Key Takeaways

- Favorable regulatory shifts and persistent reliance on baseload power are supporting stable coal demand and revenue resilience for Alliance Resource Partners.

- Expanding oil & gas royalties and operational improvements are boosting margins, diversifying earnings, and insulating cash flow from coal market volatility.

- Heavy dependence on U.S. coal demand and regulatory support exposes Alliance to significant risks from policy changes, pricing declines, and limited diversification.

Catalysts

About Alliance Resource Partners- A diversified natural resource company, engages in the production and marketing of coal to utilities and industrial users in the United States.

- Recent legislative and administrative shifts in U.S. energy policy-such as regulatory reprieves for coal plants, the phasing out of renewable tax credits in favor of baseload power, and direct financial incentives to keep fossil fuel plants operational-have created the most favorable regulatory environment for coal in decades. These tailwinds should support stable or potentially higher future coal sales volumes and improve longer-term revenue visibility for Alliance Resource Partners.

- Stronger-than-expected electricity demand increases driven by AI data center expansion, domestic manufacturing growth, and warmer-than-average weather have decreased utility coal inventories to near equilibrium levels and spurred multiple new long-term contract solicitations. This inflection in utility behavior is likely to stabilize or grow future contracted tonnage, protecting revenue and earnings streams over a multi-year horizon.

- Persistent global and domestic reliance on affordable, reliable baseload energy (coal and natural gas) due to slow renewable adoption and ongoing energy security concerns has prompted utilities to extend the life of coal plants and delay retirements. This is likely to underpin consistent demand for Alliance's coal, supporting resilient top-line revenue for the foreseeable future.

- Expanding high-margin oil & gas royalty business-evidenced by upgraded volume guidance and continued investments in high-quality basins-provides both organic growth and reduces cash flow cyclicality. This diversification is poised to strengthen EBITDA and net margins while insulating overall earnings from coal market volatility.

- Operational improvements-including successful mine transitions in Appalachia, enhanced recoveries, and ongoing cost reductions-position Alliance to sustain or improve net margins even as average realized coal prices trend slightly lower, supporting robust free cash flow and earnings stability across commodity cycles.

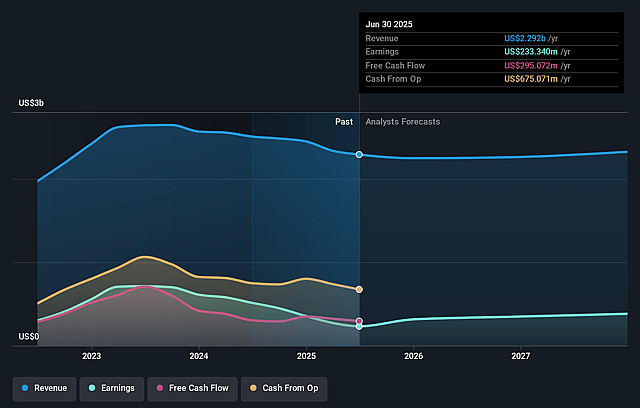

Alliance Resource Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alliance Resource Partners's revenue will grow by 1.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 16.4% in 3 years time.

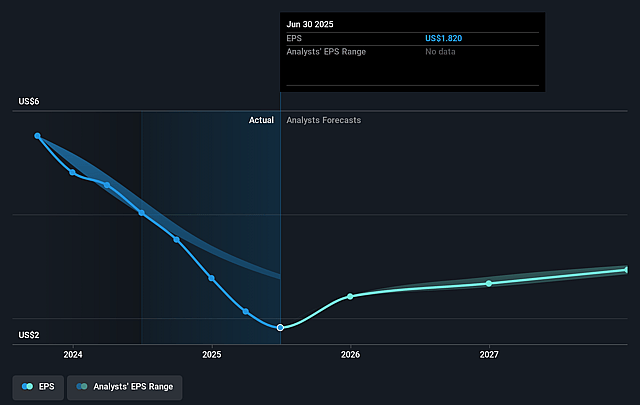

- Analysts expect earnings to reach $389.8 million (and earnings per share of $2.99) by about September 2028, up from $233.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, which is the same as it is today today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.06%, as per the Simply Wall St company report.

Alliance Resource Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The 11.3% year-over-year decline in average coal sales price per ton and management's guidance for 2026 pricing to be approximately 5% below 2025 levels indicate a sustained downward trend in coal pricing as legacy higher-priced contracts roll off, putting continued pressure on revenues and the company's ability to sustain current margins.

- Despite optimism about domestic demand and a favorable regulatory environment, there is heavy reliance on U.S. coal-fired generation and relatively limited export volumes, leaving Alliance acutely exposed to the risk of rapid domestic policy reversals, regulatory shifts, or accelerated coal plant retirements, all of which could significantly reduce addressable market size and negatively impact revenues and earnings.

- The company's need to cut its distribution by ~$50 million annually, justified as a move toward "more sustainable" margins post-energy crisis and increased financial flexibility, suggests weakened long-term earnings power and cash flow visibility-especially in comparison to 2022 highs.

- While royalty revenues and EBITDA margins from oil and gas have grown, the overall size and growth potential of the segment remain constrained and subject to commodity price volatility, limiting its ability to offset potential declines or margin compression in the core coal business and posing a risk to long-term earnings stability.

- The text highlights positive, but short-term, regulatory and political support for coal; however, this creates heavy dependence on the current U.S. administration-should national or state-level energy policy direction change, or should long-term secular trends toward renewables and decarbonization reassert themselves, Alliance's coal assets could become stranded, leading to rapid revenue and margin declines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $30.5 for Alliance Resource Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $389.8 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 7.1%.

- Given the current share price of $22.54, the analyst price target of $30.5 is 26.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Alliance Resource Partners?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.