Key Takeaways

- Heavy reliance on decarbonization mandates and concentrated contracts leaves future revenue and earnings vulnerable to policy shifts, customer volumes, and competitor pricing.

- Rising medium-term demand is challenged by near-term EV production headwinds, battery content changes, and potential margin pressure from cost competition and operational risks.

- Persistent weak demand, margin compression, client concentration, high fixed costs, and industry headwinds threaten Aspen Aerogels’ long-term revenue growth, profitability, and market share.

Catalysts

About Aspen Aerogels- An aerogel technology company, designs, develops, manufactures, and sells aerogel materials primarily for use in the energy industrial, sustainable insulation materials, and electric vehicle (EV) markets in the United States, Canada, Asia, Europe, and Latin America.

- Although Aspen Aerogels is benefiting from growing global decarbonization efforts, with ongoing innovation validated by recent awards from leading EV OEMs like GM, Mercedes-Benz, and Volvo Truck, the company remains heavily exposed to potential delays or policy reversals in net-zero mandates, which could significantly limit future revenue growth if electrification or renewable energy adoption slows.

- While the expansion of EV battery platforms and the surge in renewable energy investments expand Aspen’s addressable market and point to increased medium-term demand, near-term headwinds—such as lower EV production schedules at core customers and declining content per vehicle due to changing battery cell form factors—may cap the growth trajectory of the EV thermal barrier segment, constraining revenue upside and putting additional pressure on maintaining gross margins.

- Despite Aspen’s progress on supply chain flexibility and localization of manufacturing, sustained cost competitiveness is far from assured; the risk of further margin compression remains if Asian manufacturers accelerate commoditization in aerogel or substitute materials, which could erode pricing power, hurt net margins, and threaten volume growth.

- Although management is implementing sweeping cost reductions and restructuring, with ambitions to reduce breakeven revenue for positive adjusted EBITDA to $245 million, these initiatives are not without execution risk; delays in fully realizing operational efficiencies, coupled with persistently high capital expenditure requirements, may limit improvements in earnings and keep net margins below target levels for longer than anticipated.

- Even as strategic partnerships with top OEMs create a pipeline for future launches and international expansion, Aspen Aerogels remains highly reliant on a concentrated set of large contracts—leaving earnings vulnerable to any contract losses or volume reductions, particularly if adoption rates among key EV and industrial customers lag expectations or competitors gain traction with lower-cost solutions.

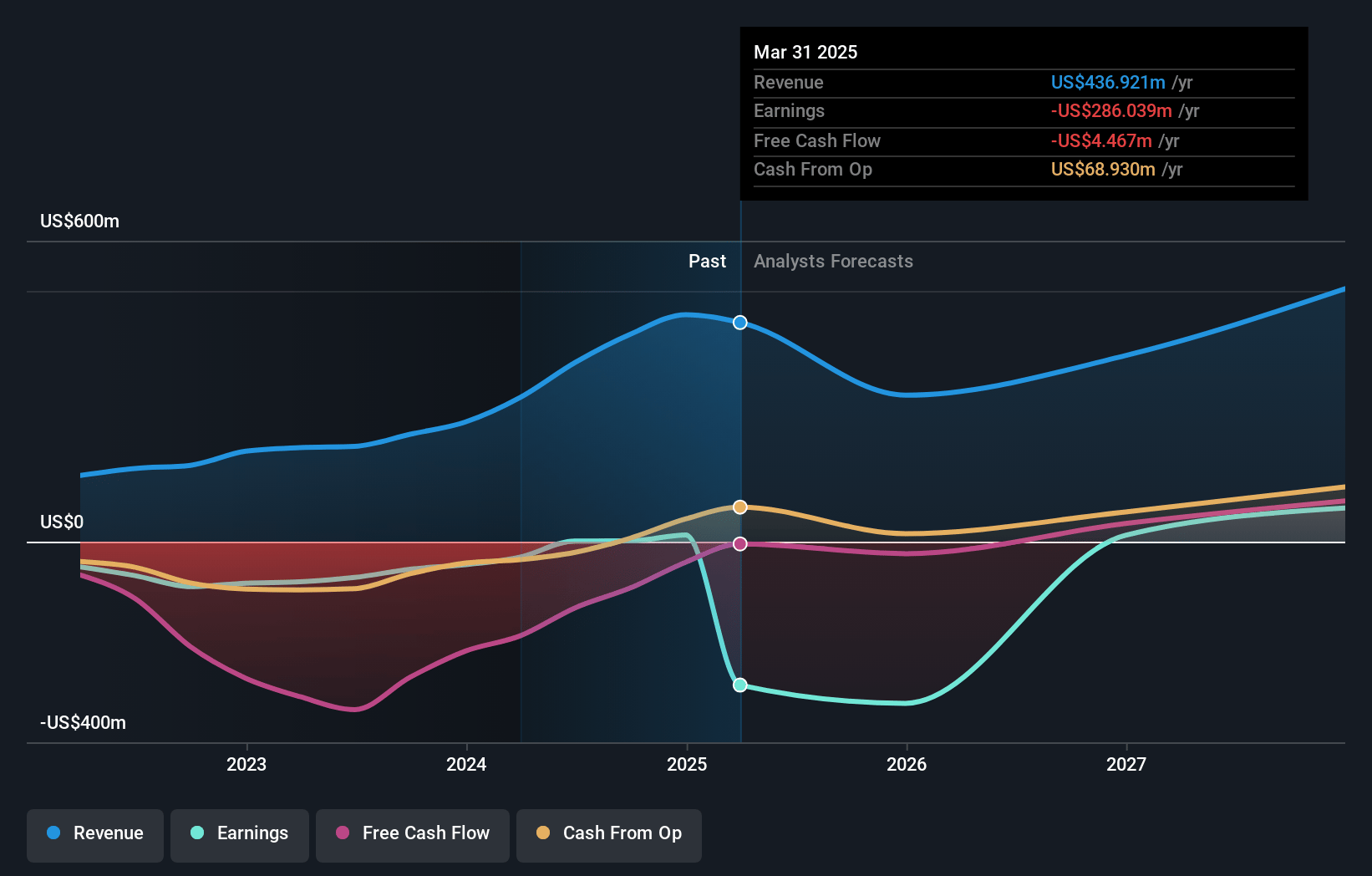

Aspen Aerogels Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Aspen Aerogels compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Aspen Aerogels's revenue will grow by 3.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -65.5% today to 17.4% in 3 years time.

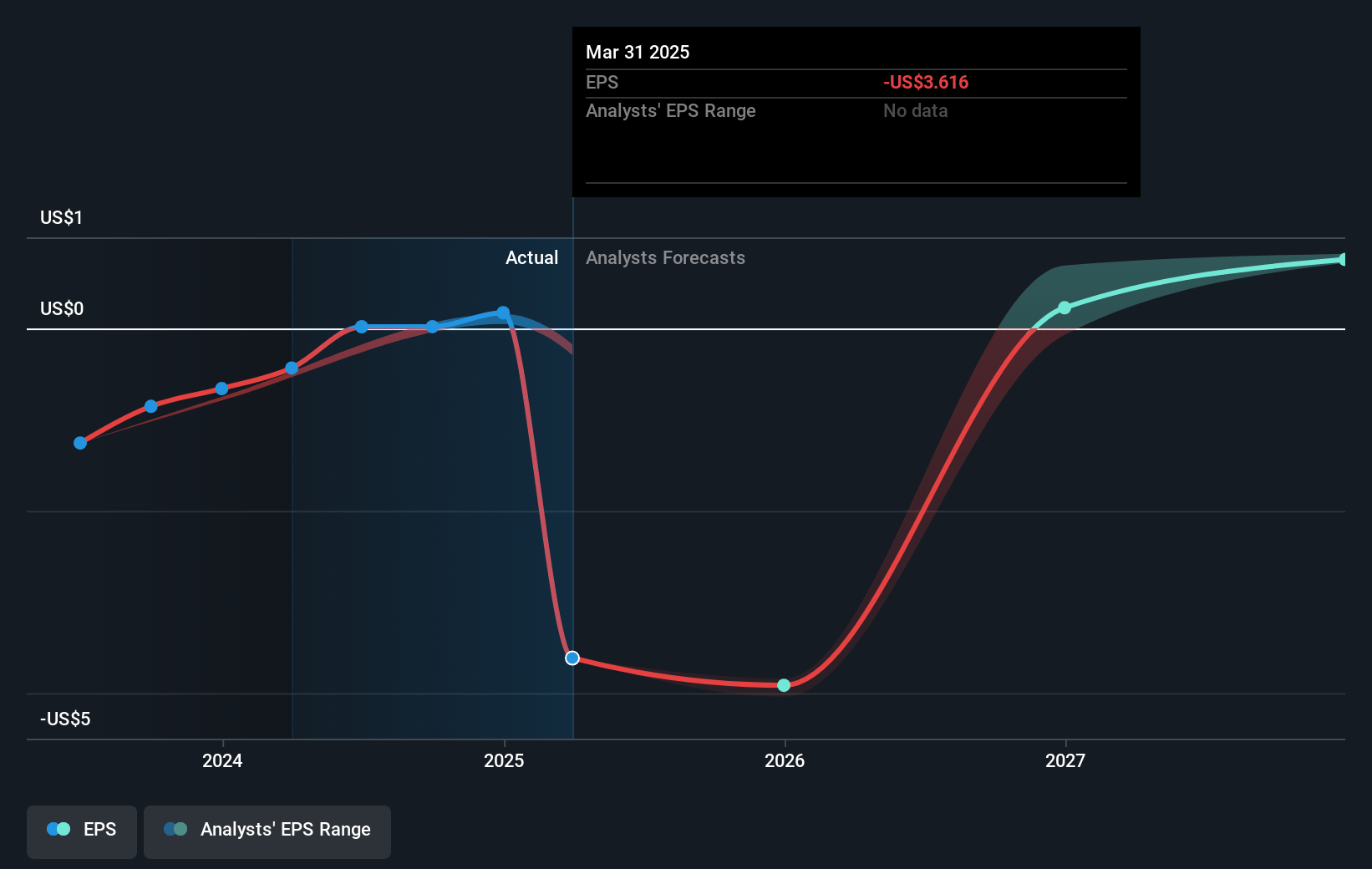

- The bearish analysts expect earnings to reach $83.7 million (and earnings per share of $0.97) by about July 2028, up from $-286.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.3x on those 2028 earnings, up from -1.8x today. This future PE is lower than the current PE for the US Chemicals industry at 22.7x.

- Analysts expect the number of shares outstanding to grow by 6.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.5%, as per the Simply Wall St company report.

Aspen Aerogels Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Aspen Aerogels is experiencing a sharp decline in year-over-year revenues for both its Energy Industrial and EV thermal barrier segments, and the company is indicating that demand is likely to remain subdued at least through 2025, which could pressure revenue growth and lead to persistent net income losses.

- The EV thermal barrier business faces significant erosion in content per vehicle as battery form factors shift from pouch to prismatic cells, moving average revenue from more than $1,000 per vehicle to as low as $200, alongside ongoing low OEM production schedules, which may compress gross margins and constrain long-term sales growth.

- The company’s revenue base is highly concentrated among a small group of automotive OEMs and energy sector customers, increasing vulnerability to contract losses or order reductions from major clients like General Motors, and such concentration could result in pronounced volatility in annual revenues and earnings.

- Aspen has undertaken major restructuring, including the write-down and closure of its Georgia facility and repeated cost-cutting efforts, illustrating high fixed costs and large capital expenditure requirements; delays or challenges in achieving planned cost reductions or monetizing assets could further pressure net margins and operating cash flow.

- Broader market uncertainties—such as EV adoption headwinds, energy industrial demand cycles, and possible global political pushback on decarbonization—together with intensifying competitive threats from alternative low-cost thermal insulation materials, may erode the company’s long-term market share and limit both revenue and profitability growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Aspen Aerogels is $7.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Aspen Aerogels's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $481.8 million, earnings will come to $83.7 million, and it would be trading on a PE ratio of 10.3x, assuming you use a discount rate of 7.5%.

- Given the current share price of $6.35, the bearish analyst price target of $7.0 is 9.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.