Key Takeaways

- Difficult international market conditions and evolving customer preferences threaten Rockwell's global growth and the competitiveness of its traditional product lines.

- Rising competition, regulatory pressures, and cybersecurity concerns are likely to compress margins and hinder sustained earnings and market share growth.

- Growth in recurring software revenues, innovation in automation, and operational resilience position Rockwell for strong, sustainable margins and earnings amid global digitalization trends.

Catalysts

About Rockwell Automation- Provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

- Growing global trade barriers and geopolitical fragmentation are likely to limit Rockwell Automation's access to key international markets and result in persistent sales headwinds outside North America, dampening long-term revenue growth and stalling global expansion.

- The global push for decarbonization and energy efficiency is accelerating a shift toward newer, more adaptable automation solutions, which may render Rockwell's legacy programmable logic controllers and hardware-centric offerings less competitive, ultimately pressuring margins and leading to slower forward earnings growth.

- Widespread adoption of open automation standards is reducing vendor lock-in and eroding Rockwell's traditional pricing power, increasing competition and likely forcing price cuts or increased R&D investment-both of which threaten to compress operating margins and suppress net income.

- Escalating cybersecurity threats targeting industrial control systems are driving up compliance costs and could increase customer reluctance to invest in automation, introducing sustained uncertainty around future project timing and potentially causing periods of revenue stagnation.

- As manufacturers respond to labor shortages by favoring flexible, lower-cost automation providers-including disruptive entrants and lower-cost Asian competitors-Rockwell faces material risks of losing share in both established and emerging sectors, shrinking its addressable market and placing ongoing pressure on future revenue and margin expansion.

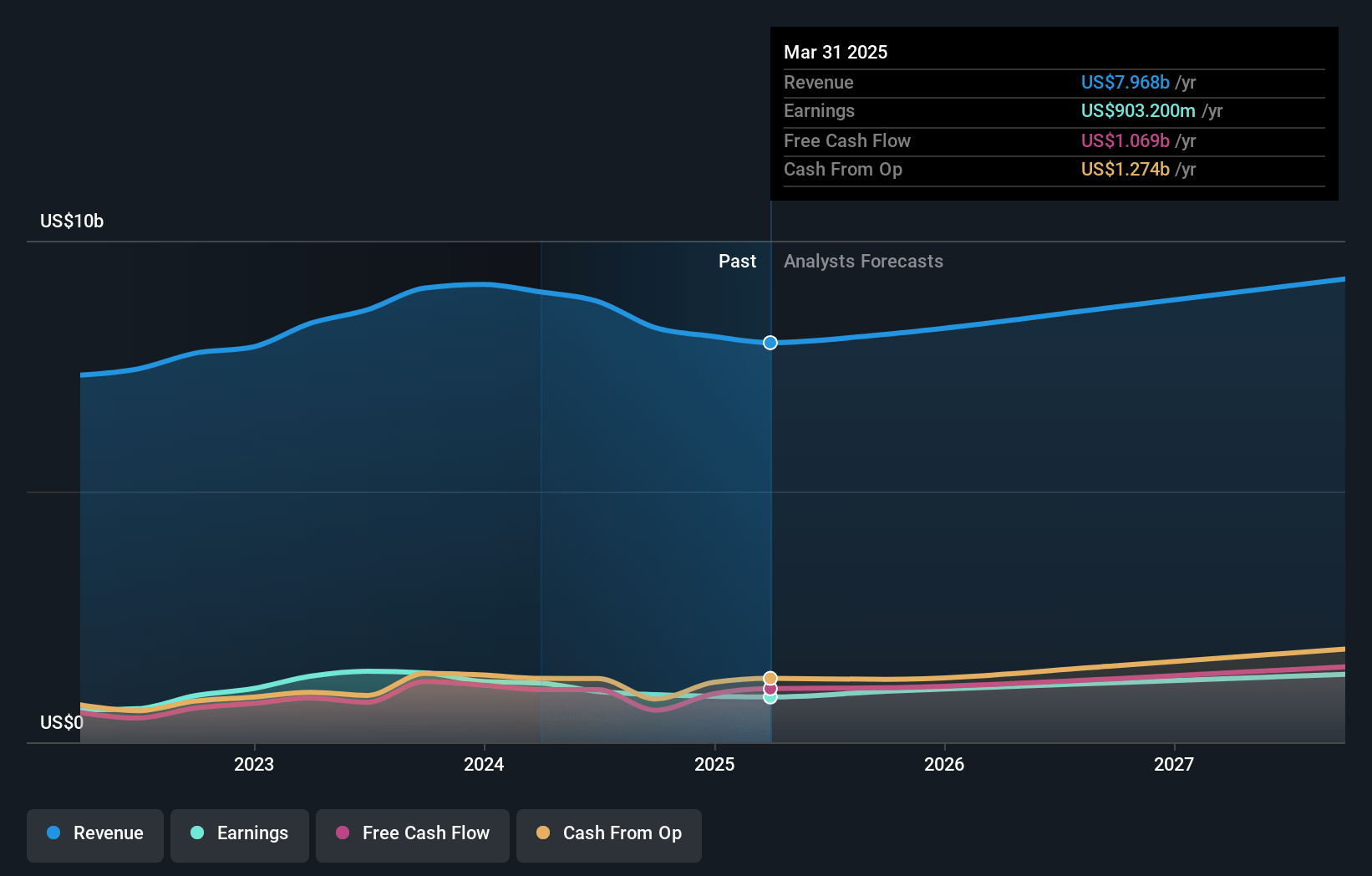

Rockwell Automation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Rockwell Automation compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Rockwell Automation's revenue will grow by 5.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.3% today to 15.0% in 3 years time.

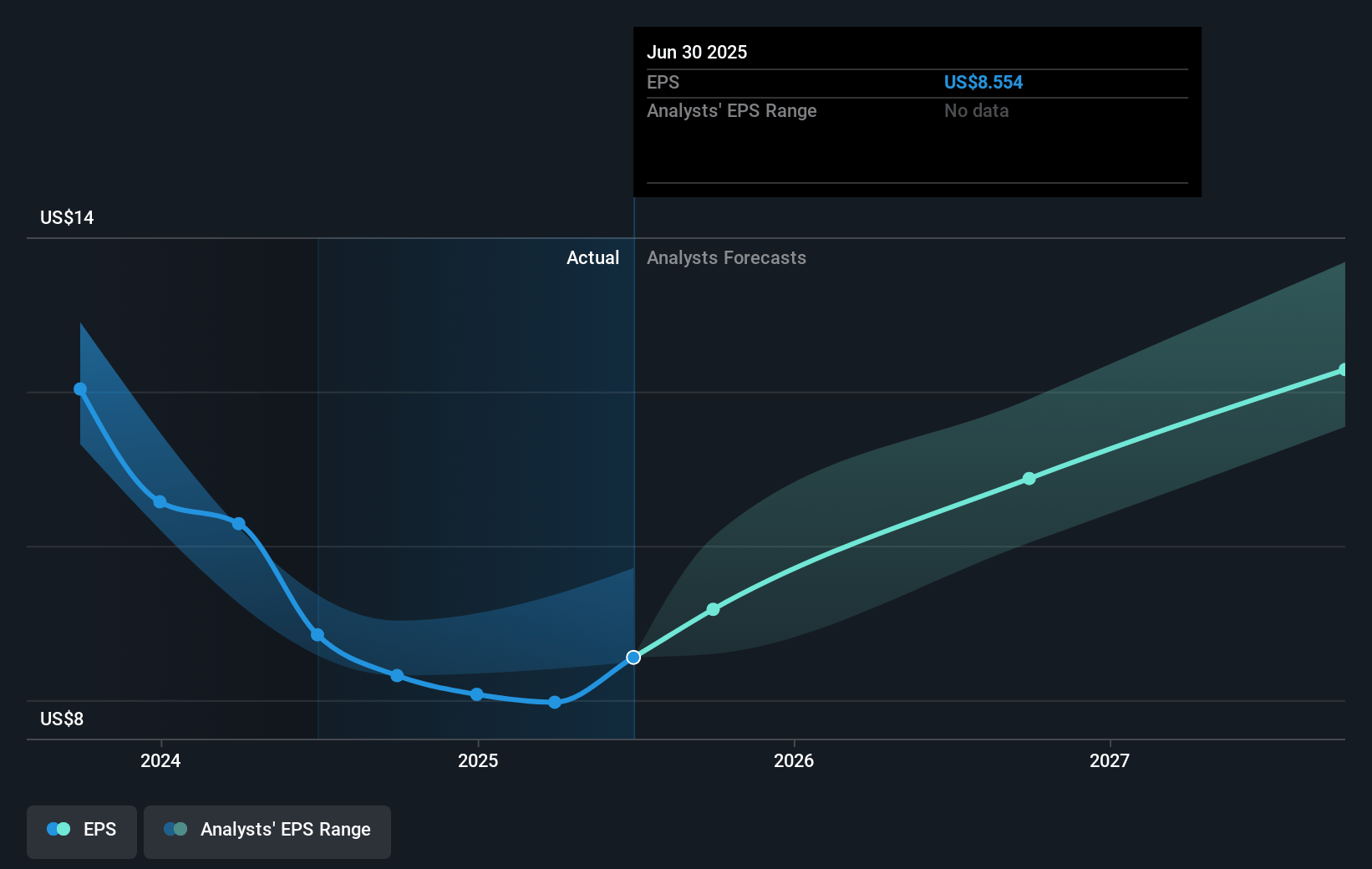

- The bearish analysts expect earnings to reach $1.4 billion (and earnings per share of $13.04) by about July 2028, up from $903.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 24.3x on those 2028 earnings, down from 43.9x today. This future PE is lower than the current PE for the US Electrical industry at 27.3x.

- Analysts expect the number of shares outstanding to decline by 0.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

Rockwell Automation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite short-term uncertainty, Rockwell is seeing strong growth in high-potential secular areas like e-commerce and warehouse automation, with these verticals expected to grow 45% in fiscal year 2025, which could drive robust revenue and margin expansion as digitalization and automation trends accelerate globally.

- The company's recurring revenue from software, analytics, and lifecycle services continues to expand, with annual recurring revenue growing 8% in the quarter and double-digit growth from Plex and Fiix, which supports higher earnings predictability and improved net margins even in cyclical downturns.

- Rockwell's ongoing investments in innovation-such as FactoryTalk Design Studio with GenAI Copilot and scalable automation solutions-are driving adoption in industries focused on efficiency and sustainability, potentially increasing long-term revenues and sustaining pricing power.

- The operational resilience built through supply chain flexibility, production location moves, and targeted cost-reduction initiatives enabled Rockwell to expand gross margins by 130 basis points year-over-year, suggesting potential for sustained improvements in earnings quality and net margins.

- Customer project delays remain temporary, with very low cancellation rates and indications from customers that postponed projects will likely resume when macro uncertainty (such as tariffs and policy changes) lessens, supporting a healthier backlog and stabilizing long-term sales and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Rockwell Automation is $242.39, which represents two standard deviations below the consensus price target of $334.63. This valuation is based on what can be assumed as the expectations of Rockwell Automation's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $410.0, and the most bearish reporting a price target of just $229.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $9.3 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 24.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $351.67, the bearish analyst price target of $242.39 is 45.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.