Last Update 15 Nov 25

WHD: Profit Margin Recovery And Discount Rate Will Support Higher Share Prices

Analysts have updated their price target for Cactus, maintaining the fair value estimate at $48.38. They have adjusted expectations based on lowered profit margin projections and a higher anticipated future price-to-earnings ratio.

Valuation Changes

- Consensus Analyst Price Target remains unchanged at $48.38 per share.

- Discount Rate has declined modestly from 7.38% to 7.01%.

- Revenue Growth projection remains steady at approximately 13%.

- Net Profit Margin estimate has dropped significantly from 24.20% to 16.60%.

- Future P/E ratio has increased substantially from 11.8x to 17.0x.

Key Takeaways

- Expansion into the Middle East and product innovation are driving sustainable revenue growth and stronger market positioning amid evolving industry demand and environmental concerns.

- Strategic acquisitions, operational optimizations, and efficiency-focused product offerings are supporting margin expansion and higher quality, recurring earnings.

- Rising input costs, weak demand, limited pricing power, integration risks, and secular industry shifts threaten profitability, revenue growth, and long-term market opportunity.

Catalysts

About Cactus- Designs, manufactures, sells, and rents engineered pressure control and spoolable pipe technologies in the United States, Australia, Canada, the Middle East, and internationally.

- The acquisition of a majority interest in Baker Hughes' Surface Pressure Control business will significantly expand Cactus' geographic footprint and customer base into the Middle East, an area poised for long-term energy infrastructure investment and supply security; this is likely to drive sustained revenue growth and higher earnings resiliency.

- Ongoing global population growth and industrialization, particularly in emerging markets, supports continued oil & gas demand, which increases the long-term addressable market for Cactus' advanced wellhead and pressure control solutions-positively impacting top-line revenue.

- Heightened environmental scrutiny and the industry's preference for operational efficiency is spurring adoption of Cactus' proprietary, lower-leakage and streamlined wellhead systems (e.g., SafeDrill™), which support premium pricing and drive net margin expansion as customers increasingly value efficiency and safety.

- The successful integration and cross-selling opportunities from the FlexSteel acquisition, especially as Cactus broadens its offering into spoolable pipe, are expected to increase recurring revenue streams and improve earnings quality over time.

- Cost-recovery initiatives, supply chain optimization (via migration of sourcing from China to Vietnam and aggressive rightsizing), and scalable manufacturing are positioned to restore and expand operating margins even in a lower demand environment-strengthening future net margins and free cash flow.

Cactus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cactus's revenue will grow by 15.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.2% today to 13.6% in 3 years time.

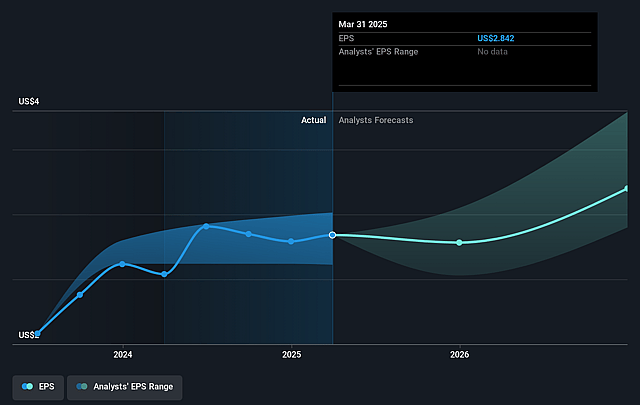

- Analysts expect earnings to reach $232.7 million (and earnings per share of $3.62) by about September 2028, up from $181.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.8x on those 2028 earnings, up from 15.5x today. This future PE is greater than the current PE for the US Energy Services industry at 15.0x.

- Analysts expect the number of shares outstanding to grow by 2.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

Cactus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant and unexpected increases in tariffs on steel imports (including from China and Vietnam) have sharply raised input costs, pressuring margins and exposing the company to further vulnerability if trade policies remain volatile-this could negatively impact net margins and profitability.

- Persistent weakness in U.S. land drilling and completion activity, coupled with customer capital discipline and reluctance to expand CapEx despite reasonable oil prices, is reducing demand for core Pressure Control products and rental equipment-risking continued declines in revenue.

- Customer requests for price relief and inability to pass on higher costs during periods of commodity price weakness indicate limited pricing power and increased risk of ongoing margin compression, particularly if competitive pressures intensify-threatening net margins and earnings quality.

- Execution and integration risks related to major acquisitions (such as the Surface Pressure Control business from Baker Hughes), cultural differences, and legal disputes (including ongoing litigation) could result in unexpected costs, lower-than-expected synergies, and put pressure on earnings and return on invested capital.

- Industry secular trends-such as the accelerating global transition to renewables, growing environmental scrutiny, and advancing alternatives like energy storage and electric vehicles-present long-term headwinds for oilfield equipment demand, which could decrease the addressable market and revenue potential for Cactus over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $49.625 for Cactus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $56.0, and the most bearish reporting a price target of just $39.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $232.7 million, and it would be trading on a PE ratio of 22.8x, assuming you use a discount rate of 7.5%.

- Given the current share price of $40.88, the analyst price target of $49.62 is 17.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.