Last Update 28 Nov 25

REYN: Raised Guidance And Consistent Execution Will Drive Further Upside

Analysts have increased their price target for Reynolds Consumer Products from $25 to $28, citing the company's strong quarterly performance and effective management in a challenging environment.

Analyst Commentary

Bullish analysts have responded positively to Reynolds Consumer Products' latest earnings report and guidance raise, prompting a price target increase. Their commentary highlights several key factors driving optimism, while also acknowledging areas of caution regarding the company's outlook.

Bullish Takeaways- The company has delivered better-than-expected quarterly results, indicating solid execution across its core businesses and effective cost management.

- Management has demonstrated strong leadership by navigating challenging macroeconomic conditions while still finding ways to improve operational efficiency.

- The upward revision in earnings guidance suggests confidence in ongoing demand trends and the company's pricing power within the consumer products sector.

- Strategic steps taken by management are viewed as positioning the company for sustained improvement, which supports the higher valuation target.

- Some analysts remain cautious, maintaining a neutral sector rating due to concerns about ongoing inflation and input cost pressures in the industry.

- The company still faces a competitive environment that could weigh on market share and top-line growth if not managed effectively.

- Continued macro uncertainty could limit upside potential, despite the recent positive performance. This leads to a measured approach to valuation upgrades.

What's in the News

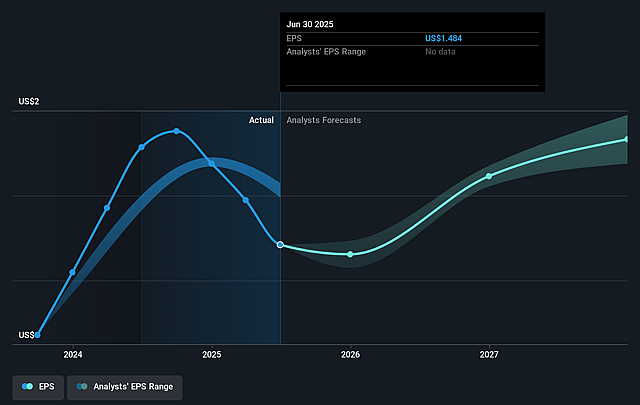

- The company issued new earnings guidance for Q4 2025, expecting net revenues to decline 1% to 5% from the previous year and projecting EPS between $0.52 and $0.56. Full-year net revenues are expected to be flat or down up to 1%, with EPS guidance of $1.40 to $1.44 (Company Guidance).

- The company launched the Reynolds Wrap Dubai Chocolate Turkey recipe, featuring a blend of spices, chocolate, gold kataifi, and pistachios, highlighting innovative holiday offerings (Product Announcement).

- The company announced the return of Fun Foil with a Holiday Pattern, an embossed aluminum foil designed in collaboration with Brittany Jepsen for festive food presentations (Product Announcement).

- The company was added as a constituent to several major indices, including the S&P 1000, S&P Composite 1500, and S&P 600 Consumer Staples sector (Index Announcements).

Valuation Changes

- Fair Value remains unchanged at $27.75, reflecting stability in the company's assessed intrinsic worth.

- Discount Rate has decreased very slightly from 6.96% to 6.96%, indicating marginally lower risk assumptions in financial modeling.

- Revenue Growth expectation is nearly stable, ticking down insignificantly from 1.70% to 1.70%.

- Net Profit Margin is virtually flat, moving from 10.60% to 10.60%, signifying steady profitability expectations.

- Future P/E multiple remains almost unchanged at 17.26x, indicating consistent valuation relative to projected earnings.

Key Takeaways

- Sustainable product innovation and shifting consumer demographics are expected to fuel revenue growth and strengthen market share in disposable kitchenware and food storage solutions.

- Operational efficiencies, enhanced retail strategies, and proprietary technology position the company for higher margins and long-term earnings growth amid rising sustainability trends.

- Margin and revenue growth are pressured by volatile input costs, weak consumer demand, competitive pricing, limited innovation, and retailer power in a slow-growing market.

Catalysts

About Reynolds Consumer Products- Produces and sells products in cooking, waste and storage, and tableware product categories in the United States and internationally.

- Ongoing product innovation, particularly in sustainable and convenience-focused products such as Hefty ECOSAVE compostable cutlery, air fryer liners, and unbleached parchment, is expected to drive future revenue growth as Reynolds captures premium pricing and gains share among environmentally conscious and convenience-seeking consumers.

- Demographic and lifestyle changes-such as younger, convenience-focused populations, increased household formation, and the need for at-home meal solutions due to the rising cost of food away from home-are supporting resilient and growing demand for disposable kitchenware, food storage, and waste management solutions, which should contribute to sustained top-line expansion.

- Investments in automation, supply chain improvements, and onshoring manufacturing are projected to improve operating leverage and reduce costs, positioning the company to expand net margins and deliver stronger earnings growth beyond 2025.

- Enhanced retail partnerships and updated revenue growth management strategies (reallocating trade spend to higher-return programs), combined with gains in distribution and online channels, are likely to boost recurring revenue by solidifying shelf space and responding quickly to evolving consumer purchase patterns.

- Proprietary technology and acquisitions (such as Atacama for compostable products) provide a unique platform for Reynolds to address regulatory and consumer shifts toward sustainability, opening new market opportunities and supporting long-term growth in revenue and earnings.

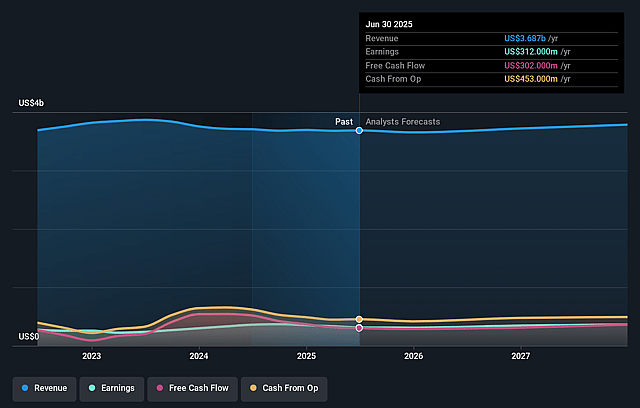

Reynolds Consumer Products Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Reynolds Consumer Products's revenue will grow by 1.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.5% today to 10.0% in 3 years time.

- Analysts expect earnings to reach $383.5 million (and earnings per share of $1.83) by about September 2028, up from $312.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.5x on those 2028 earnings, up from 15.6x today. This future PE is lower than the current PE for the US Household Products industry at 21.6x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Reynolds Consumer Products Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened raw material (aluminum, resin) and tariff cost volatility, with only partial pricing pass-through and uncertain consumer elasticity, could continue to pressure net margins and earnings, especially if input costs rise faster or are harder to recoup through higher prices.

- Persistent weakness in US consumer confidence, amplified by reduced SNAP benefits and increased value-seeking behavior among lower and middle-income households, indicates risk of ongoing or worsening volume/mix and potential topline (revenue) stagnation or decline.

- Intensifying competition from private label/store brands, as well as risk of promotion-led price wars (notably in core trash and storage segments), threatens Reynolds' pricing power and branded margins in an environment with limited volume growth.

- Slow category growth and limited evidence of step-change innovation beyond core offerings may leave Reynolds exposed to longer-term secular consumer shifts towards sustainable, reusable, or eco-friendly packaging-impacting revenue growth and share, especially if innovation execution lags industry advances.

- Heavy reliance on a concentrated set of large US retail customers and channels (including club and online) may increase exposure to retailer bargaining power and inventory management practices, risking gross margin pressure or revenue volatility if contract terms deteriorate or shelf space/inventory is reduced.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.25 for Reynolds Consumer Products based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.8 billion, earnings will come to $383.5 million, and it would be trading on a PE ratio of 17.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of $23.07, the analyst price target of $26.25 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.