Key Takeaways

- Ongoing shifts to renewables, stricter regulations, and carbon pricing may erode Crescent Energy’s revenue, margins, and earnings growth potential.

- High leverage, reliance on acquisitions, and aging assets could strain financial flexibility and threaten long-term production and cash flow sustainability.

- Strong free cash flow, operational flexibility, accretive M&A, and a robust balance sheet position Crescent Energy for resilient earnings and long-term growth amid market volatility.

Catalysts

About Crescent Energy- An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

- The accelerating global transition to renewable energy sources is expected to cause a long-term reduction in worldwide oil demand, leading to persistent downward pressure on commodity prices and diminishing Crescent Energy’s future revenue and cash flow potential.

- Tightening environmental regulations and the adoption of carbon pricing mechanisms are likely to raise compliance and capital costs for fossil fuel producers such as Crescent Energy, eroding net margins and suppressing earnings growth over the next decade.

- Elevated leverage and the company’s ongoing reliance on acquisitions for growth may increase financial risk, with higher debt servicing costs and a strained balance sheet potentially constraining capital allocation flexibility and leading to lower net income.

- Crescent Energy’s asset base is heavily concentrated in mature U.S. basins, making it vulnerable to higher maintenance costs, declining production efficiency, and a limited inventory of high-return drilling locations, all of which threaten long-term production growth and free cash flow sustainability.

- Growing competition from alternative energy providers and more technologically advanced shale operators, coupled with increased volatility in commodity pricing, is expected to put sustained pressure on Crescent’s market share and profitability, resulting in unpredictable and potentially declining earnings over time.

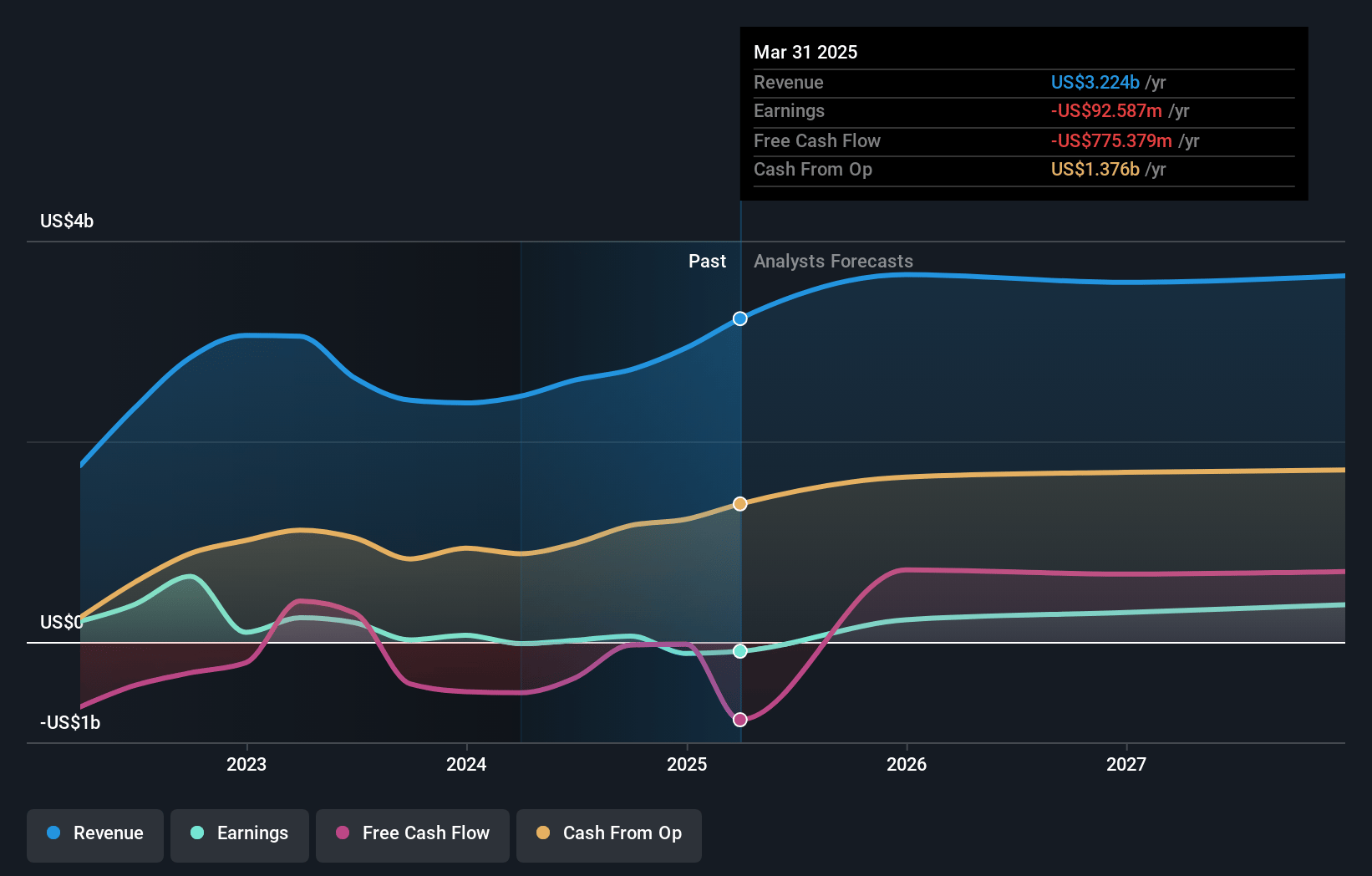

Crescent Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Crescent Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Crescent Energy's revenue will decrease by 0.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -2.9% today to 6.0% in 3 years time.

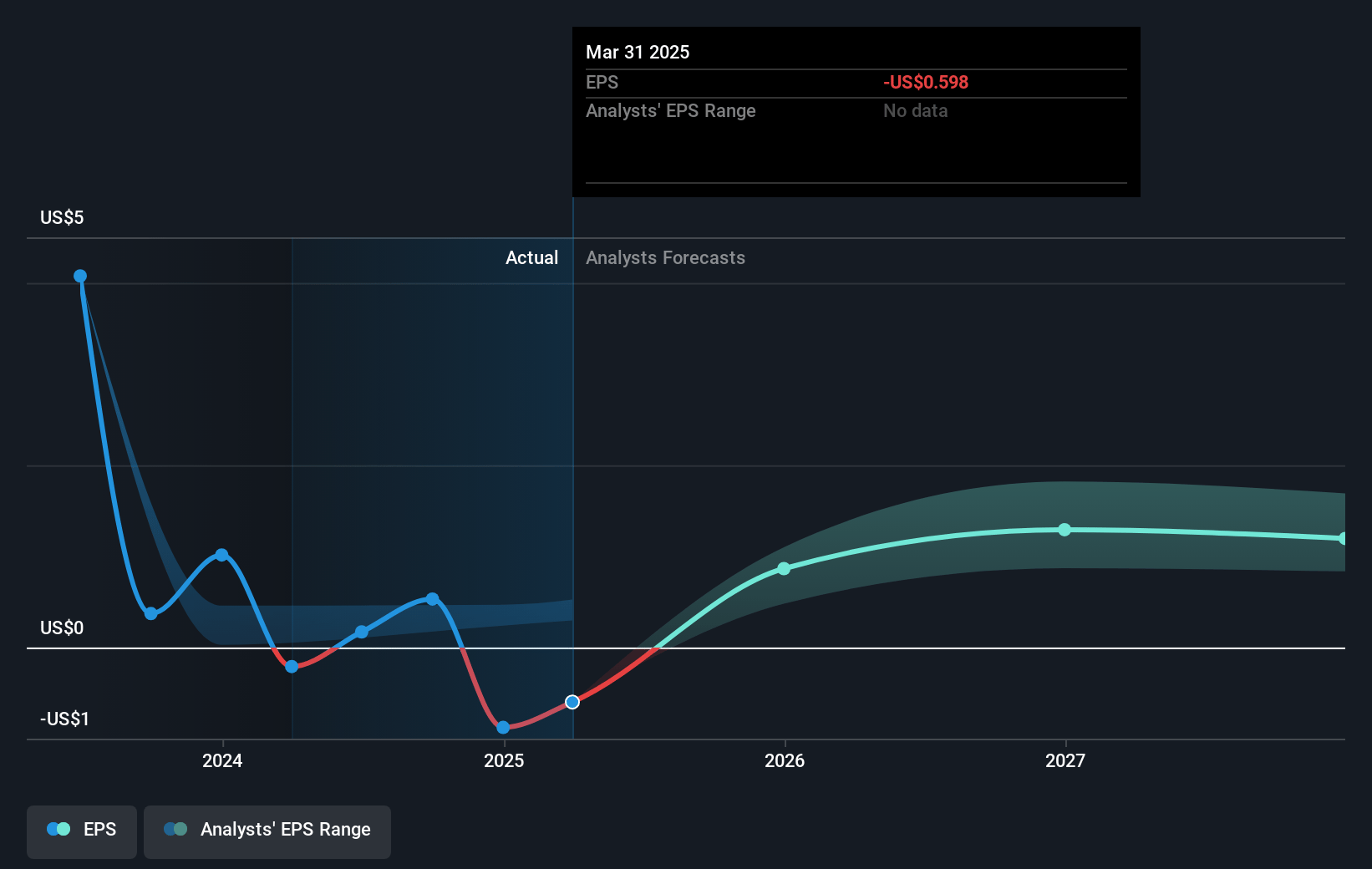

- The bearish analysts expect earnings to reach $198.0 million (and earnings per share of $0.64) by about May 2028, up from $-92.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, up from -26.1x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

Crescent Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Crescent Energy’s disciplined capital allocation, demonstrated by significant free cash flow generation, continued efficiency gains in drilling and completions, and a flexible approach to commodity exposure, supports a resilient business model that could underpin stable or rising earnings even in periods of price volatility.

- The company’s successful record of accretive M&A, highlighted by the seamless integration and strong initial performance of the Ridgemar bolt-on acquisition, increases high-margin production and low-risk inventory, which can drive sustained long-term revenue growth.

- Crescent’s portfolio is characterized by a low production decline rate and significant operational optionality (with a strong mix of oil and gas assets and limited lease obligations), which allows management to rapidly scale activity up or down based on prevailing commodity prices, thereby protecting margins and preserving free cash flow.

- With a focus on maintaining low net leverage (currently within a target range of 1 to 1.5 times) and no near-term debt maturities, Crescent benefits from robust balance sheet strength, which reduces financial risk and supports ongoing shareholder returns, such as dividends and opportunistic share repurchases, resulting in higher free cash flow per share and potential valuation uplift.

- The ongoing trend of energy supply constraints due to global underinvestment, combined with continued global baseline demand for oil and gas—even during energy transitions—could lead to structurally higher commodity prices, directly benefiting Crescent’s realized prices, revenues, and EBITDA over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Crescent Energy is $8.1, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Crescent Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $8.1.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $198.0 million, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 8.2%.

- Given the current share price of $9.47, the bearish analyst price target of $8.1 is 16.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.