Narratives are currently in beta

Key Takeaways

- Extensive capital expenditure in new projects may pressure revenue growth and compress future earnings due to delayed returns.

- Investments in sour gas and CO2 sequestration could increase operational costs and impact net margins before achieving revenue growth.

- Kinetik's improved financial profile, strategic projects, and risk management hint at sustained revenue growth and robust earnings despite market volatility.

Catalysts

About Kinetik Holdings- Operates as a midstream company in the Texas Delaware Basin.

- The construction of the new high-pressure gas pipeline between Eddy County and Culberson County aims to optimize processing capacity and increase flexibility. However, the extensive capital expenditure without immediate clear revenue return could pressure revenue growth and compress future earnings.

- Kinetik is expanding its investment in sour gas treating and CO2 sequestration, which may increase operational complexities and costs before achieving significant revenue, potentially impacting future net margins until these investments mature.

- The company’s increased stakes in EPIC Crude and related transactions, while enhancing long-term strategic positioning, may initially strain financial resources with the uncertainty of immediate earnings improvement, affecting net earnings and perceived overvaluation risks.

- Planned extensive future capital projects, like expansions in the Kings Landing processing complex, could strain current financial resources. Without immediate returns, these projects may delay revenue and profit growth, influencing investor perception of stock overvaluation.

- Ongoing hedging activities through 2025 indicate a cautious stance on commodity price swings, potentially dampening the ability to capitalize on favorable market conditions, thus impacting potential future revenue growth and earnings.

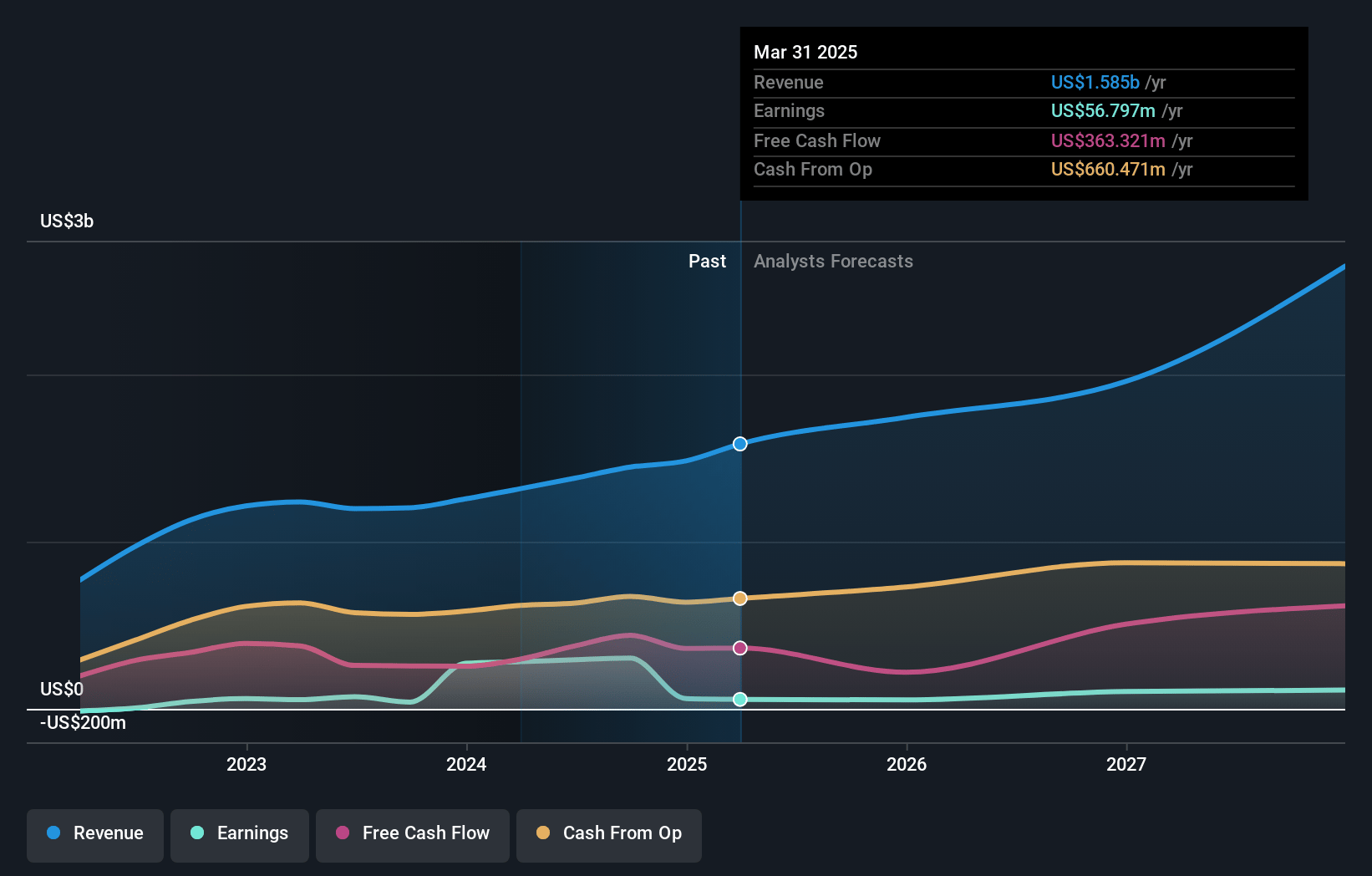

Kinetik Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kinetik Holdings's revenue will grow by 22.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 21.0% today to 9.8% in 3 years time.

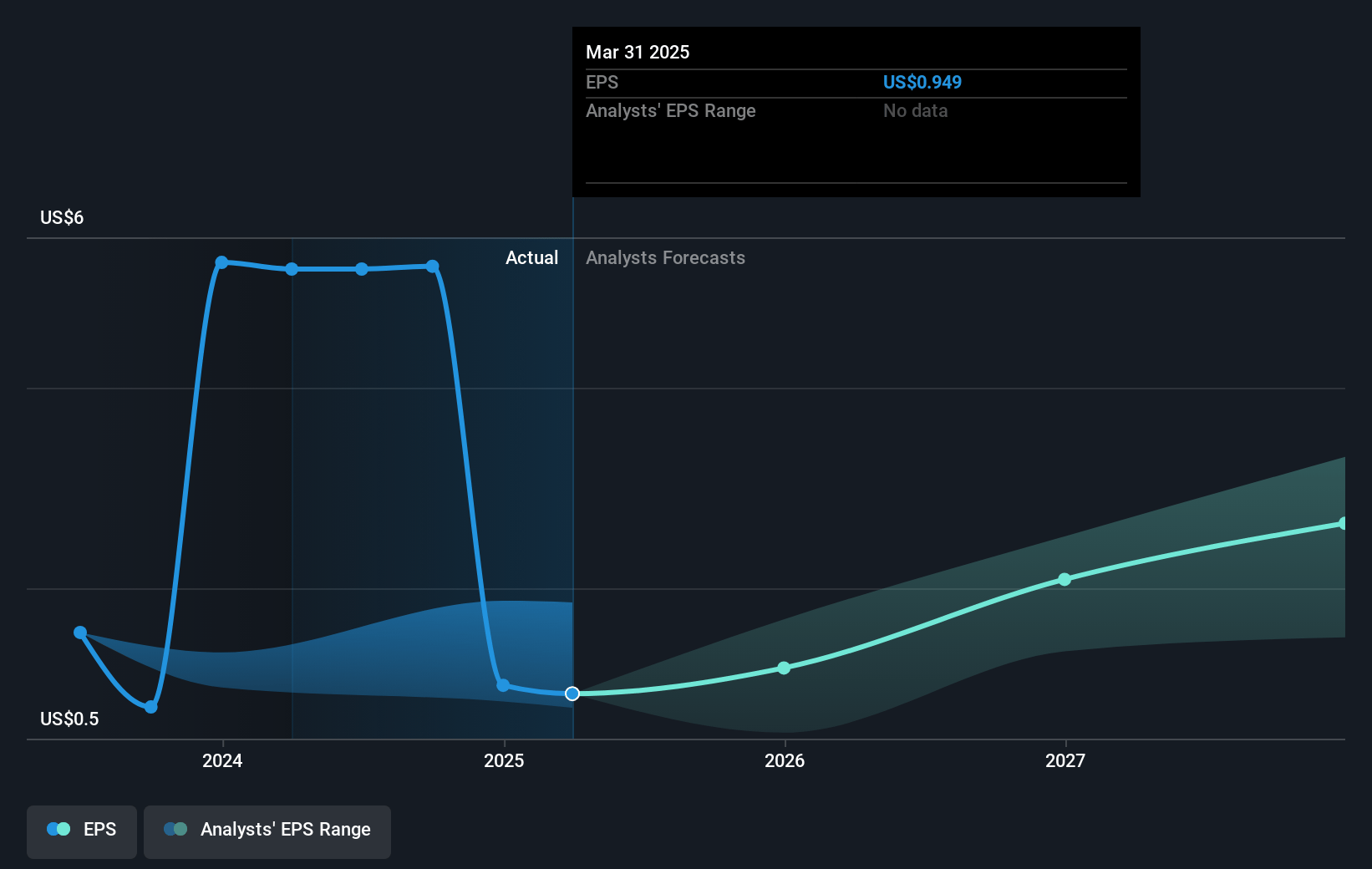

- Analysts expect earnings to reach $257.7 million (and earnings per share of $2.62) by about November 2027, down from $303.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.0x on those 2027 earnings, up from 11.8x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to decline by 14.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.8%, as per the Simply Wall St company report.

Kinetik Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kinetik's financial performance is strong, with a record quarter for adjusted EBITDA, signaling positive momentum and potential resilience in revenue and earnings growth.

- The acquisition of additional equity in EPIC Crude and obtaining a long-term transport agreement, along with credit rating upgrades, enhance the company’s financial profile and could stabilize or improve net margins.

- Upgraded guidance for adjusted EBITDA and capital expenditure discipline indicate effective cost management and operational efficiency, supporting steady earnings.

- Strategic projects, like the new high-pressure gas pipeline, are on track and expected to enable operational optimization, which might support revenue growth and higher margins.

- Active hedging strategies and flexibility in gas processing suggest risk management proficiency, potentially safeguarding against volatile market conditions and protecting net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $50.48 for Kinetik Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $58.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.6 billion, earnings will come to $257.7 million, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 7.8%.

- Given the current share price of $60.14, the analyst's price target of $50.48 is 19.1% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives