Key Takeaways

- Domestic manufacturing focus and supply chain trends position MEC to gain market share and benefit from re-shoring and infrastructure investment.

- Strategic moves into electrification, operational efficiencies, and potential acquisitions support revenue growth, market diversification, and sustained margin improvement.

- Heavy exposure to cyclical core markets and large clients, plus lagging automation, heightens vulnerability to industry shifts, regulatory risk, and disruptive manufacturing technologies.

Catalysts

About Mayville Engineering Company- Engages in the production, design, prototyping and tooling, fabrication, aluminum extrusion, coating, and assembling of aftermarket components in the United States.

- MEC’s overwhelmingly domestic manufacturing and sourcing footprint positions the company to be a leading beneficiary as more OEMs and suppliers relocate manufacturing to the United States in response to shifting trade policies and the need for supply chain resiliency. This should lead to meaningful share gains and incremental revenue growth as new and existing customers shift procurement to local partners.

- The company is actively engaged in winning business related to next-generation electrified vehicles, electrical infrastructure, and data centers, with a strong pipeline of projects scheduled to ramp up in 2026 and 2027. This expanding exposure to high-growth verticals tied to electrification is expected to diversify revenues and drive robust top-line growth in the coming years.

- Ongoing U.S. infrastructure investment, particularly in energy and transportation segments, is creating sustained demand for fabricated metal products. MEC’s existing programs and recent customer wins in Military, Construction, and Access markets suggest they are well-positioned to capture project volume as these trends accelerate, supporting both revenue and earnings potential over the next several years.

- MEC’s relentless focus on operational excellence—including lean initiatives, automation investment, and value-based pricing—has already delivered sequential margin expansion and improved free cash flow even in a down-cycle environment. As industry volumes recover and new programs scale, these efficiencies are expected to drive structural margin improvement and stronger earnings.

- The company’s pipeline of M&A targets, combined with a low net leverage ratio and strong cash flow generation, signal capacity for strategic acquisitions that will further diversify end markets, expand geographic reach, and enhance capabilities. Successful execution of this M&A agenda could increase both revenue scale and margin profile, supporting outsized long-term EPS growth.

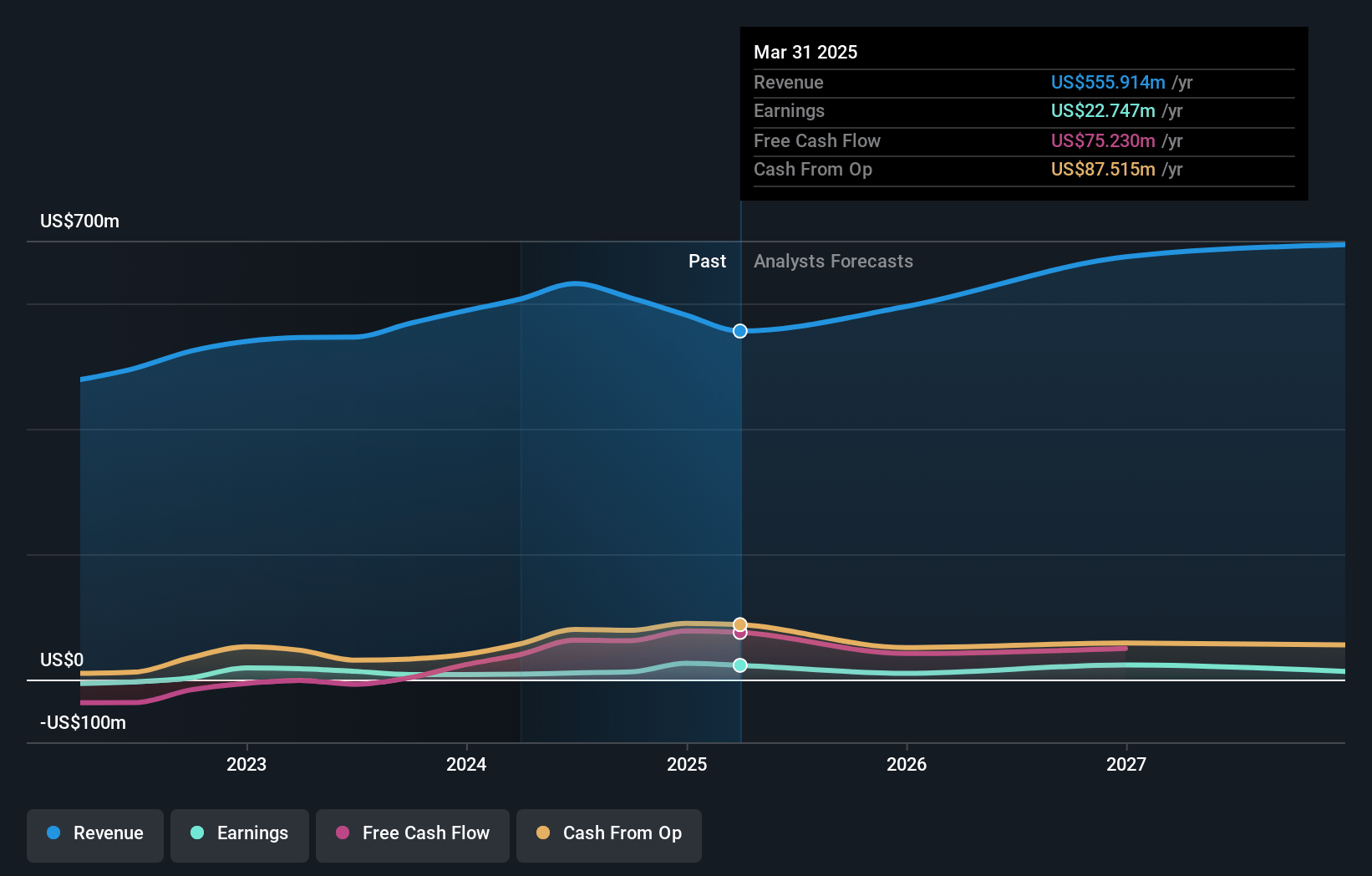

Mayville Engineering Company Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Mayville Engineering Company compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Mayville Engineering Company's revenue will grow by 6.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 4.1% today to 1.9% in 3 years time.

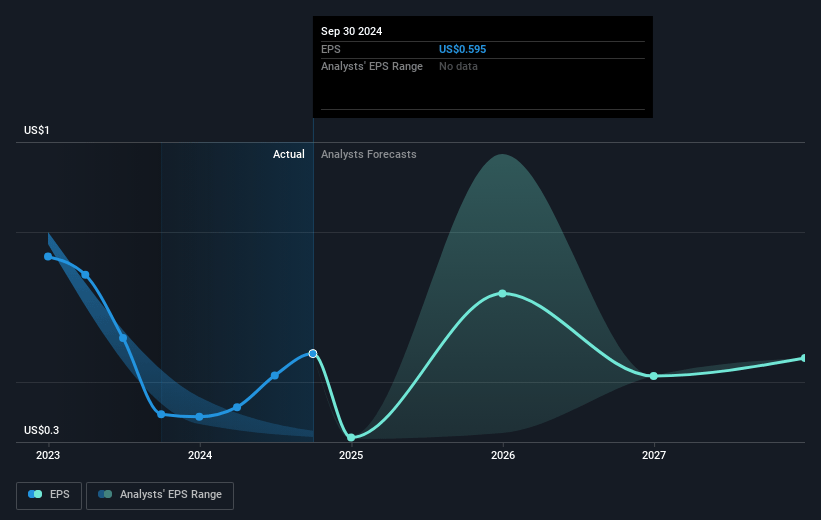

- The bullish analysts expect earnings to reach $12.9 million (and earnings per share of $1.95) by about July 2028, down from $22.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 50.5x on those 2028 earnings, up from 14.6x today. This future PE is greater than the current PE for the US Machinery industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.25%, as per the Simply Wall St company report.

Mayville Engineering Company Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent soft demand, significant year-over-year revenue declines in core end markets such as Commercial Vehicles, Powersports, Construction and Access, and Agriculture expose Mayville Engineering to ongoing top-line pressure and increase the risk that revenues will remain below historical levels if secular demand shifts or macroeconomic weakness persists.

- The company’s high reliance on large commercial vehicle customers—who themselves are subject to cyclical downturns, regulatory uncertainty, and emission rule changes—means that any loss of a major client or a prolonged slump could result in disproportionately large drops in both revenues and earnings.

- Mayville Engineering’s current capital-light automation strategy may fall behind broader industry trends in automation and AI, resulting in reduced competitiveness if customers shift toward more technologically advanced or fully vertically integrated suppliers, which could erode future order flow and compress operating margins.

- Increasing regulatory and ESG pressures, including stricter emissions and energy-use standards, could necessitate significant capital expenditures to upgrade facilities or manufacturing processes, reducing both free cash flow and net margins over the long term if these investments cannot be offset with higher-margin business.

- The proliferation of alternative manufacturing techniques such as 3D printing and advanced composites, as well as OEMs reshoring or bringing fabrication in-house, may structurally decrease demand for outsourced traditional metal fabrication, threatening Mayville Engineering’s revenue growth and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Mayville Engineering Company is $27.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Mayville Engineering Company's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $674.3 million, earnings will come to $12.9 million, and it would be trading on a PE ratio of 50.5x, assuming you use a discount rate of 8.2%.

- Given the current share price of $16.18, the bullish analyst price target of $27.0 is 40.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.