Key Takeaways

- Structural shifts toward electrification and renewables could erode LNG demand, exposing Stabilis to future earnings and revenue risk despite diversification efforts.

- Increased ESG scrutiny may elevate financing costs and undermine the sustainability of margin gains achieved through operational improvements.

- Heavy reliance on industrial and marine sectors, volatile contracts, and exposure to energy transition trends threaten consistent growth, profitability, and market resilience.

Catalysts

About Stabilis Solutions- An energy transition company, provides turnkey clean energy production, storage, transportation, and fueling solutions primarily using liquefied natural gas (LNG) to various end markets in North America.

- Although there is solid multi-year demand for LNG in power generation, marine bunkering, and the aerospace segment-particularly as remote sites and the commercial space industry seek cleaner fuels-Stabilis Solutions could face shrinking revenue growth if accelerating global energy transition policies lead key customers to pursue more direct electrification and bypass LNG as a bridge solution.

- While Stabilis continues to invest in small-scale LNG infrastructure and considers expanding liquefaction capacity along the Gulf Coast, the persistent decline in the cost of renewable energy technologies and widespread adoption of batteries threaten to structurally reduce LNG demand and put downward pressure on long-term capital returns.

- Even as the company diversifies its customer base into fast-growing sectors like AI/data centers and maintains strong liquidity, its continued concentration in the LNG value chain exposes it to potential earnings risk if structural capital flight shifts away from natural gas towards purely renewable projects.

- Although there are tangible signs of increased bidding and commercial interest in distributed power, marine bunkering, and aerospace, Stabilis remains vulnerable to long-term demand destruction as industrial and transport customers increasingly electrify their processes and vehicles, potentially depressing future revenue streams.

- While operational automation and process innovation may improve margins temporarily, heightened scrutiny from ESG-focused investors is likely to elevate the company's cost of capital and limit access to financing, undermining the sustainability of margin expansion and future earnings growth.

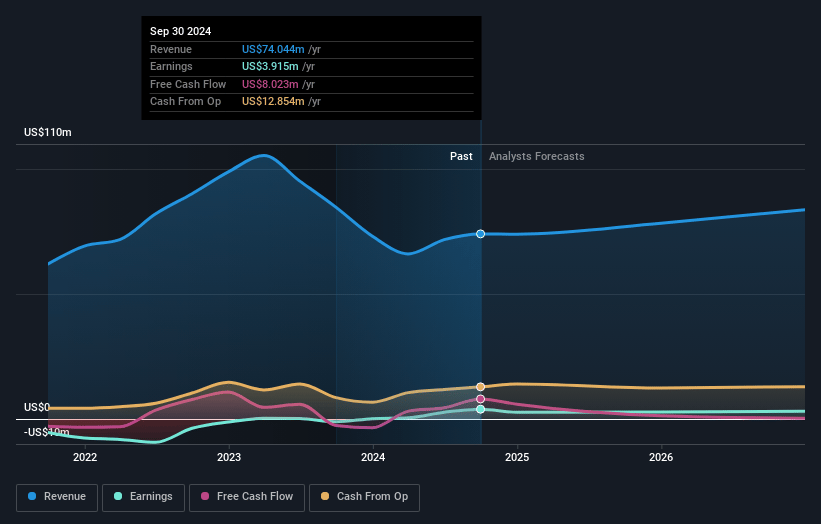

Stabilis Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Stabilis Solutions compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Stabilis Solutions's revenue will grow by 10.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.2% today to 5.1% in 3 years time.

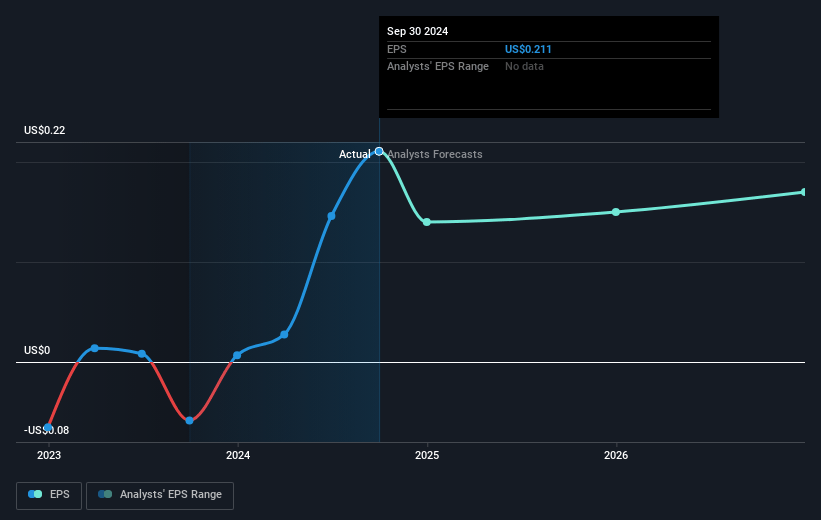

- The bearish analysts expect earnings to reach $4.9 million (and earnings per share of $0.27) by about July 2028, up from $1.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 39.9x on those 2028 earnings, down from 63.1x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Stabilis Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's revenue declined by 12 percent year-over-year in the first quarter, primarily due to the roll-off of a large contract and planned customer downtime, which exposes Stabilis Solutions to significant revenue volatility tied to concentrated industrial and marine customers and raises concerns about its ability to maintain consistent revenue growth.

- The first quarter saw a swing from net income of one point five million dollars in the prior year to a net loss of one point six million dollars, highlighting ongoing margin pressures and operating leverage risks that could impact long-term earnings if contract wins do not offset these losses.

- Ongoing investments in commercial, technical, and operational personnel, as well as significant capital expenditures focused on growth initiatives, are already pressuring near-term earnings and could stretch balance sheet flexibility if new contract conversions or market expansions fall short of expectations.

- Although aerospace revenues grew significantly, more than half of Stabilis' revenue remains concentrated in the marine and aerospace sectors, implying that adverse market changes, regulatory shifts, or technological advances such as adoption of alternative fuels or electrification in these segments could lead to further revenue instability.

- Broader long-term secular headwinds, including the acceleration of renewable energy adoption, declining costs for batteries, and more aggressive net-zero mandates, threaten to reduce the addressable market for LNG and could make it increasingly difficult for Stabilis Solutions to grow market share or sustain high returns on invested capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Stabilis Solutions is $9.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Stabilis Solutions's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $95.8 million, earnings will come to $4.9 million, and it would be trading on a PE ratio of 39.9x, assuming you use a discount rate of 6.4%.

- Given the current share price of $5.2, the bearish analyst price target of $9.0 is 42.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.