Key Takeaways

- Sustained margin growth, productivity initiatives, and digital transformation position Clorox for significant long-term earnings and profitability gains beyond industry expectations.

- Diverse innovation, focus on health and sustainability, and strong channel agility give Clorox a competitive edge in capturing demand shifts and driving recurring revenue.

- Shifting consumer preferences, increased competition, slow category growth, brand concentration, and operational challenges all threaten Clorox's pricing power, revenue stability, and profitability.

Catalysts

About Clorox- Engages in the manufacture and marketing of consumer and professional products worldwide.

- Analyst consensus expects modest gross margin expansion, but given Clorox's demonstrated track record-ten consecutive quarters of margin growth and robust productivity initiatives-there is significant potential for accelerated, sustained EBIT margin growth well above industry expectations, materially boosting long-term earnings power.

- Analysts broadly agree that innovation will reinforce organic sales growth, yet the company's unique multi-tier innovation, offering both premium and value solutions across cleaning and personal care, positions Clorox to outperform and capture heightened category demand when consumer confidence improves, driving a potential inflection in top-line growth ahead of consensus.

- Clorox is poised to disproportionately benefit from the ongoing health, hygiene, and safety focus that has reset baseline demand for essential cleaning categories, suggesting a new, structurally higher level of recurring revenue and cash flows that can fuel increased dividends and share repurchases.

- The accelerating shift toward eco-consciousness and sustainable purchasing favors Clorox's expanding green portfolio-including market-leading brands like Burt's Bees and Green Works-enabling premium pricing, market share gains, and gross margin improvement as consumer preferences evolve.

- The company's advanced digital transformation, including holistic ERP and supply chain automation, is expected to unlock agility in channel mix (e-commerce, mass retail, clubs) and yield significant long-term cost savings while supporting revenue acceleration from high-growth distribution channels, elevating both net margins and overall profitability.

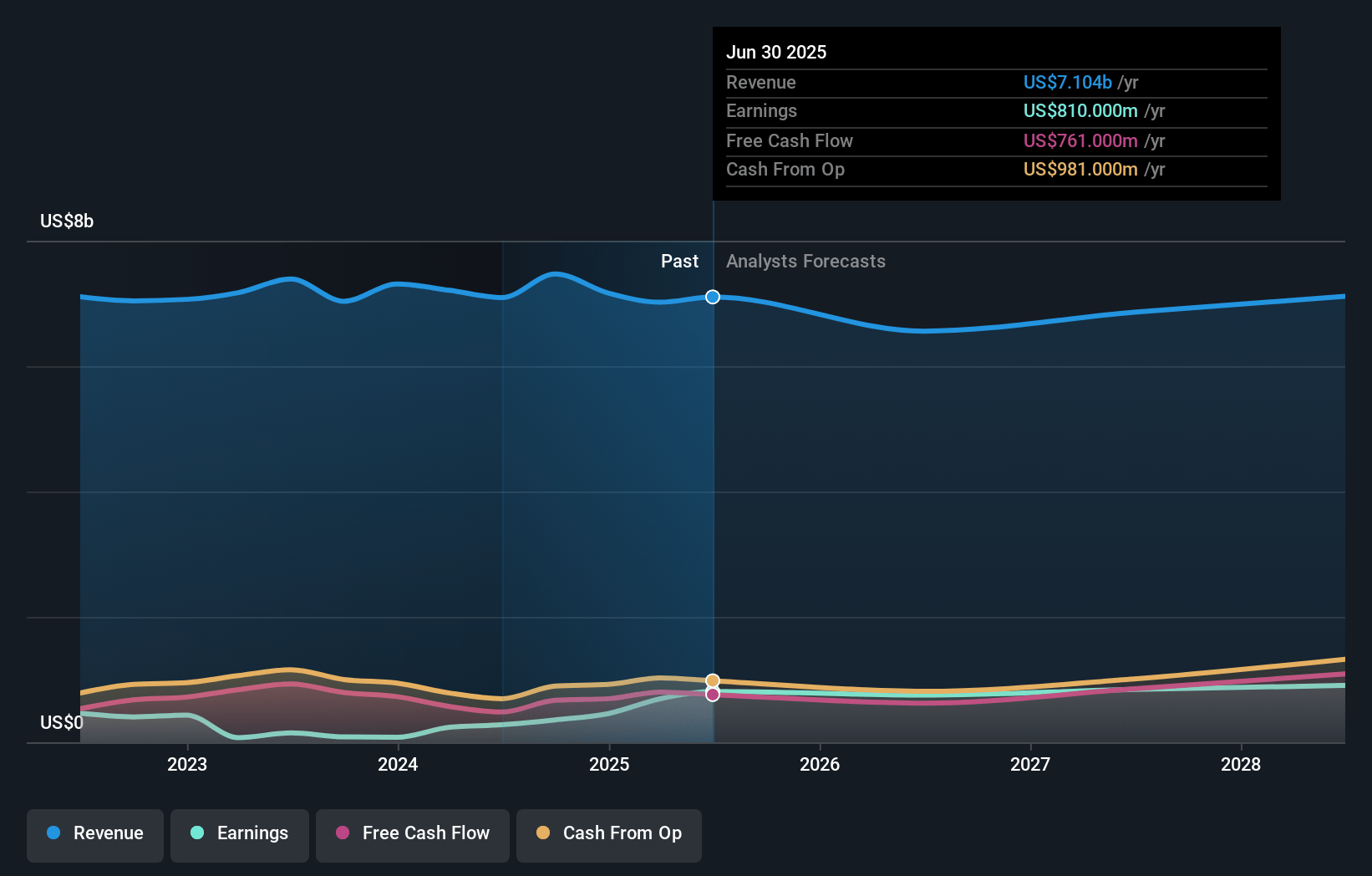

Clorox Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Clorox compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Clorox's revenue will grow by 3.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.9% today to 12.9% in 3 years time.

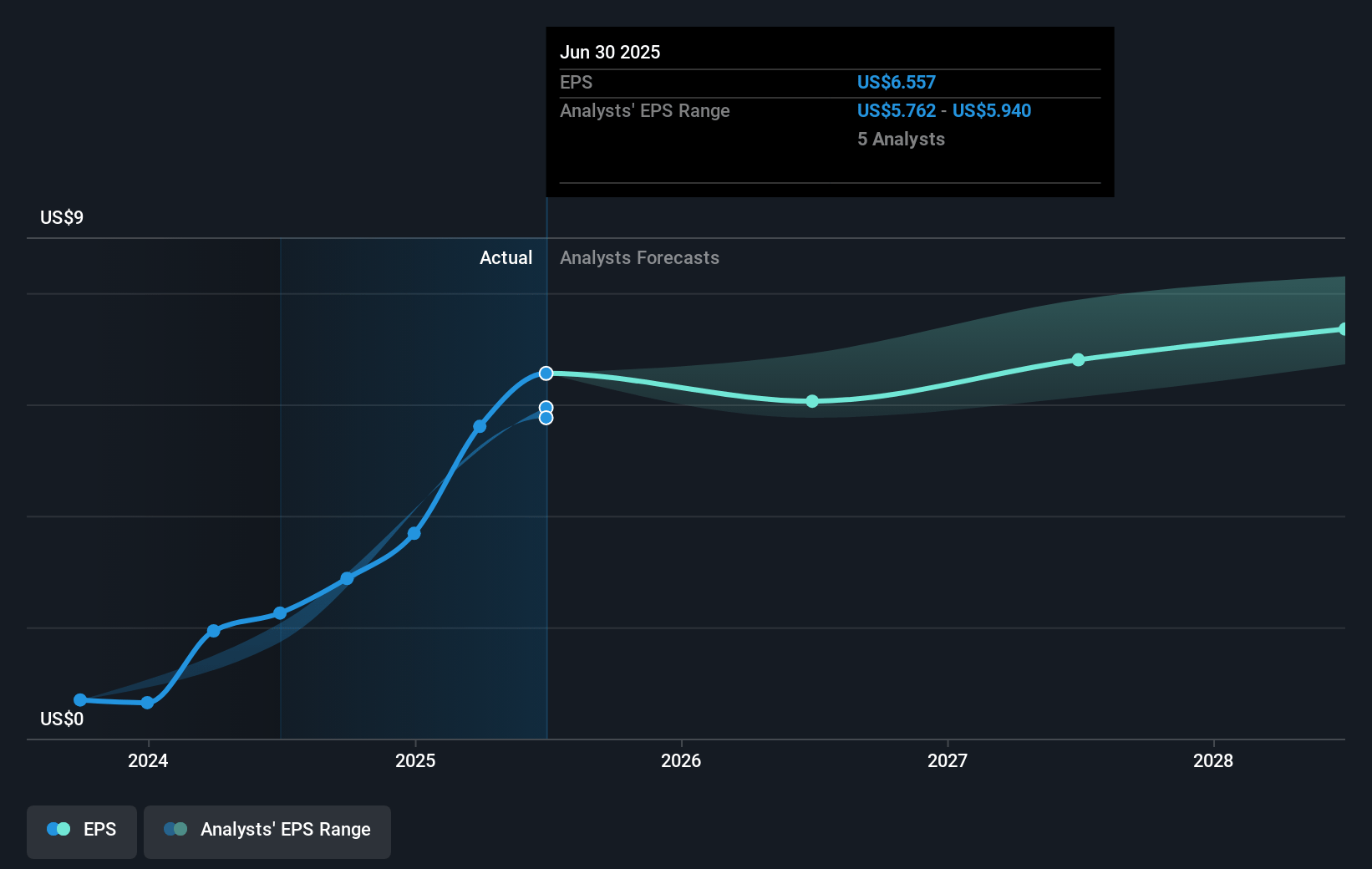

- The bullish analysts expect earnings to reach $997.2 million (and earnings per share of $8.3) by about July 2028, up from $694.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.9x on those 2028 earnings, up from 22.1x today. This future PE is greater than the current PE for the US Household Products industry at 21.7x.

- Analysts expect the number of shares outstanding to decline by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Clorox Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Clorox is facing a persistent shift in consumer preferences toward more sustainable, natural, and non-chemical cleaning products, which could gradually erode demand for its core bleach and disinfectant brands and negatively affect long-term revenue growth.

- An environment of increased competition from private-label brands and value players, especially during periods of consumer belt-tightening, leads to deeper promotions and price-cutting in core categories like Glad and Litter, pressuring Clorox's ability to maintain pricing power and compressing net margins.

- A slower-growing population base and stagnant category growth in developed markets, as evidenced by their lowered expectations around household essentials and cleaning product volumes, may limit Clorox's ability to achieve its historical 3 percent to 5 percent organic sales growth algorithm, restraining long-term top-line and earnings growth.

- Clorox's reliance on a concentrated portfolio of flagship brands like Clorox Bleach exposes the company to outsized risk if competitive, regulatory, or consumer preferences shift away from these brands, potentially resulting in volatility in overall sales and reduced revenue stability.

- Ongoing supply chain complexities, the need for costly ERP and digital transformation investments, as well as exposure to disruptions such as tariffs, retailer destocking, and manufacturer input cost increases, create uncertainty around the company's ability to control costs and deliver consistent profitability, threatening future earnings growth and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Clorox is $183.98, which represents two standard deviations above the consensus price target of $143.48. This valuation is based on what can be assumed as the expectations of Clorox's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $189.0, and the most bearish reporting a price target of just $119.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $7.7 billion, earnings will come to $997.2 million, and it would be trading on a PE ratio of 26.9x, assuming you use a discount rate of 6.4%.

- Given the current share price of $124.17, the bullish analyst price target of $183.98 is 32.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives