Last Update07 May 25Fair value Decreased 1.58%

Key Takeaways

- Rapid expansion of processing and midstream capacity, disciplined capital allocation, and operational excellence position Matador for enhanced profitability and predictable shareholder returns.

- Strong drilling inventory and ongoing technological advancements support sustained, efficient production growth and long-term free cash flow strength amid rising global energy demand.

- Long-term viability is threatened by decarbonization trends, market shifts, financial leverage, regional risks, and persistent exposure to commodity price and regulatory volatility.

Catalysts

About Matador Resources- An independent energy company, engages in the acquisition, exploration, development, and production of oil and natural gas resources in the United States.

- Rapid expansion in gas processing capacity, with the Marlan plant coming online and bringing total processing to 720 million per day, positions Matador to handle higher production volumes and third-party business, ultimately supporting higher revenues and expanding net margins as operating leverage improves.

- Strong discipline in capital allocation, as evidenced by significant debt repayment and a flexible approach to share buybacks, dividends and opportunistic acquisitions, enables Matador to capitalize on volatility in commodity prices and industry consolidation, driving future earnings per share growth and supporting shareholder returns.

- A deep runway of high-return drilling inventory in the Delaware Basin and consistently strong well results allow Matador to pursue measured, profitable production growth as global energy demand increases, elevating long-term cash flows and EBITDA margins in line with demand tailwinds.

- Expansion and optional monetization of midstream assets, including the possibility of an IPO or joint venture growth, are expected to generate recurring fee-based income and reduce transportation costs, strengthening free cash flow and improving predictability of earnings over time.

- Ongoing technological advancements in drilling and completion, combined with Matador’s operational excellence, create a persistent structural advantage by lowering break-even costs per barrel, increasing well productivity and reducing environmental impact, which enhances returns and profitability as energy demand continues to rise globally.

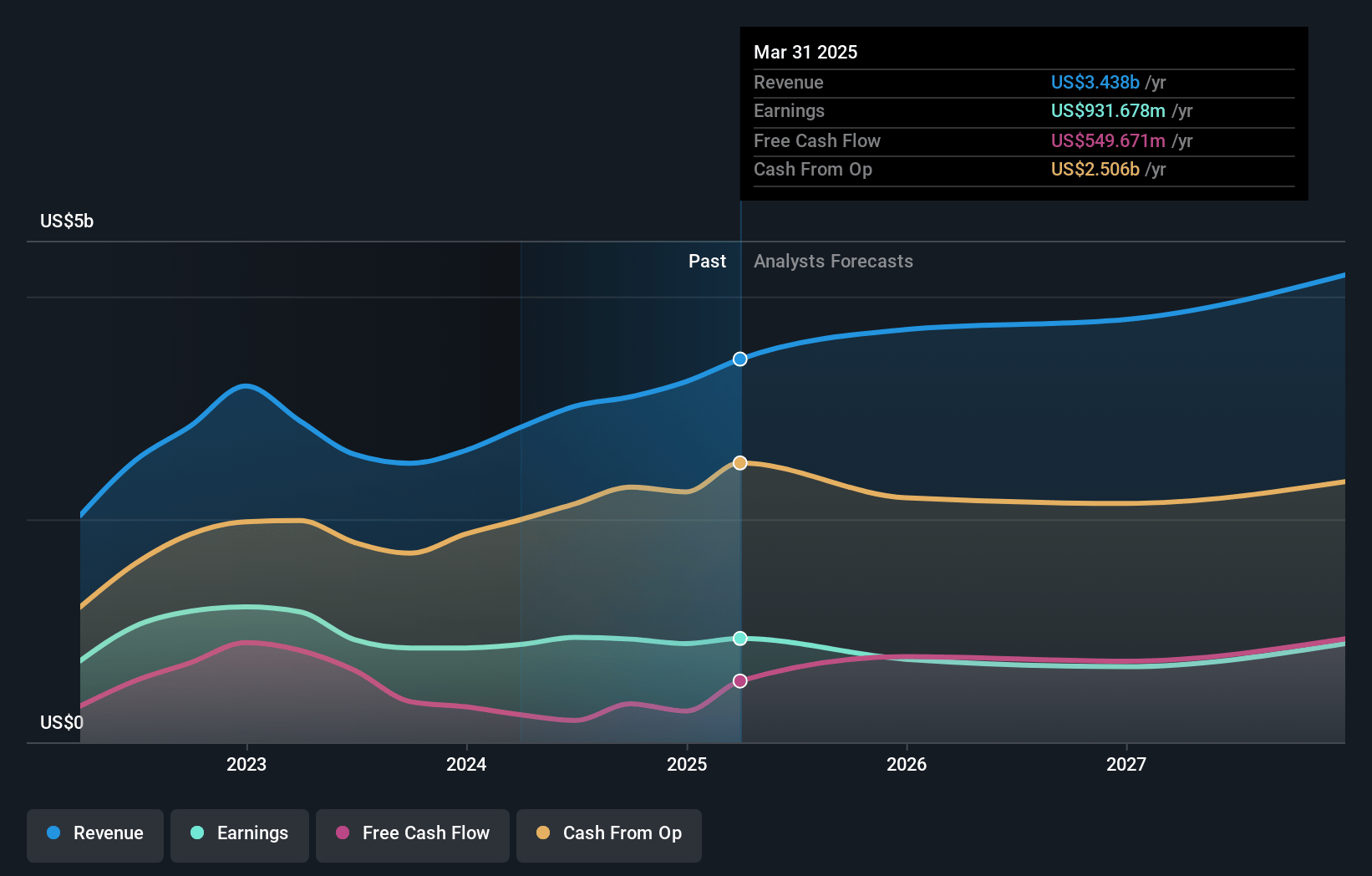

Matador Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Matador Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Matador Resources's revenue will grow by 8.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 27.1% today to 27.0% in 3 years time.

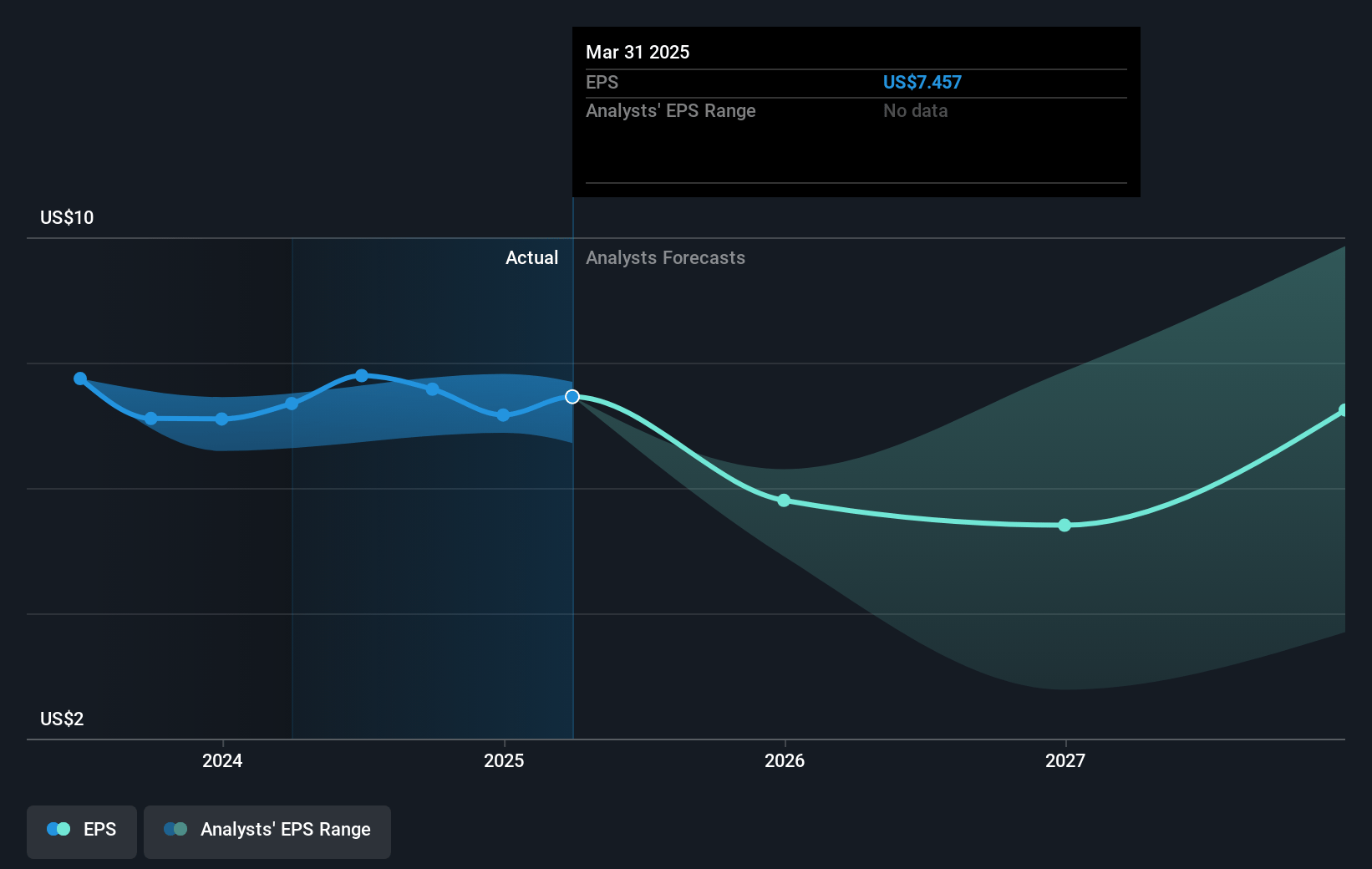

- The bullish analysts expect earnings to reach $1.2 billion (and earnings per share of $9.71) by about May 2028, up from $931.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from 5.4x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.3x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

Matador Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying global decarbonization initiatives and stricter climate policies pose significant long-term risks to Matador's core oil and gas business, as described by management's ongoing need to adapt to shifting world government actions and volatile commodity prices, ultimately threatening future revenue opportunities.

- The accelerating transition toward renewables, increased electric vehicle adoption, and secular declines in global oil demand may structurally reduce the addressable market for Matador's products, challenging the company’s ability to generate and sustain top-line growth in the years ahead.

- High reliance on debt to fund major acquisitions and infrastructure expansion, as noted in management’s discussion of prior $2 billion deals and adjusting Reserve-Based Loans, exposes Matador to heightened balance sheet vulnerability and the risk of elevated interest expenses, which could suppress future earnings and reduce financial flexibility during downturns.

- Matador’s heavy operational concentration in the Permian Basin makes it acutely sensitive to local regulatory shifts and infrastructure bottlenecks, which management acknowledged through references to capacity issues addressed via hedging and shifting drilling schedules, potentially increasing operating costs and disrupting revenue streams.

- The need for increased hedging and careful management of optionality, as discussed by both management and the CFO, reflects persistent exposure to commodity price volatility, rising input costs, and growing environmental compliance burdens, all of which threaten to compress net margins and undermine long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Matador Resources is $82.91, which represents two standard deviations above the consensus price target of $63.53. This valuation is based on what can be assumed as the expectations of Matador Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $86.0, and the most bearish reporting a price target of just $46.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.4 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of $40.33, the bullish analyst price target of $82.91 is 51.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives