Last Update 03 Dec 25

Fair value Decreased 2.26%SAIC: Future Cash Flows Will Support Upside Despite Revenue Headwinds

Analysts have trimmed their price target on Science Applications International to approximately $113.38 from $116.00. This reflects mounting concerns over weakening revenue momentum, multi year growth headwinds in a tougher federal funding backdrop, and heightened risk of a prolonged slowdown despite some resilience in profitability.

Analyst Commentary

Street research following the latest quarter reflects a more cautious stance on Science Applications International, with several firms cutting price targets and reassessing growth and execution assumptions. While views on valuation diverge, there is a common focus on the durability of revenue and margin trends in a shifting federal spending environment.

Bullish Takeaways

- Bullish analysts highlight that, despite muted top line prospects, the shares screen as an attractive value idea, with current multiples already discounting a slower growth profile.

- Some see room for upside if management can execute on cost reductions and efficiency initiatives, preserving or modestly expanding margins even as revenue softens.

- Supportive commentary around profitability guidance, including raised near term expectations, is viewed as evidence that SAIC can still generate healthy cash flows to underpin the equity story.

- A subset of investors views current policy and funding uncertainty as cyclical rather than structural, arguing that a normalization in federal priorities could enable a re rating if SAIC stabilizes its backlog and book to bill ratios.

Bearish Takeaways

- Bearish analysts emphasize a weakening revenue trajectory, noting organic declines and a reduced multi year outlook that point to a risk of prolonged top line contraction.

- There is concern that SAIC has struggled to generate on contract growth, with more scrutiny on scope additions and slower awards, raising questions around execution and competitive positioning.

- JPMorgan and Goldman Sachs flag the potential for a multi year revenue and margin slowdown as government priorities shift and funding reallocations take time to work through the system.

- Several research notes characterize the demand backdrop as sluggish, with policy uncertainty and stretched federal budgets limiting visibility, which in turn caps near term upside to valuation and justifies lower price targets.

What's in the News

- Won a $1.4 billion, five year COBRA task order to develop and integrate multi domain command and control technologies across the CJADC2 ecosystem, expanding SAIC’s role in modern warfighting architectures (client announcement).

- Awarded a $242 million, five year follow on contract from the Naval Undersea Warfare Center in Newport to operate, maintain and modernize the Navy’s Propulsion Test Facility supporting key torpedo and undersea systems programs (client announcement).

- Announced a strategic organizational restructuring effective January 31, 2026, consolidating five business groups into three and realigning the Chief Innovation Office to sharpen market focus and drive growth (business reorganization and legal structure change).

- The board appointed James (Jim) Reagan as interim chief executive officer effective October 23, 2025, following the departure of prior CEO Toni Townes Whitley. This adds an industry veteran with extensive defense and government services experience (executive change).

- Lowered fiscal 2026 revenue guidance to $7.25 billion to $7.325 billion and signaled mid single digit organic revenue declines in the back half of the year, underscoring headwinds to the top line despite ongoing share repurchases (corporate guidance and buyback update).

Valuation Changes

- Fair Value: Trimmed slightly to approximately $113.38 from $116.00, reflecting a modest reduction in the intrinsic value estimate.

- Discount Rate: Increased from about 7.95 percent to roughly 8.30 percent, indicating a somewhat higher perceived risk profile or required return.

- Revenue Growth: Assumed long term growth rate raised from roughly 1.04 percent to about 1.44 percent, suggesting a modestly more optimistic view on future top line expansion.

- Profit Margin: Forecast net profit margin increased from around 4.48 percent to approximately 4.83 percent, implying slightly better expected profitability.

- Future P/E: Target future price to earnings multiple reduced from about 15.66 times to roughly 14.55 times, signaling a more conservative valuation framework despite the updated growth and margin assumptions.

Key Takeaways

- Ongoing investments in artificial intelligence and cost controls are expected to boost margins and cash flow despite a challenging revenue environment.

- Strategic positioning in digital modernization and government-focused solutions aligns SAIC for stable, long-term growth amid evolving federal priorities.

- Increased government scrutiny, budget uncertainty, and industry shifts threaten SAIC's growth, margins, and long-term relevance amid rising competition and reduced demand for traditional IT services.

Catalysts

About Science Applications International- Provides technical, engineering, and enterprise information technology (IT) services in the United States.

- Progress in operational efficiency through enterprise-wide adoption of artificial intelligence and automation is expected to drive incremental margin improvement, even in a restrained revenue environment, supporting higher net margins and free cash flow.

- The company's strategic focus on differentiated, high-growth capabilities in areas such as mission integration, digital transformation, and advanced IT modernization positions SAIC to benefit from the government's ongoing push to update legacy systems, likely accelerating top-line growth as procurement normalizes.

- A robust pipeline and strong book-to-bill ratios, along with sustained win rates in recompetes and pending award backlogs, provide significant building blocks for revenue recovery and long-term expansion once current government funding delays and efficiency initiatives subside.

- Increasing activity in defense, homeland security, missile defense, and space-driven by geopolitical uncertainty and elevated federal spending priorities-aligns well with SAIC's current solution portfolio, potentially leading to larger, higher-value contracts and stable revenue growth over the next few years.

- Targeted investments in cost control and operational flexibility are enabling SAIC to mitigate near-term revenue compression, while simultaneously preserving the ability to pursue capability-focused M&A and R&D, supporting future earnings and long-term shareholder value through improved capital allocation.

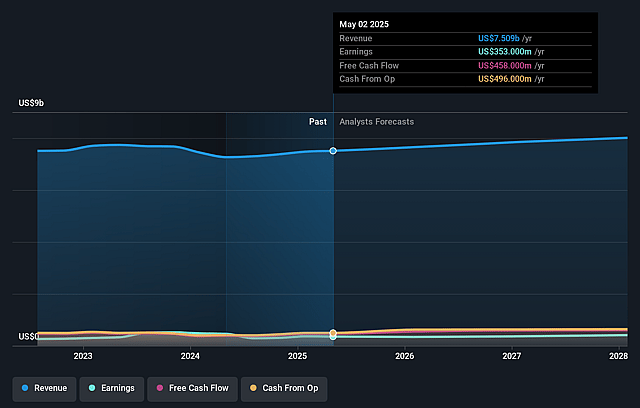

Science Applications International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Science Applications International's revenue will grow by 1.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.3% today to 4.5% in 3 years time.

- Analysts expect earnings to reach $344.8 million (and earnings per share of $8.49) by about September 2028, down from $399.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from 11.9x today. This future PE is lower than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Science Applications International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased government scrutiny on spending, efforts to drive efficiency, and budget uncertainty-especially in key areas like Army transformation and civilian agencies-are leading to delays and softness in on-contract growth and new business awards, which could compress revenues and prolong below-trend top-line growth.

- Rising competition from non-traditional and commercial technology entrants, combined with a shift toward commercial-like, fixed-price, or outcome-based government contracting, raises the risk of pricing pressure and margin compression if SAIC cannot effectively differentiate its offerings or protect its core services (potentially impacting net margins and EPS growth).

- Secular trends in government IT-specifically, the push to automate, modernize, and utilize commoditized cloud/off-the-shelf solutions-are materially reducing demand for traditional, labor-based, and legacy IT services, creating a risk of margin pressure and diminishing long-term revenue streams for SAIC's historic business mix.

- Labor market shortages, government workforce turnover (especially in acquisition functions), and SAIC's dependence on specific large programs/customers increase execution risk, potentially resulting in delayed or lost revenue, contract re-bids, or delivery challenges that can erode both net margins and revenue predictability.

- Expectations of flat to low-single-digit growth in government IT and defense budgets due to macro budget constraints, the potential for continuing resolutions or shutdowns, and ongoing structural reprioritization of federal funds all threaten future backlog conversion rates and could limit long-term revenue and free cash flow growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.0 for Science Applications International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $91.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.7 billion, earnings will come to $344.8 million, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of $102.78, the analyst price target of $116.0 is 11.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Science Applications International?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.