Narratives are currently in beta

Key Takeaways

- Expansion in online and offline programs, coupled with AI-powered innovations, aims to drive future revenue growth by attracting more users.

- Focus on lower ASP products and operational efficiency improvements seeks broader market capture and enhanced competitiveness, potentially boosting margins and EPS.

- Rising costs, increased competition, and high marketing expenses threaten TAL Education Group's profit margins and future profitability, especially in the loss-making learning devices segment.

Catalysts

About TAL Education Group- Provides K-12 after-school tutoring services in the People’s Republic of China.

- TAL Education Group is focused on expanding its learning services with both online and offline programs, addressing evolving market demands which may drive future revenue growth.

- Introduction of new AI-powered learning devices and continuous innovation in offering personalized learning experiences are expected to attract a broader user base and enhance user engagement, potentially boosting future earnings.

- Expansion into lower ASP products, such as the XBook, aims to capture a wider market segment, which could lead to increased revenue in underserved areas.

- Investment in strengthening online product capabilities and operational strategies is anticipated to improve competitiveness and operational efficiency, potentially positively impacting net margins.

- The company's share repurchase program indicates a commitment to maximizing shareholder value, which can enhance earnings per share (EPS) in the near future.

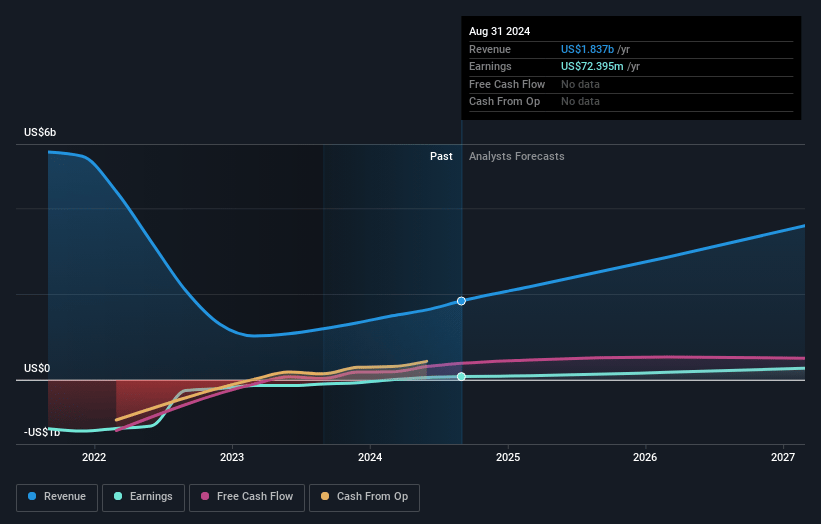

TAL Education Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TAL Education Group's revenue will grow by 25.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.9% today to 7.4% in 3 years time.

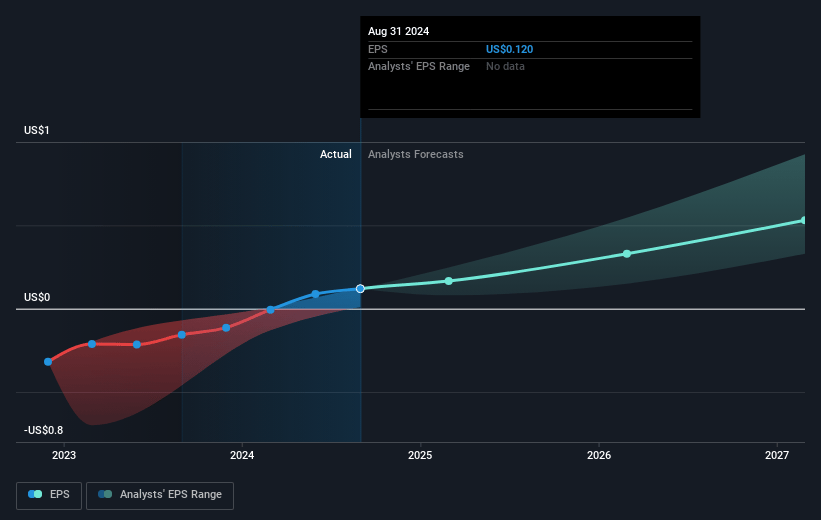

- Analysts expect earnings to reach $270.1 million (and earnings per share of $0.53) by about November 2027, up from $72.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $565.3 million in earnings, and the most bearish expecting $95 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.5x on those 2027 earnings, down from 82.9x today. This future PE is greater than the current PE for the US Consumer Services industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 5.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.08%, as per the Simply Wall St company report.

TAL Education Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increase in cost of revenue by 59.8% year-over-year, outpacing revenue growth, suggests risks to profit margins if costs continue to rise faster than revenue, potentially impacting net margins.

- Selling and marketing expenses rose by 56.4%, indicating a need for high spending to sustain revenue growth, which could pressure earnings if not balanced by proportional revenue increases.

- The learning devices segment is currently loss-making, presenting a risk to overall profitability if this segment does not become self-sustaining or generate sufficient revenue to offset costs.

- Gross margin decreased from 58.9% to 56.3% year-over-year, implying potential challenges in maintaining pricing power or increased competition leading to squeezed margins, impacting overall earnings.

- The company faces competitive pressures from “full stack” players in the learning devices market, potentially requiring continued high investment in R&D and marketing to maintain market position, impacting cash flow and future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.04 for TAL Education Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $10.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.7 billion, earnings will come to $270.1 million, and it would be trading on a PE ratio of 32.5x, assuming you use a discount rate of 7.1%.

- Given the current share price of $9.91, the analyst's price target of $14.04 is 29.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives