Last Update 06 Sep 25

Fair value Increased 9.20%Despite a notable reduction in consensus revenue growth forecasts, a slight improvement in net profit margin has contributed to the analyst price target for Brady increasing from $87.00 to $95.00.

What's in the News

- Brady expects GAAP earnings per diluted Class A Nonvoting Common Share to rise 15.5%–23.1% to $4.55–$4.85 for the year ending July 31, 2026.

- The company repurchased 257,282 shares for $17.68 million from May through July, completing a total of 3,911,852 shares repurchased (8% of shares) for $213.05 million under its buyback program.

- The board approved an increase in the annual dividend on Class A Common Stock from $0.96 to $0.98 per share, with a quarterly dividend of $0.245 per share to be paid on October 31, 2025.

Valuation Changes

Summary of Valuation Changes for Brady

- The Consensus Analyst Price Target has risen from $87.00 to $95.00.

- The Consensus Revenue Growth forecasts for Brady has significantly fallen from 5.1% per annum to 4.1% per annum.

- The Net Profit Margin for Brady has risen slightly from 15.23% to 15.90%.

Key Takeaways

- Strong R&D investments and strategic acquisitions are driving growth in automation, traceability, and compliance solutions, expanding Brady's presence in higher-margin markets.

- Operational improvements and global expansion, especially in high-growth regions, are enhancing profitability and providing diversified, resilient revenue streams.

- Brady's reliance on cost-cutting and legacy product demand, amid rising trade barriers, slow growth, and competitive pressures, threatens long-term revenue and margin sustainability.

Catalysts

About Brady- Manufactures and supplies identification solutions and workplace safety products that identify and protect premises, products, and people in the Americas, Asia, Europe, and Australia.

- Brady's consistent and increasing investment in R&D-especially the recent record spend and focus on high-performance, engineered products (such as the i7500 industrial printer and microfluidics platform)-positions the company to capture a greater share of demand from automation, IoT, and digital transformation initiatives in industrial, healthcare, and manufacturing sectors, setting up for sustained organic revenue growth and higher gross margins.

- The company's deepening product ecosystem and recent acquisitions (Gravotech, Funai Microfluidics, Mecco) expand capabilities in direct part marking, barcode/RFID solutions, and software integration, directly addressing rising global requirements for traceability, regulatory compliance, and asset tracking; this supports entry into higher-growth, higher-margin markets and drives recurring revenue streams.

- Operational efficiency initiatives-including facility closures, workforce reductions, cost structure realignment, and supply chain optimizations-are expected to significantly enhance profitability and support operating margin expansion as tariff headwinds are offset and integration synergies are realized.

- Brady's ongoing global expansion, especially robust organic growth in the Americas and Asia (with Asia ex-China up 23% in the latest quarter), leverages secular growth in emerging markets and the continued buildout of industries such as data centers, aerospace, and utilities, laying a foundation for diversified and resilient top-line growth.

- The rising demand for ESG, safety, and compliance solutions across industries-combined with Brady's growing ability to offer complete, customized identification systems-positions the company to benefit from long-term secular increases in regulatory and workplace safety spend, supporting both revenue growth and durable net margin expansion.

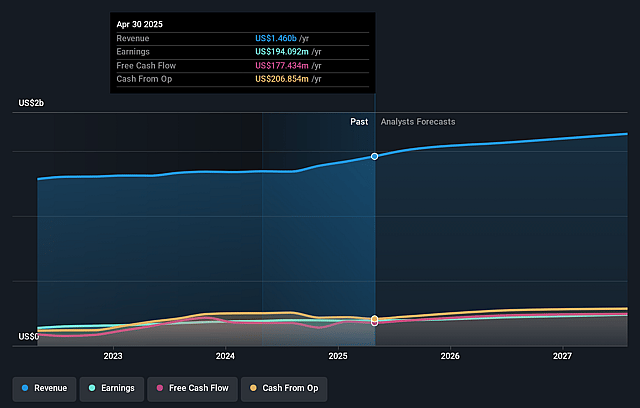

Brady Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Brady's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.5% today to 15.9% in 3 years time.

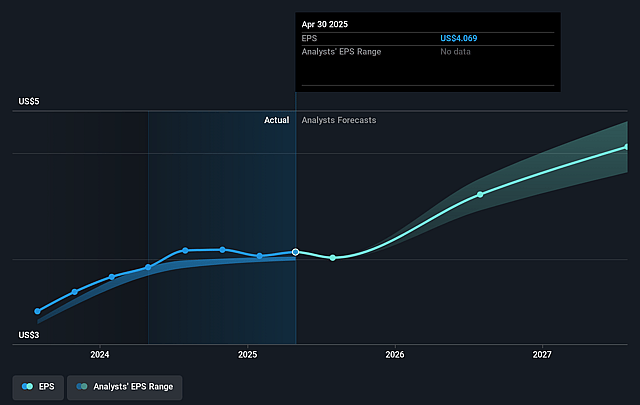

- Analysts expect earnings to reach $271.5 million (and earnings per share of $5.78) by about September 2028, up from $188.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, down from 19.6x today. This future PE is lower than the current PE for the US Commercial Services industry at 25.7x.

- Analysts expect the number of shares outstanding to decline by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

Brady Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Brady faces persistent challenges from tightening global trade policies and rising tariffs-estimated at $8 to $12 million incremental impact in FY26-which could erode operating margins if mitigation efforts and price increases are not fully effective or if trade policies worsen, impacting future earnings and profitability.

- Organic sales growth remains low single digits, and there is ongoing organic decline in key regions such as Europe and Australia, raising concerns about long-term revenue stagnation, especially if macroeconomic weakness persists in these mature markets and limits new growth opportunities.

- A significant portion of Brady's revenue (~40%) is dependent on printers and consumables, particularly serving end markets like data centers and defense; this exposes the company to risk if digital transformation or sustainability initiatives reduce future demand for traditional labeling solutions, potentially reducing future revenue streams.

- Ongoing facility consolidations, headcount reductions, and cost structure actions signal dependency on cost-cutting for near-term margin improvements rather than robust top-line growth or innovation-driven expansion, which could limit sustainable long-term margin expansion and earnings power.

- Increasing competition and the potential for commoditization in labeling and identification products threaten Brady's ability to maintain premium pricing, particularly as new acquisitions are integrated-any failure to achieve expected synergies or differentiate through technology could compress gross margins and reduce earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $95.0 for Brady based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $271.5 million, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of $78.53, the analyst price target of $95.0 is 17.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Brady?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.