Key Takeaways

- Strategic partnerships, digital transformation, and data-driven underwriting are expected to expand market share, improve operational efficiency, and enhance profitability.

- Industry trends favor risk-adjusted premium growth, while portfolio shifts and stronger cash flow are positioned to boost investment returns and net earnings.

- Geographic concentration, volatile renewal agreements, inflation, past underwriting issues, and limited reinsurance leverage collectively threaten profitability and make sustainable growth uncertain.

Catalysts

About Kingstone Companies- Through its subsidiary, provides property and casualty insurance products in the United States.

- The company's recent renewal rights agreement with AmGUARD gives Kingstone access to a significant new pool of policyholders in Downstate New York, with an estimated $25–35 million in premiums over the next 12 months, which is likely to accelerate premium revenue and expand market share.

- Sustained investment in pricing segmentation and underwriting discipline—evidenced by the shift toward the Select homeowners product and away from legacy lines—will likely improve net combined ratios, lower loss frequency, and support stronger net margins.

- Industry-wide demand for property insurance is growing due to climate change and the increasing frequency of natural catastrophes; this macro trend provides Kingstone opportunities for risk-adjusted pricing and higher premiums, supporting topline and earnings growth.

- The company’s digital transformation and use of data analytics for improved risk selection—particularly in platforms like its Select product—are expected to drive operational efficiency and lower the expense ratio over time, which enhances overall profitability.

- Favorable investment portfolio dynamics, including reinvestment of maturing lower-yield assets into higher-yield securities and strong operating cash flow, are anticipated to materially boost investment income and net earnings in coming quarters.

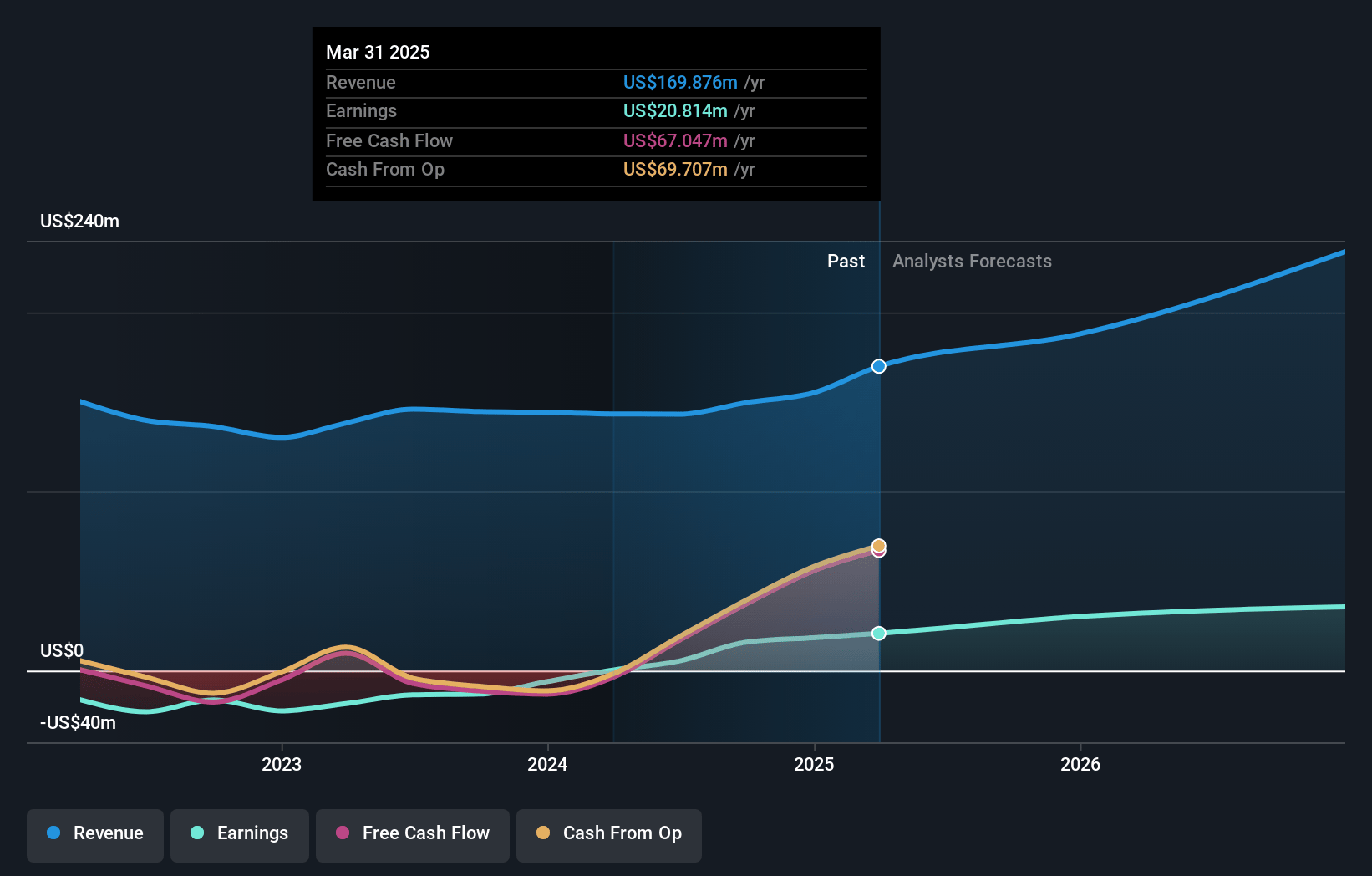

Kingstone Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kingstone Companies's revenue will grow by 18.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.3% today to 18.6% in 3 years time.

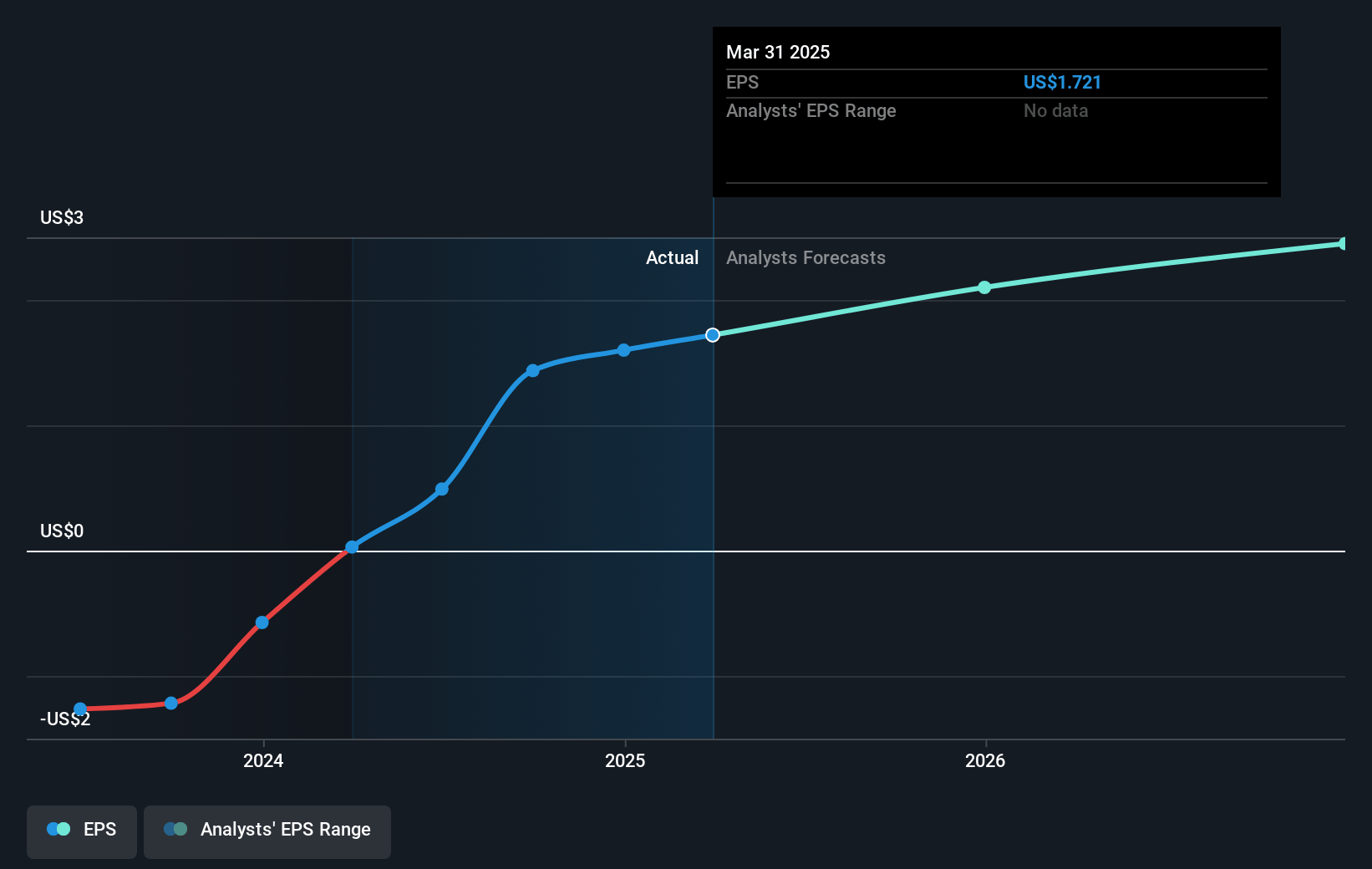

- Analysts expect earnings to reach $52.2 million (and earnings per share of $3.13) by about July 2028, up from $20.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.6x on those 2028 earnings, down from 10.4x today. This future PE is lower than the current PE for the US Insurance industry at 14.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Kingstone Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kingstone’s geographic concentration in New York, particularly in downstate areas, exposes the company to outsized catastrophe risk and market volatility; severe weather events or local downturns could significantly impact loss ratios and cause unpredictable swings in earnings.

- The company’s reliance on a renewal rights agreement with AmGUARD introduces material uncertainty regarding premium growth and conversion rates, especially given acknowledged “sticker shock” risk from higher Kingstone pricing, potentially limiting new policy uptake and affecting revenue growth.

- Persistently rising inflation and increasing costs of building materials, exacerbated by tariff-related pressures, could outpace planned rate adjustments, leading to higher claims severity and compressing net margins.

- Historical weaknesses in underwriting discipline—particularly the legacy homeowners’ product that experienced adverse selection—raise concerns that any expansion outside New York or accelerated growth might repeat past mistakes, risking poor profitability and diminished capital reserves.

- Limited scale in reinsurance negotiations, when compared to larger industry players, may subject Kingstone to higher reinsurance costs or reduced reinsurance availability, thereby weakening net earned premiums and putting downward pressure on profitability and future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.0 for Kingstone Companies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $281.1 million, earnings will come to $52.2 million, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of $15.45, the analyst price target of $22.0 is 29.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.