Last Update 05 Nov 25

Fair value Increased 6.68%AMG: Expanded Credit Partnership And Share Buybacks Will Drive Profitability

Narrative Update on Affiliated Managers Group: Analyst Price Target Raised

Analysts have raised their price target for Affiliated Managers Group from $288.71 to $308.00. They cite improved profit margin projections and a lower discount rate as key factors.

What's in the News

- From July 1, 2025 to November 3, 2025, Affiliated Managers Group repurchased 341,894 shares, representing 1.21% of its outstanding shares for $76.97 million. The company has now completed repurchasing 2,055,852 shares (7.05%), totaling $370.28 million under the July 29, 2024 buyback plan (Key Developments).

- Affiliated Managers Group and Brown Brothers Harriman (BBH) announced a strategic collaboration to expand BBH’s structured and alternative credit investment offerings into the U.S. wealth market through AMG’s capabilities. AMG will provide seed capital and make a minority investment in BBH Credit Partners, a new BBH subsidiary created for these initiatives (Key Developments).

- BBH Credit Partners, launched as part of this partnership, will offer innovative structured and alternative credit solutions tailored to U.S. wealth clients. This initiative will leverage BBH’s $55 billion taxable fixed income franchise and AMG’s strategic expertise (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen from $288.71 to $308.00, indicating a positive valuation adjustment.

- Discount Rate has decreased slightly, moving from 9.12% to 8.87%.

- Revenue Growth projections have declined modestly, changing from 5.98% to 5.51%.

- Net Profit Margin has increased from 27.77% to 28.44%.

- Future P/E ratio has risen marginally from 12.86x to 13.40x.

Key Takeaways

- Surging demand for alternative and tax-efficient strategies is driving significant revenue and margin growth via higher management and performance fees from specialized affiliates.

- Ongoing affiliate investments and disciplined capital allocation support expanding shareholder value, margin improvement, and resilience against fee compression in commoditized segments.

- Heavy reliance on key affiliates and alternatives exposes AMG to concentration, industry shifts toward passive investing, pricing pressure, and heightened execution and earnings risk.

Catalysts

About Affiliated Managers Group- Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

- Record-breaking inflows and rapid expansion in alternative assets-AMG increased alternative AUM by 20% in six months and reported its strongest organic growth quarter in 12 years-position the company to benefit from persistent global demand for yield, diversification, and differentiated strategies, directly supporting top-line revenue and future net margin improvement due to higher fee structures in alternatives.

- Rising client demand for tax-aware and innovative liquid alternative strategies, especially from high net worth and wealth channels, is driving higher management and performance fees at affiliates like AQR, supporting both revenue growth and higher net margins as these strategies command premium fee rates and have longer asset duration.

- AMG's disciplined capital allocation-deploying nearly $1.2 billion across growth investments and share repurchases in the first half of 2025-points to ongoing per-share earnings growth and return on equity expansion, with substantial buybacks expected to continue compounding shareholder value through enhanced EPS.

- A robust pipeline of new affiliate investments (four new partnerships in 2025 already, mostly in private markets and liquid alternatives) and strong organic growth at existing affiliates are set to drive a step-up in EBITDA and economic EPS for 2026 and beyond, with management signaling these new investments will be increasingly accretive as they scale and begin contributing carried interest.

- AMG's scalable partnership model-allowing it to efficiently add new affiliates without full integration-supports margin expansion and long-term earnings stability while positioning the company to capitalize on industry-wide growth in investable assets and demand for specialist alternatives, insulating it from fee compression faced by more commoditized active managers.

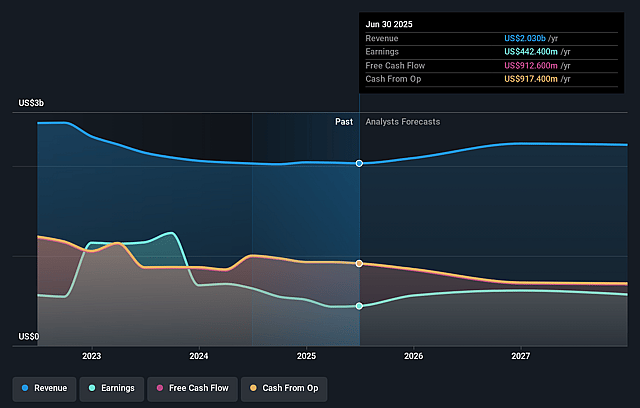

Affiliated Managers Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Affiliated Managers Group's revenue will grow by 2.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 21.8% today to 27.0% in 3 years time.

- Analysts expect earnings to reach $594.9 million (and earnings per share of $24.03) by about September 2028, up from $442.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, down from 14.9x today. This future PE is lower than the current PE for the US Capital Markets industry at 26.7x.

- Analysts expect the number of shares outstanding to decline by 6.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Affiliated Managers Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent outflows from traditional active equity (long-only) strategies and continued "industry and near-term performance headwinds" in this category may offset alternative inflows, and long-term secular trends toward passive investing and lower-cost products could further pressure AMG's aggregate AUM and top-line revenue.

- AMG's earnings are increasingly concentrated among a few large affiliates, particularly Pantheon and AQR; any underperformance, reputational event, or capacity constraint at these core boutiques could result in revenue volatility and reduce overall business stability.

- While alternative assets are growing rapidly, the text acknowledges that private markets fundraising can be "more volatile in terms of its magnitude," subjecting AMG's growth trajectory and future management/performance fee revenues to unpredictable market cycles and investor sentiment.

- Fee rates in alternatives are higher today, but ongoing industry-wide fee compression and the rise of digital platforms could pressure AMG's pricing power over time and negatively impact net margins and EBITDA growth.

- As AMG focuses more capital on new affiliate investments and share buybacks, future earnings are increasingly reliant on successful integration and performance from newly acquired boutiques-raising execution risks, ongoing talent retention challenges, and possible adverse impacts on future earnings if acquisition returns underwhelm.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $253.857 for Affiliated Managers Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $331.0, and the most bearish reporting a price target of just $195.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.2 billion, earnings will come to $594.9 million, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 9.2%.

- Given the current share price of $231.96, the analyst price target of $253.86 is 8.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.