Last Update 05 Nov 25

Fair value Decreased 12%VTS: Annual Production Guidance Increase Will Drive Expanded Output And Reserves

Analyst Price Target for Vitesse Energy Adjusted Downward

Analysts have lowered their fair value estimate for Vitesse Energy from $27.69 to $24.50. This adjustment reflects more cautious revenue growth and profit margin projections in recent forecasts.

What's in the News

- Vitesse Energy increased its production guidance for 2025, aiming for an annual production range of 17,000 to 17,500 barrels of oil equivalent per day. This is up from the previous range of 15,000 to 17,000.

- The company raised its production targets by 8 percent at the midpoint, reflecting greater confidence in operational output.

- Vitesse Energy has also tightened the range of its capital expenditure guidance and narrowed the projected proportion of oil in annual production. (Key Developments)

Valuation Changes

- The consensus analyst price target has fallen from $27.69 to $24.50, reflecting a more conservative valuation.

- The discount rate decreased slightly, moving from 6.78% to 6.78%.

- The revenue growth forecast has fallen significantly from 18.8% to 2.7%.

- The net profit margin dropped sharply from 14.0% to less than 0.1%.

- The future P/E ratio surged dramatically, increasing from 30.1x to approximately 6,058.8x.

Key Takeaways

- The Lucero acquisition is expected to boost dividends, improve the balance sheet, and positively impact earnings and revenue.

- Strategic focus on hedging and new well completions aims to stabilize revenue and support profitability amidst commodity price swings.

- Dependence on Lucero assets and hedging strategies pose risks to revenue growth, while flexible capital allocation may lead to inefficient capital use impacting margins.

Catalysts

About Vitesse Energy- Engages in the acquisition, development, and production of non-operated oil and natural gas properties in the United States.

- The acquisition of Lucero Energy Corp. is expected to be immediately accretive, which should bolster dividends and strengthen the balance sheet, potentially impacting earnings positively.

- The expansion in well production from the Lucero acquisition, with a significant increase in barrels of oil equivalent per day, should drive increased revenues.

- An increase in total proved reserves and a strategic focus on completing new wells could improve future revenue streams and profitability.

- The hedging strategy, which covers a significant portion of oil and natural gas production, is expected to stabilize revenues and protect net margins from commodity price volatility.

- Plans to use the improved balance sheet and liquidity to pursue additional acquisitions could lead to increased production and revenue growth in the near future.

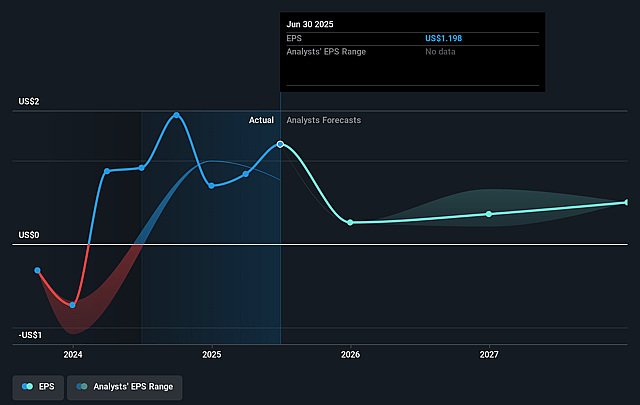

Vitesse Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vitesse Energy's revenue will grow by 18.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.6% today to 14.0% in 3 years time.

- Analysts expect earnings to reach $51.9 million (and earnings per share of $0.5) by about May 2028, up from $21.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.1x on those 2028 earnings, down from 39.4x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Vitesse Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reduction in net realized oil and natural gas prices negatively impacted year-end reserves causing potential concerns regarding future revenues and earnings stability.

- The company's production increase is partly reliant on the successful integration and development of Lucero assets, which introduces execution risks that could affect profitability and net margins.

- A significant portion of oil production and a smaller portion of natural gas production have been hedged, possibly limiting the company's ability to capitalize on potential commodity price increases, thus impacting future revenue growth.

- The oil price environment in the $60s is advantageous for acquisitions, but it also signals volatility and unpredictability in oil markets, which could pressure future earnings if prices fluctuate unexpectedly lower.

- The company has a flexible capital allocation strategy without a fixed CapEx budget, which, while allowing operational agility, might introduce risks of inefficient capital usage impacting overall earnings and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $27.25 for Vitesse Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $369.8 million, earnings will come to $51.9 million, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $21.52, the analyst price target of $27.25 is 21.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.