Key Takeaways

- Minimal near-term revenue growth is expected due to slow OEM reshoring, cyclical market declines, and delayed customer decisions impacting sales volumes.

- Long-term prospects look promising with electrification trends and new business wins, but near-term earnings and cash flow remain constrained by lingering uncertainty and cost pressures.

- Heavy reliance on cyclical end markets and major OEMs, coupled with low demand visibility and delayed growth initiatives, leaves earnings and cash flow highly vulnerable to external shocks.

Catalysts

About Mayville Engineering Company- Engages in the production, design, prototyping and tooling, fabrication, aluminum extrusion, coating, and assembling of aftermarket components in the United States.

- Although Mayville Engineering Company is set to benefit from the ongoing trend of OEM reshoring and domestic supply chain adjustments-supported by a 95% U.S.-sourced sales base-this process remains slow-moving, with customer decisions around structural tariff changes being delayed and incremental volumes unlikely to accelerate until late in the current year or into 2026, leaving near-term revenue growth under pressure.

- While long-term opportunities from electrification of vehicles and next-generation product launches could expand demand for custom fabrication and advanced components, the company is highly exposed to cyclical end-markets such as commercial vehicles, construction, agriculture, and powersports, all of which are seeing double-digit year-over-year declines and ongoing inventory destocking, which may lead to a muted earnings recovery over the next several quarters.

- Despite recent investment in automation, lean manufacturing, and ongoing operational discipline shown by margin expansion and positive free cash flow, the benefit to net margins could be offset by lower fixed cost absorption on falling sales volumes and higher compliance and consulting costs, which have already pushed SG&A expense above long-term targeted levels.

- Even though MEC is winning new business and diversifying into adjacent markets, with a $100 million new business win target and an active M&A pipeline, the bulk of booked new programs are 2026 or 2027 starts, meaning visibility and volume contribution in the near term will remain limited; cash flow and EBITDA growth will be constrained until these projects are ramped.

- While structural changes like persistent tariff regimes and domestic manufacturing incentives could favor MEC's positioning in the long run, uncertainty around the timing and permanence of these policy actions, as well as the risk of regulatory reversals or a potential recession, could continue to suppress order activity and create downside risk to both revenue and earnings in the next 12 to 18 months.

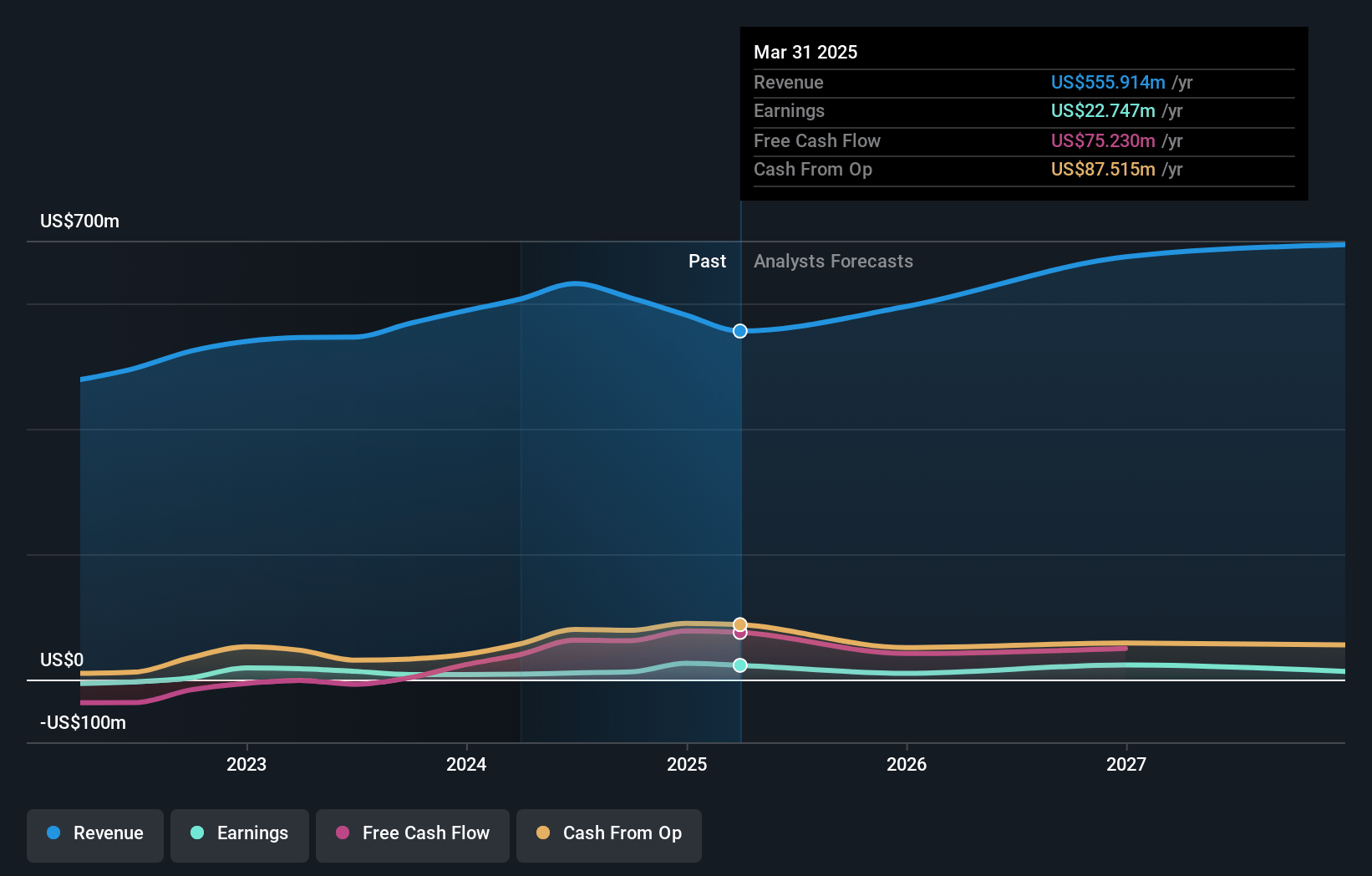

Mayville Engineering Company Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Mayville Engineering Company compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Mayville Engineering Company's revenue will grow by 6.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 4.1% today to 1.9% in 3 years time.

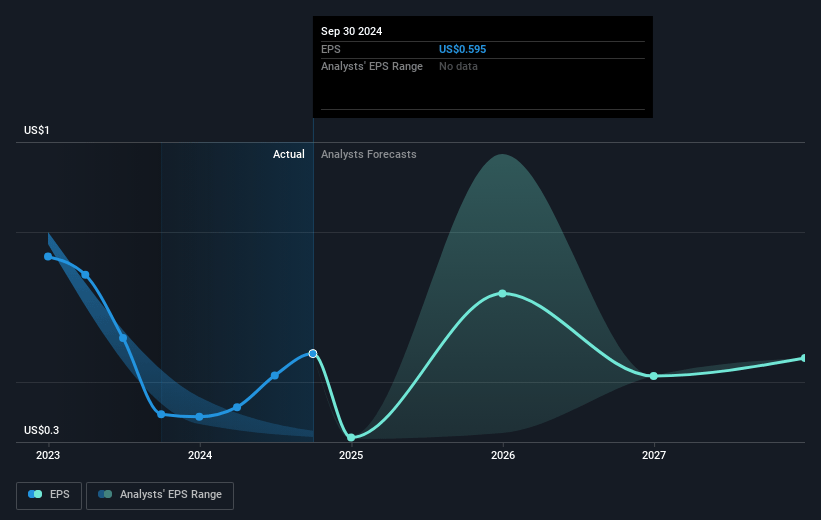

- The bearish analysts expect earnings to reach $12.9 million (and earnings per share of $1.42) by about July 2028, down from $22.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 37.5x on those 2028 earnings, up from 14.2x today. This future PE is greater than the current PE for the US Machinery industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.25%, as per the Simply Wall St company report.

Mayville Engineering Company Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Mayville Engineering Company remains highly exposed to cyclical end markets, such as commercial vehicles, construction, agriculture, and powersports, all of which experienced double-digit year-over-year revenue declines in recent quarters; if macroeconomic weakness or recession persists, further revenue and earnings pressure is likely.

- The company's revenue guidance for 2025 depends on no recession and no material change to key EPA 2027 regulations; if either a recession materializes or expected emissions regulations are amended or repealed, demand for prebuy orders could collapse, leading to materially lower revenues and profitability.

- Customer demand visibility remains low, with major end users adopting a wait-and-see approach amid inventory destocking, high interest rates, and trade policy uncertainties, contributing to unpredictable sales and increased margin risk.

- A significant share of new business wins are slated to launch only in 2026 or 2027, while current-year growth is limited by ongoing weakness in core end markets and low adoption of MEC's value-based pricing programs, muting immediate improvement in margins and earnings.

- The risk of high customer concentration in a few large OEMs, combined with only incremental progress in end-market diversification and lagging exposure to higher value-added, less cyclical segments, leaves the company vulnerable to further earnings and free cash flow contraction if large customers pull back orders.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Mayville Engineering Company is $20.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Mayville Engineering Company's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $676.0 million, earnings will come to $12.9 million, and it would be trading on a PE ratio of 37.5x, assuming you use a discount rate of 8.3%.

- Given the current share price of $15.74, the bearish analyst price target of $20.0 is 21.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.