Narratives are currently in beta

Key Takeaways

- Expanding production efficiency and market penetration through Texas plant upgrades and independent dealer networks could enhance revenue growth and net margins.

- New revenue streams from land and mobile home lot development, alongside increased retail financing, promise positive impacts on future earnings.

- Declining sales, production issues, and low occupancy pose risks to revenue, net margins, and cash flow, impacting growth forecasts negatively.

Catalysts

About Legacy Housing- Engages in the building, sale, and financing of manufactured homes and tiny houses primarily in the southern United States.

- The successful fall show, which featured significant updates to home finishes, resulted in a backlog of orders extending into the first quarter of 2025. This is likely to increase future revenue as these orders are fulfilled.

- Plans to ramp up production at the Texas plants suggest higher production efficiency and capacity utilization, which could improve net margins and increase revenue as output rises.

- An increase in retail finance applications and funding indicates potential growth in customer financing options, likely boosting sales revenue and earnings through higher transaction volumes in 2025.

- Expanding independent dealer networks in key areas such as South Texas, Florida, and the Carolinas could enhance market penetration and drive revenue growth from new markets.

- The development and sale of land and mobile home lots, such as those in Bastrop County and Horseshoe Bay, promise additional revenue streams and potential for gain recognition, impacting overall earnings positively when these transactions occur.

Legacy Housing Future Earnings and Revenue Growth

Assumptions

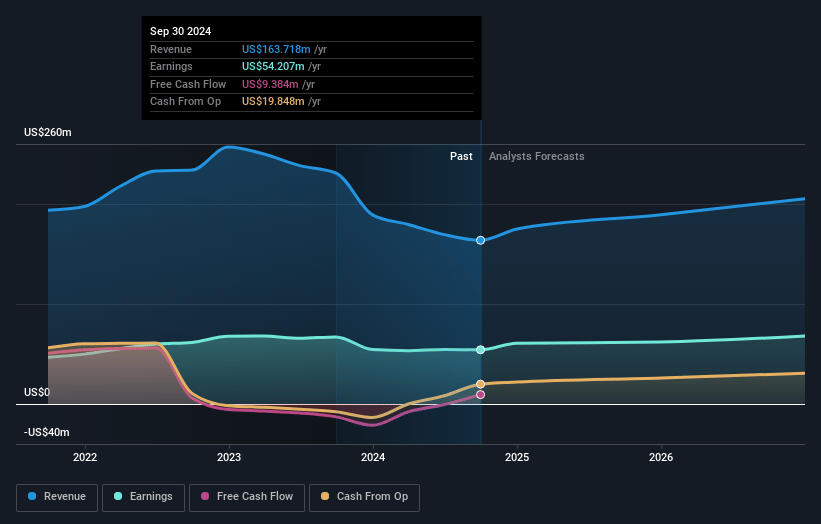

How have these above catalysts been quantified?- Analysts are assuming Legacy Housing's revenue will grow by 10.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 33.1% today to 32.6% in 3 years time.

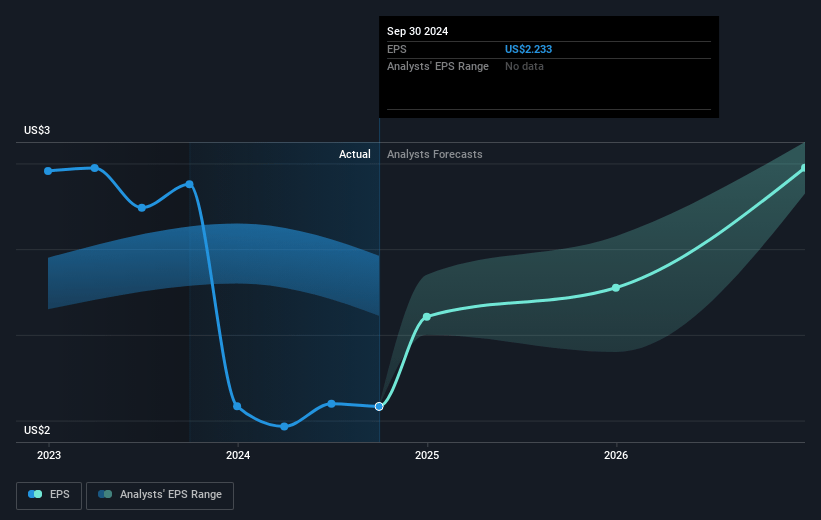

- Analysts expect earnings to reach $72.0 million (and earnings per share of $2.94) by about November 2027, up from $54.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2027 earnings, up from 11.2x today. This future PE is greater than the current PE for the US Consumer Durables industry at 11.2x.

- Analysts expect the number of shares outstanding to grow by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.78%, as per the Simply Wall St company report.

Legacy Housing Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Product sales decreased by 18.3% in the third quarter of 2024 compared to the same period in 2023, primarily due to lower unit volumes shipped in key sales categories, impacting revenue negatively.

- Gross profit margin fell from 32.9% to 29.2%, driven by decreased production levels and under-absorbed labor costs, which could pressure net margins.

- Delays in production due to the introduction of new product finishes and materials could disrupt sales flow and lead to backlog management issues, affecting both revenue and earnings stability.

- High-interest rates continue to depress transaction volumes in the community business, which may adversely impact growth forecasts and related revenues.

- The occupancy rates at recently acquired mobile home parks are only at approximately 35%, introducing risks related to operational costs and potential delays in monetization that might influence net income and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.5 for Legacy Housing based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $220.5 million, earnings will come to $72.0 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of $25.2, the analyst's price target of $31.5 is 20.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives