Key Takeaways

- Accelerating energy transition and regulatory pressures threaten long-term oil and gas demand, diminishing revenue streams and increasing operational costs for the company.

- Dependence on continuous acquisitions and industry investment amid declining shale activity and ESG trends poses risks to revenue growth and sustainable earnings.

- Asset diversification, accretive acquisitions, strong balance sheet, and tax-advantaged distributions position the company for sustainable revenue growth and attractive investor returns.

Catalysts

About Kimbell Royalty Partners- Owns and acquires mineral and royalty interests in oil and natural gas properties in the United States.

- The accelerating global adoption of renewable energy and the shift toward electrification in transport threaten to materially erode long-term demand for oil and gas, which would reduce royalty income streams and directly diminish revenue and distributable cash flow for Kimbell over time.

- Growing regulatory and legislative pressure to address environmental externalities, such as the potential introduction of broader carbon taxes and tighter methane emission standards, is poised to increase operator costs and cripple the profitability of upstream oil and gas producers, leading to lower royalty payments and net margins for Kimbell.

- Heavy reliance on proved developed producing reserves means the company must continuously execute acquisitions just to sustain or grow cash flows; as high-quality mineral assets become scarcer and acquisition costs rise, this dependence creates long-term risks to revenue growth and the sustainability of earnings.

- Structural decline in U.S. shale drilling activity is likely as the most productive acreage is exhausted and marginal costs increase, which will impair production growth on Kimbell’s acreage, resulting in flat or declining royalty volumes, cash distributions, and ultimately lower earnings power.

- Persistent ESG-driven divestment trends and rising capital costs associated with oil and gas-linked entities will further curtail industry investment and hamper Kimbell’s access to attractively priced financing, threatening both its ability to fund acquisitions and maintain favorable net margins in the future.

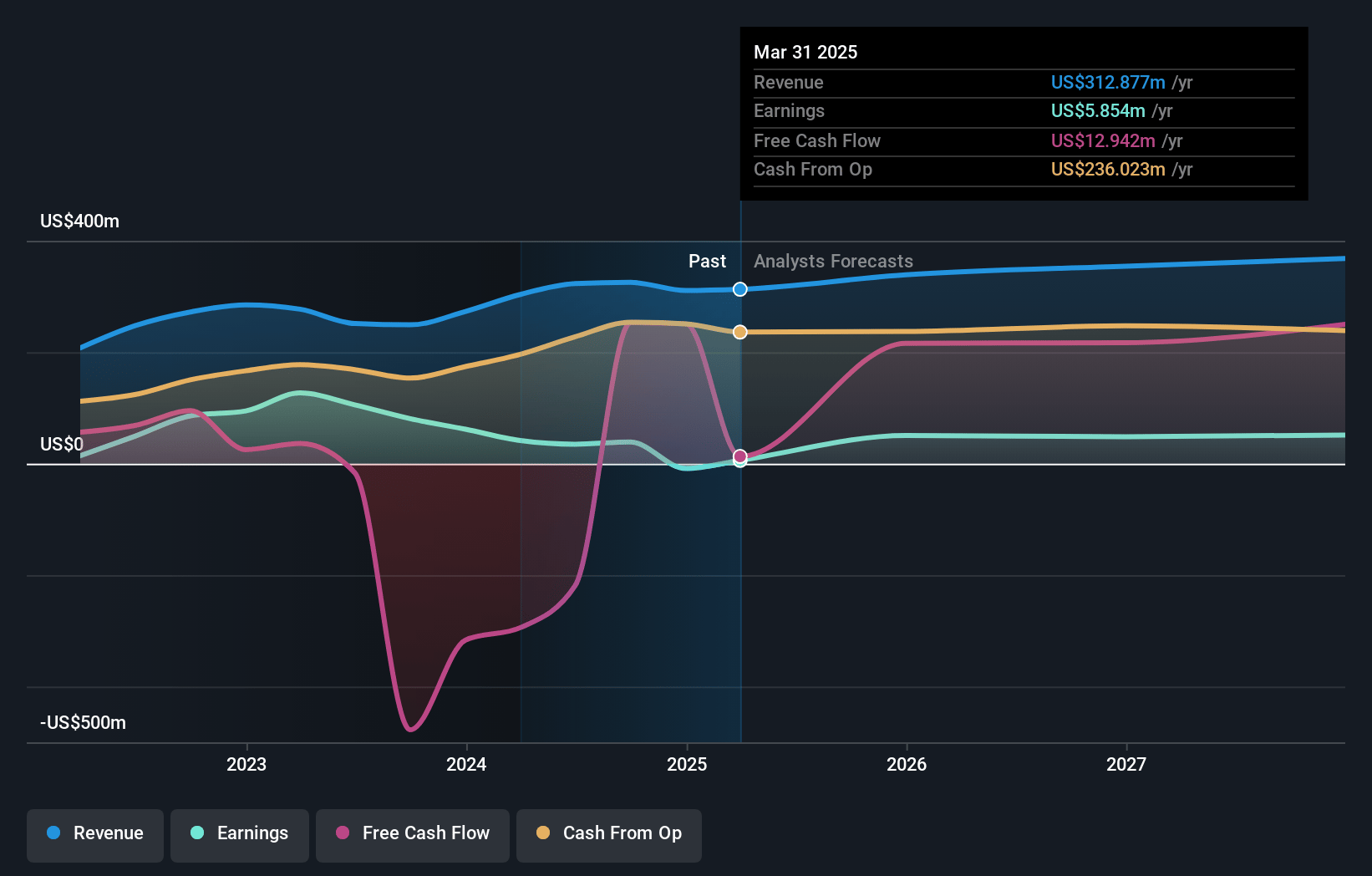

Kimbell Royalty Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Kimbell Royalty Partners compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Kimbell Royalty Partners's revenue will grow by 4.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.9% today to 12.0% in 3 years time.

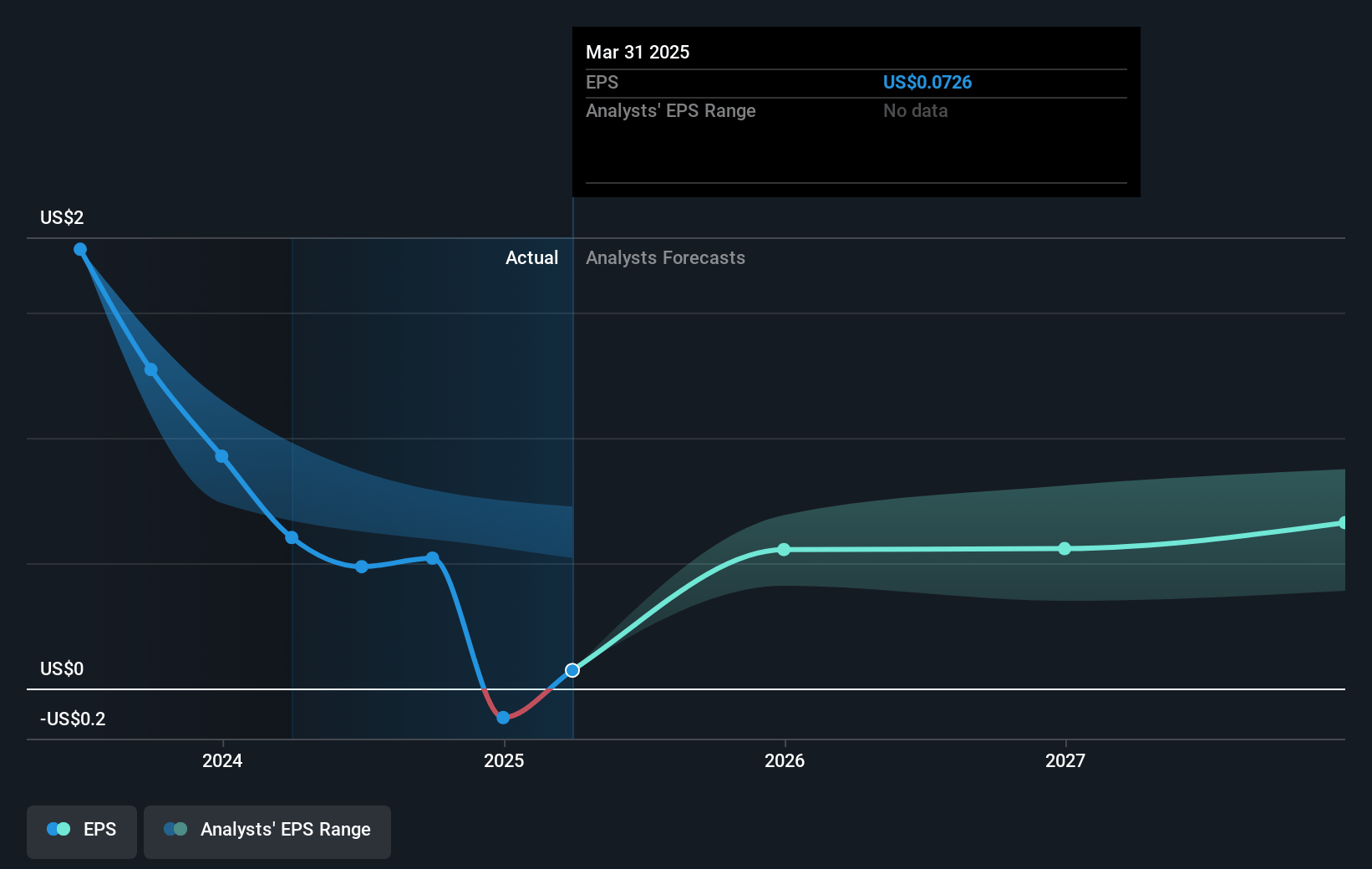

- The bearish analysts expect earnings to reach $43.5 million (and earnings per share of $0.47) by about July 2028, up from $5.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 44.0x on those 2028 earnings, down from 225.9x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.53%, as per the Simply Wall St company report.

Kimbell Royalty Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust global and U.S. energy demand, the resilience of drilling activity on Kimbell’s acreage (with 90 rigs representing 16% Lower 48 market share), and continued strong permitting and lease bonus trends suggest sustained or growing future revenues, contradicting expectations of a long-term decline in top-line results.

- Kimbell’s diversified, shallow-decline, high-margin asset base requires no operating capital, and the recurring addition of new wells—including organic growth and contributions from acquisitions—positions the company for steady free cash flow and the ability to maintain and potentially increase distributions and net income over time.

- The company’s proven track record of accretive, disciplined acquisitions in prolific basins like the Permian, along with a leadership position as a consolidator in the fragmented minerals market, points to ongoing portfolio growth and potential for further revenue and EBITDA expansion.

- Strong balance sheet management, highlighted by low net debt to EBITDA, continued deleveraging using excess cash flow, and proactive reduction in preferred equity, reduces financial risk and interest expense, potentially preserving or increasing profit margins over the long term.

- Tax-advantaged distributions, where a significant portion is classified as return of capital and thus lightly taxed for investors, could support unit price stability or even increases as yield-seeking investors may be drawn to Kimbell for the after-tax cash flow, supporting both market valuation and total return.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Kimbell Royalty Partners is $12.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kimbell Royalty Partners's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $361.5 million, earnings will come to $43.5 million, and it would be trading on a PE ratio of 44.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of $14.16, the bearish analyst price target of $12.0 is 18.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.