Last Update 12 Dec 25

Fair value Decreased 1.66%GIS: Improving Volume Trends Will Support A Gradual Return To Durable Demand

Analysts have modestly trimmed their fair value estimate for General Mills to approximately $53, reflecting a series of lower price targets in the $47 to $52 range as they factor in softer growth expectations despite largely in line recent results and guidance.

Analyst Commentary

Recent Street research on General Mills reflects a cautious but nuanced view, with modest price target reductions tied to tempered growth expectations and mixed sentiment on execution against multi year guidance.

Bullish analysts acknowledge that valuation has de rated to levels that better reflect slower growth, while pointing to operational trends and share performance that could support the stock if management delivers on its outlook.

Bullish Takeaways

- Bullish analysts highlight that volume and share trends are starting to improve, which, if sustained, could underpin a gradual return to more durable top line growth.

- In line quarterly results and unchanged multi year guidance are seen as evidence of operational stability, supporting the case that downside risk to earnings is limited at current valuation levels.

- Some see the lower price targets as largely mechanical, reflecting sector wide multiple compression rather than a fundamental break in the company growth story.

- The view that near term stock reactions to results may be muted can be interpreted as a sign that expectations are already conservative, creating potential for upside if execution surprises positively.

Bearish Takeaways

- Bearish analysts argue that the company needs more than 2 percent revenue growth in the second half to reach the midpoint of guidance, a hurdle they see as challenging given the current demand backdrop.

- Reduced price targets are framed as recognition that structural growth remains limited, constraining the potential for sustained multiple expansion.

- There are concerns that even relatively in line results will not be enough to re rate the stock, as investors look for clearer evidence of accelerating growth beyond management current trajectory.

- Ongoing Sell and Underweight stances reflect skepticism about the company ability to consistently out execute peers in a slower category growth environment, keeping risk skewed to the downside if volumes soften again.

What's in the News

- USDA will tap contingency funds to ensure partial November SNAP payments, a move that could influence at-home food demand dynamics for General Mills products (Reuters)

- General Mills is launching a limited edition Marty Supreme Wheaties box in collaboration with film studio A24, tying the iconic cereal brand to the upcoming Marty Supreme movie release (company announcement)

- Reese's Puffs is introducing its first new flavor combination since 1994 with Dark Chocolate cereal made using Hershey's cocoa and real Reese's Peanut Butter, supported by a "Reese's After Dark" packaging universe (company announcement)

- Cascadian Farm is quadrupling General Mills use of climate friendly Kernza grain by adding it to four leading organic flake cereals, signaling continued focus on regenerative agriculture and sustainable sourcing (company announcement)

- General Mills management reaffirmed that mergers and acquisitions remain an "always on" capability, with excess cash after dividends earmarked first for strategic deals to enhance the portfolio growth profile and then for share repurchases (management commentary)

Valuation Changes

- Fair Value Estimate was trimmed slightly from approximately $53.89 to $53.00, reflecting modestly weaker long term assumptions.

- The Discount Rate increased slightly from about 6.78 percent to 6.96 percent, implying a marginally higher required return and lower present value of future cash flows.

- Revenue Growth was revised slightly lower, with the long term growth rate moving from roughly negative 0.34 percent to negative 0.39 percent, signaling a modestly more cautious top line outlook.

- Net Profit Margin edged down from about 10.98 percent to 10.68 percent, indicating slightly lower expected profitability over the forecast horizon.

- Future P/E was nudged higher from around 15.0x to 15.4x, suggesting a small increase in the multiple applied to forward earnings despite the more subdued growth profile.

Key Takeaways

- General Mills’ increased investment and reinvestment strategy may delay improvements in net margins and earnings in the short term.

- Challenges like the potential Yoplait closure and changing consumer behavior could suppress revenue growth and impact future earnings projections.

- General Mills' focus on strategic reinvestment, targeted marketing, and innovation aims to enhance competitiveness and drive future revenue and earnings growth.

Catalysts

About General Mills- Manufactures and markets branded consumer foods worldwide.

- General Mills plans a sizable step-up in investment for fiscal '26, including at least 5% through Holistic Margin Management (HMM) savings and $100 million in additional cost savings. However, reinvestment of these savings into pricing, innovation, in-store activity, and media could delay improvements in net margins and overall earnings in the short term.

- The company faces a challenging consumer environment, with low consumer confidence leading to increased value-seeking behavior. Even as General Mills invests in competitive pricing and marketing to address this, the shift in consumer behavior may suppress revenue growth in the near term.

- General Mills expects a significant headwind from the potential closure of the Yoplait business, equivalent to a 5-point hit on profit. This anticipated drop in profit could affect future earnings projections and contribute to a perception of overvaluation.

- Continued investment will be necessary to make pricing adjustments for snacks and to improve competitiveness across various brands. Such investments may not immediately boost earnings, as achieving the right pricing balance will take time, potentially affecting revenue and net margins.

- General Mills' strategy of fewer, but bigger innovations in fiscal '26 involves focusing on a smaller number of larger innovations. While this may benefit future revenue growth, the time required to develop and execute such innovations means immediate impacts on earnings might be limited.

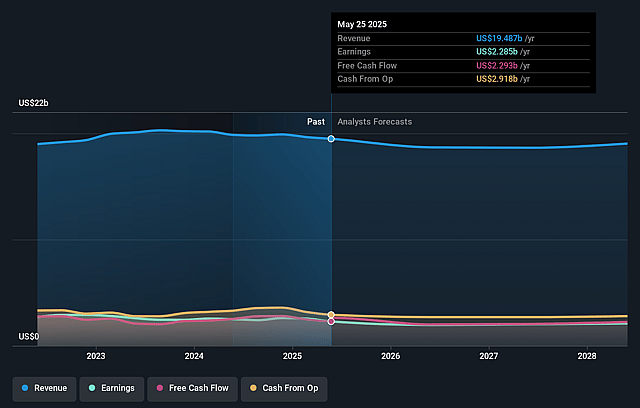

General Mills Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming General Mills's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.7% today to 11.0% in 3 years time.

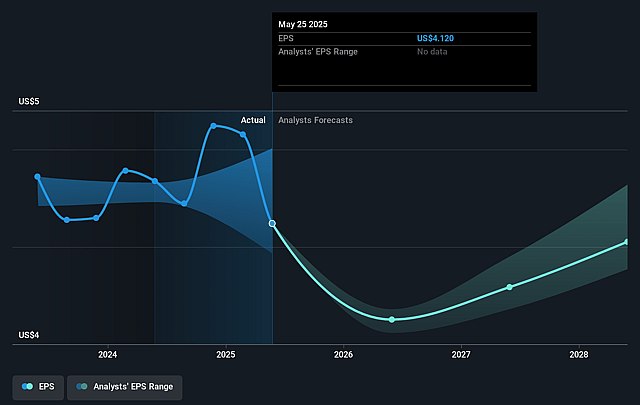

- Analysts expect earnings to reach $2.1 billion (and earnings per share of $4.02) by about September 2028, down from $2.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, up from 11.6x today. This future PE is lower than the current PE for the US Food industry at 19.8x.

- Analysts expect the number of shares outstanding to decline by 2.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

General Mills Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- General Mills plans to reinvest savings from cost efficiencies and the 53rd week of fiscal year into marketing and innovation, potentially improving competitiveness and driving revenue growth.

- The company has identified several billion-dollar brands, like Blue Buffalo and Pillsbury, where refined pricing strategies and enhanced marketing have significantly improved performance, which could contribute positively to their overall earnings.

- Innovation and new product launches are being prioritized, with an emphasis on fewer, but bigger high-impact innovations, which might boost sales and revenue.

- The snack bars and cereal categories are expected to recover, with increased media expenditure and promotional activities in the upcoming quarters, which could enhance volume growth and profit margins.

- Despite current challenges, General Mills believes enhanced marketing on their core products and new innovations will significantly improve their market share and volume competitiveness, potentially leading to stronger revenue and earnings in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.8 for General Mills based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $63.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $19.0 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $49.75, the analyst price target of $54.8 is 9.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on General Mills?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.