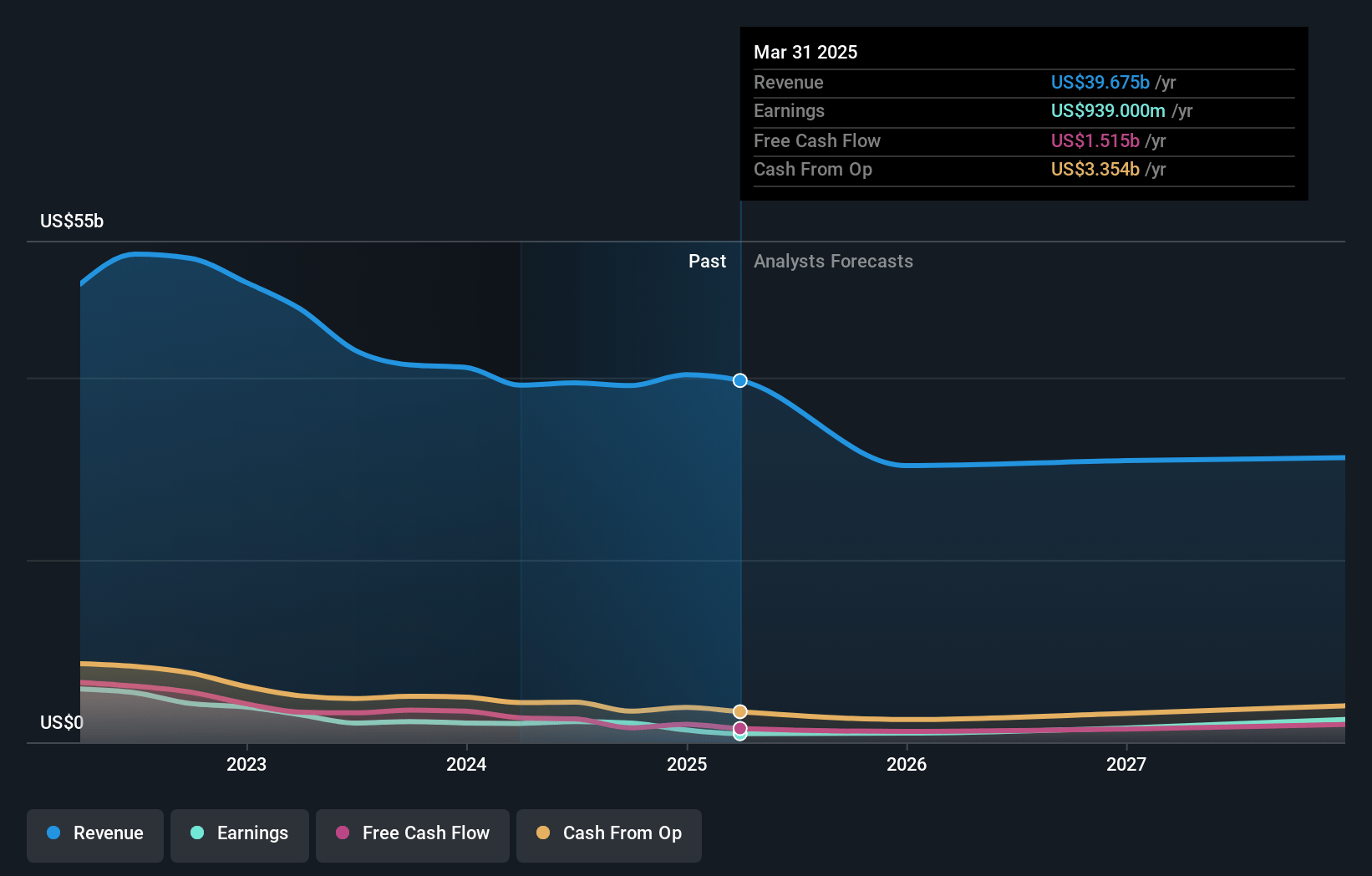

LyondellBasell Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on LyondellBasell Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming LyondellBasell Industries's revenue will decrease by 14.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.4% today to 8.0% in 3 years time.

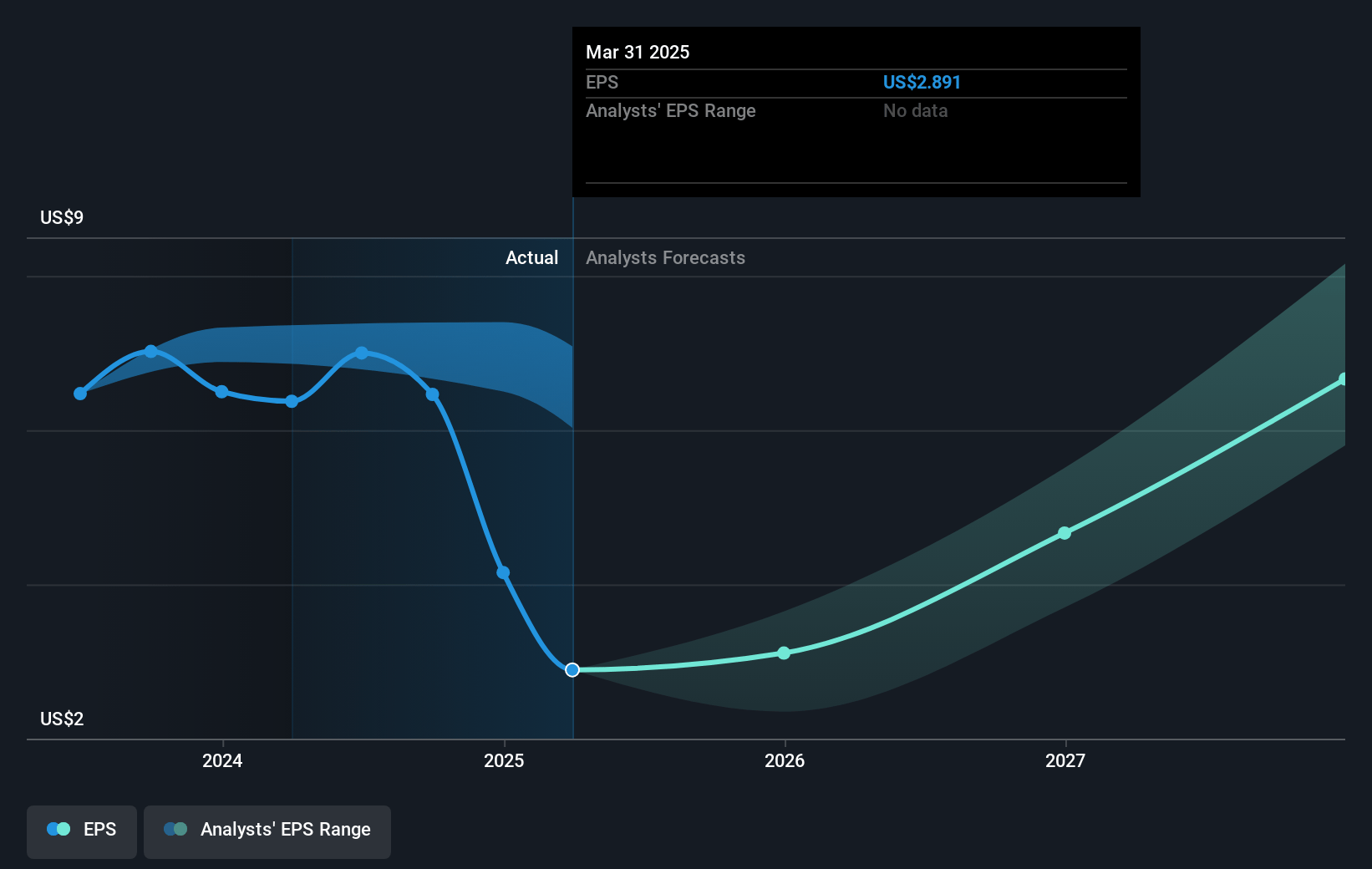

- The bearish analysts expect earnings to reach $2.0 billion (and earnings per share of $6.03) by about May 2028, up from $939.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, down from 19.0x today. This future PE is lower than the current PE for the US Chemicals industry at 20.2x.

- Analysts expect the number of shares outstanding to decline by 1.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.14%, as per the Simply Wall St company report.

LyondellBasell Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- LyondellBasell's proactive steps to reshape its portfolio and reduce annual fixed cost expenditures by $300 million can lead to an improvement in net margins and earnings, suggesting potential financial resilience in challenging times.

- The implementation of LyondellBasell's Value Enhancement Program, projected to unlock $1 billion in recurring annual EBITDA by year-end, can enhance EBITDA margins and overall profitability significantly.

- Their investment in projects like Flex 2, expected to generate an annual EBITDA benefit of approximately $150 million post-startup, and the new feedstock allocation in Saudi Arabia signal potential for long-term revenue growth and improved market competitiveness.

- With only 10% of their polyolefin sales volumes impacted by global trade tariffs, LyondellBasell's strategic positioning in local markets may stabilize revenues and reduce risk exposure from international trade uncertainties.

- LyondellBasell's disciplined approach to capital allocation, focused on maintaining an investment-grade balance sheet while returning $500 million in cash to shareholders, reveals strong financial health and supports sustained shareholder returns through dividends and share repurchases, potentially supporting share price stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for LyondellBasell Industries is $50.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of LyondellBasell Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $24.5 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 8.1%.

- Given the current share price of $55.61, the bearish analyst price target of $50.0 is 11.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.