Last Update 28 Nov 25

Fair value Increased 2.21%WU: Digital Initiatives And Policy Headwinds Will Shape Medium-Term Revenue Expansion

Analysts have raised Western Union’s price target from $9.42 to $9.63, citing a clear growth strategy and steady improvements in key financial metrics.

Analyst Commentary

Recent analyst reports have provided both encouraging insights and noted several ongoing risks regarding Western Union’s outlook and execution strategy.

Bullish Takeaways- Bullish analysts highlight Western Union’s ambitions for 20% revenue growth through 2028. This outlook is supported by a clear and measurable strategic roadmap.

- Analysts note that prioritizing improvements in Retail Money Transfer and accelerating the expansion in Digital Money Transfer are seen as key drivers of long-term profitability.

- The company’s decision to expand its offerings in Consumer Services is viewed as an important step toward broadening revenue streams and addressing new market needs.

- Incremental increases in price targets reflect confidence in Western Union's ability to execute on its core initiatives and deliver steady financial performance.

- Bearish analysts remain cautious due to ongoing challenges in modernizing the business in the context of industry shifts and digital disruption.

- Recent results have been negatively affected by increased immigration oversight, which creates near-term uncertainty around remittance volumes.

- Unlocking synergies from recent acquisitions, such as Intermex, is expected to take longer than initially anticipated. This may potentially delay the realization of growth targets.

- There is recognition that broader industry trends, including the digital transition of remittances, may continue to generate policy and operational headwinds.

What's in the News

- Western Union plans to launch a dollar-backed stablecoin called U.S. Dollar Payment Token (USDPT) on the Solana blockchain, with issuance by Anchorage Digital Bank. The launch is expected in the first half of 2026 (The Wall Street Journal).

- The new stablecoin and a Digital Asset Network aim to bridge digital and fiat currencies, expand user access to digital assets, and facilitate global money movement with enhanced security and compliance (Company announcement).

- dLocal and Western Union have formed a strategic alliance to introduce local digital payment methods on Western Union’s online platforms across several Latin American countries, supporting growing digital remittance adoption (Company announcement).

- Western Union completed a share buyback of nearly 6 million shares (1.84%) for $49.99 million, as part of a broader repurchase program totaling $199.66 million (Company report).

- Western Union’s strategic focus and financial outlook were discussed at the recent Analyst/Investor Day, highlighting initiatives for future growth (Company event).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from $9.42 to $9.63.

- Discount Rate has increased modestly from 9.11% to 9.20%.

- Revenue Growth expectations have edged up from 1.34% to 1.37%.

- Net Profit Margin has improved fractionally from 12.23% to 12.25%.

- Future P/E ratio is up from 6.19x to 6.33x.

Key Takeaways

- Expansion in digital services, AI integration, and new consumer offerings enhance cost efficiency, diversify revenue, and position the company for higher margins and long-term growth.

- Increased migration and urbanization drive resilient remittance demand, while early adoption of blockchain and stablecoin technologies offers new revenue and operational advantages.

- Declining transaction volumes, rising regulatory and compliance burdens, and intensified competition from digital and fintech disruptors threaten revenue, market share, and long-term profitability.

Catalysts

About Western Union- Provides money movement and payment services worldwide.

- The ongoing digital transformation-including expanded digital wallet offerings, card-based retail transactions, and value-added services-positions the company to capture a growing share of the large, underpenetrated market of financially included and mobile-first consumers, supporting improved revenue growth and higher long-term net margins due to better cost efficiency.

- Rising global migration flows and continued urbanization underpin resilient long-term demand for cross-border remittances, strengthening Western Union's top-line prospects despite near-term headwinds in specific corridors or geographies.

- The integration of AI-driven operational improvements across customer service, technology, and treasury operations is already driving significant cost savings and productivity gains, providing a clear path to further operating margin expansion and improved long-term earnings power.

- Early strategic engagement with stablecoins and on-chain settlement technologies offers the potential to materially lower capital requirements, accelerate settlement speed, and potentially increase revenue opportunities by serving as a global on/off-ramp between fiat and digital currencies as global payments infrastructure modernizes.

- Growth in the Consumer Services segment-including acquisitions like Eurochange and expanded travel money and bill-pay offerings-unlocks new, higher-margin revenue streams and diversifies earnings, contributing to greater earnings stability and supporting higher valuations as these businesses scale.

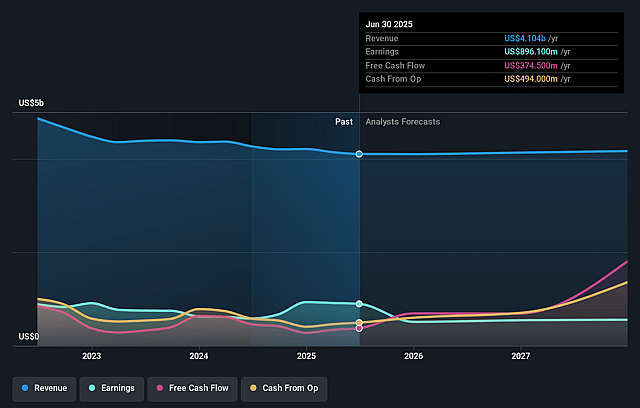

Western Union Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Western Union's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 21.8% today to 12.7% in 3 years time.

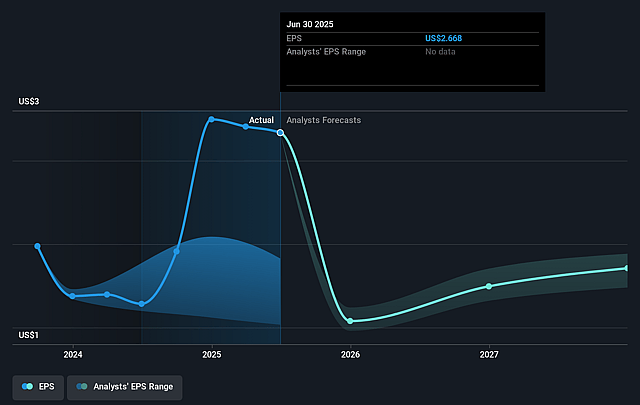

- Analysts expect earnings to reach $543.0 million (and earnings per share of $1.82) by about August 2028, down from $896.1 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $602.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.4x on those 2028 earnings, up from 3.0x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.0x.

- Analysts expect the number of shares outstanding to decline by 4.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.72%, as per the Simply Wall St company report.

Western Union Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying regulatory scrutiny and enforcement around immigration in the U.S. is creating persistent volatility and softness in key corridors, especially U.S. to Mexico, leading to lower transaction volumes and risking further revenue declines if policies tighten further or customer behavior shifts to informal or alternative remittance channels. (Impacts: revenue and earnings)

- Growth in Western Union's digital business is not offsetting weakness in the core retail channel in North America; both digital and retail money transfer transactions showed declines in critical regions, suggesting the company may be losing market share to digital-first disruptors and that topline growth is at risk. (Impacts: revenue and top-line growth)

- Aggressive expansion of lower-cost digital and fintech competitors, as well as emerging blockchain and stablecoin-based solutions, is eroding pricing power and could pressure profit margins long-term if Western Union cannot accelerate its shift to digital and innovate fast enough. (Impacts: net margins and long-term competitiveness)

- Increasing global financial inclusion and rising adoption of digital wallets may reduce dependence on cash-based remittances-Western Union's historical core-limiting customer growth potential and challenging legacy agent-network-driven cost structure. (Impacts: revenue, customer base, and cost flexibility)

- New taxes on cash remittance transactions (such as the 1% U.S. remittance tax) and ongoing regulatory changes raise compliance costs and could further drive customers towards non-traditional or lower-cost channels, making it more difficult for Western Union to protect net margins if they do not successfully transform their business mix. (Impacts: net margins and cost structure)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.318 for Western Union based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.3 billion, earnings will come to $543.0 million, and it would be trading on a PE ratio of 6.4x, assuming you use a discount rate of 9.7%.

- Given the current share price of $8.42, the analyst price target of $9.32 is 9.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.