Last Update 09 Sep 25

Fair value Decreased 3.78%Science Applications International’s fair value has been revised down to $116.00 as analysts factor in weaker revenue outlooks, ongoing policy and budget uncertainty in the federal sector, and increased risk of prolonged margin slowdown despite near-term profitability support from one-time items.

Analyst Commentary

- Revenue outlook has weakened due to on-contract growth challenges and persistent market headwinds, leading to “meaningfully” cut sales forecasts and guidance reductions.

- Organic revenue declined in Q2 and full-year guidance was reduced further, with risk of multi-year revenue and margin slowdown driven by shifting government priorities and funding reallocations.

- Ongoing policy and budget uncertainty in the federal sector is prompting cautious management commentary compared to peers and heightening investor uncertainty.

- While Q2 results and recent earnings calls failed to impress, bullish analysts view SAIC as an attractive value play, expecting the stock to benefit from eventual improvements in award wins and execution.

- Profitability outlook saw a near-term upward revision due to one-time tax items, but investors await more concrete actions on cost reductions in coming quarters.

What's in the News

- SAIC repurchased 935,540 shares for $106 million, completing the buyback of 2,802,444 shares (5.85%) for $312.29 million under the December 2024 authorization.

- Fiscal 2026 revenue guidance lowered to $7.25–$7.325 billion from previous $7.60–$7.75 billion.

- Awarded $202 million contract to provide modernized virtual and synthetic training environments for the U.S. Navy, supporting training for 19 commands through various live and virtual methods.

- Announced multi-year “AI at the Edge” alliance with Google Public Sector, leveraging Google Distributed Cloud for secure, scalable tactical edge solutions and training 1,000 SAIC personnel in Google Cloud.

- Awarded $928 million, five-year HOPE 2.0 contract to provide RDT&E mission engineering services for the U.S. Air Force TENCAP, accelerating delivery of advanced prototypes across DoD missions.

Valuation Changes

Summary of Valuation Changes for Science Applications International

- The Consensus Analyst Price Target has fallen slightly from $120.56 to $116.00.

- The Consensus Revenue Growth forecasts for Science Applications International has significantly fallen from 2.5% per annum to 1.0% per annum.

- The Net Profit Margin for Science Applications International has fallen from 4.88% to 4.48%.

Key Takeaways

- Ongoing investments in artificial intelligence and cost controls are expected to boost margins and cash flow despite a challenging revenue environment.

- Strategic positioning in digital modernization and government-focused solutions aligns SAIC for stable, long-term growth amid evolving federal priorities.

- Increased government scrutiny, budget uncertainty, and industry shifts threaten SAIC's growth, margins, and long-term relevance amid rising competition and reduced demand for traditional IT services.

Catalysts

About Science Applications International- Provides technical, engineering, and enterprise information technology (IT) services in the United States.

- Progress in operational efficiency through enterprise-wide adoption of artificial intelligence and automation is expected to drive incremental margin improvement, even in a restrained revenue environment, supporting higher net margins and free cash flow.

- The company's strategic focus on differentiated, high-growth capabilities in areas such as mission integration, digital transformation, and advanced IT modernization positions SAIC to benefit from the government's ongoing push to update legacy systems, likely accelerating top-line growth as procurement normalizes.

- A robust pipeline and strong book-to-bill ratios, along with sustained win rates in recompetes and pending award backlogs, provide significant building blocks for revenue recovery and long-term expansion once current government funding delays and efficiency initiatives subside.

- Increasing activity in defense, homeland security, missile defense, and space-driven by geopolitical uncertainty and elevated federal spending priorities-aligns well with SAIC's current solution portfolio, potentially leading to larger, higher-value contracts and stable revenue growth over the next few years.

- Targeted investments in cost control and operational flexibility are enabling SAIC to mitigate near-term revenue compression, while simultaneously preserving the ability to pursue capability-focused M&A and R&D, supporting future earnings and long-term shareholder value through improved capital allocation.

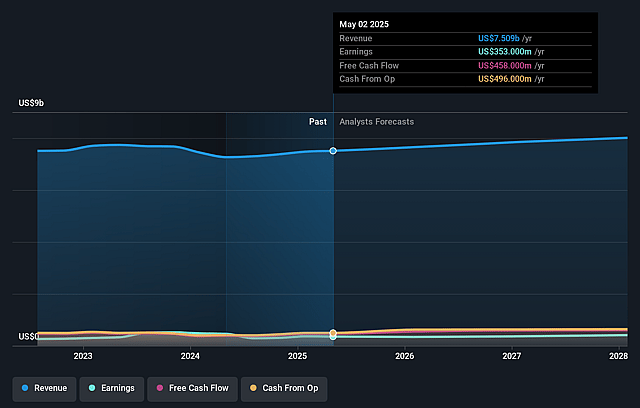

Science Applications International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Science Applications International's revenue will grow by 1.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.3% today to 4.5% in 3 years time.

- Analysts expect earnings to reach $344.8 million (and earnings per share of $8.49) by about September 2028, down from $399.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from 11.9x today. This future PE is lower than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Science Applications International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased government scrutiny on spending, efforts to drive efficiency, and budget uncertainty-especially in key areas like Army transformation and civilian agencies-are leading to delays and softness in on-contract growth and new business awards, which could compress revenues and prolong below-trend top-line growth.

- Rising competition from non-traditional and commercial technology entrants, combined with a shift toward commercial-like, fixed-price, or outcome-based government contracting, raises the risk of pricing pressure and margin compression if SAIC cannot effectively differentiate its offerings or protect its core services (potentially impacting net margins and EPS growth).

- Secular trends in government IT-specifically, the push to automate, modernize, and utilize commoditized cloud/off-the-shelf solutions-are materially reducing demand for traditional, labor-based, and legacy IT services, creating a risk of margin pressure and diminishing long-term revenue streams for SAIC's historic business mix.

- Labor market shortages, government workforce turnover (especially in acquisition functions), and SAIC's dependence on specific large programs/customers increase execution risk, potentially resulting in delayed or lost revenue, contract re-bids, or delivery challenges that can erode both net margins and revenue predictability.

- Expectations of flat to low-single-digit growth in government IT and defense budgets due to macro budget constraints, the potential for continuing resolutions or shutdowns, and ongoing structural reprioritization of federal funds all threaten future backlog conversion rates and could limit long-term revenue and free cash flow growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.0 for Science Applications International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $91.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.7 billion, earnings will come to $344.8 million, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of $102.78, the analyst price target of $116.0 is 11.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.