Key Takeaways

- Advanced power delivery products and automotive modules position Vicor to benefit from AI computing, electric vehicle trends, and expanded customer engagements in critical markets.

- Manufacturing investments, IP enforcement, and sector diversification underpin operational efficiency, premium margins, and stable long-term growth across multiple industries.

- Unpredictable demand, reliance on volatile licensing income, high fixed and legal costs, and slow diversification efforts create persistent revenue and earnings uncertainty.

Catalysts

About Vicor- Designs, develops, manufactures, and markets modular power components and power systems for converting electrical power for use in electrically-powered devices.

- The accelerated adoption of high-power, high-density AI computing in data centers is driving demand for advanced power delivery solutions-Vicor's Gen 5 vertical power delivery products and 800V-to-48V converters target this need, with customer engagements and sampling set to expand in Q3 and Q4. These next-gen products enable Vicor to address a market expected to exceed $5 billion by 2027, supporting long-term revenue growth and eventual margin expansion as manufacturing scales.

- The ongoing transition to electric vehicles-particularly the emergence of 48V zonal architectures and 800V-to-48V power conversion in automotive-presents a significant growth opportunity. Vicor's unique, high-efficiency automotive modules are gaining traction, with successful audits and new OEM engagements in Europe and Asia anticipated to drive share gains and topline growth through the decade.

- Persistent product innovation and strong IP enforcement-evidenced by recent litigation wins, ongoing licensing actions, and expansion of royalty streams-enable Vicor to defend premium pricing and realize incremental high-margin revenue from both settlements and ongoing royalties, enhancing net margin and earnings stability as the licensing base diversifies.

- Expanding manufacturing capacity and operational efficiency, with ongoing investments in U.S.-based production and automation, will eventually improve fab utilization and drive operating leverage-reducing unit costs and boosting gross margin as new product volumes ramp and addressable markets expand in data center, automotive, and industrial segments.

- Diversification into aerospace, defense, and industrial sectors alongside automotive and data centers reduces customer concentration risk; healthy pipelines and product introductions in these segments are expected to put these businesses on trajectories to double in size over 4–6 years, providing more predictable, less volatile revenue and earnings streams over time.

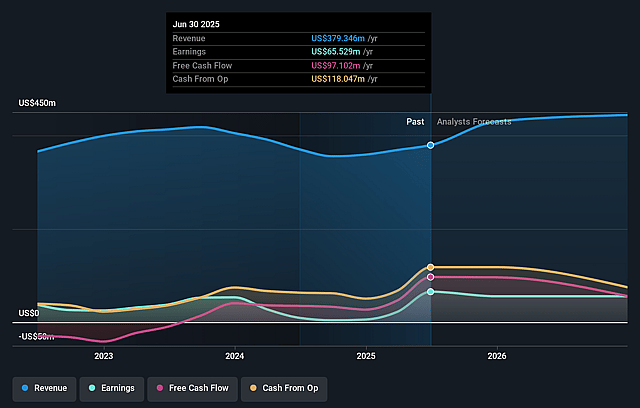

Vicor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vicor's revenue will grow by 11.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.3% today to 8.7% in 3 years time.

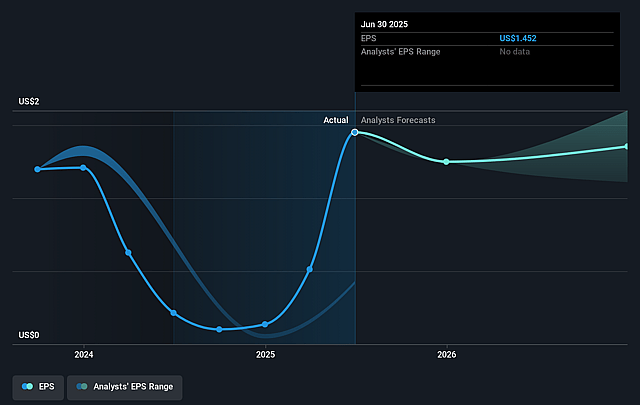

- Analysts expect earnings to reach $45.4 million (and earnings per share of $1.21) by about August 2028, down from $65.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 65.2x on those 2028 earnings, up from 32.4x today. This future PE is greater than the current PE for the US Electrical industry at 31.1x.

- Analysts expect the number of shares outstanding to decline by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.59%, as per the Simply Wall St company report.

Vicor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Book-to-bill ratio below 1 and a 9.6% sequential decrease in 1-year backlog suggest near-term demand weakness and order instability, particularly exacerbated by order cancellations in China and hesitancy around tariffs-risks that may persist and result in unpredictable or declining product revenue in the longer term.

- Significant reliance on licensing and patent litigation settlements for outsized quarterly financial performance adds volatility and uncertainty; management notes large quarterly swings and an inability to provide guidance, which may lead to unpredictable earnings and net margins if licensing outcomes falter or industry practices adapt to circumvent Vicor's IP.

- Vicor's ongoing underutilization of its newly constructed fab and slow capacity ramp in new product lines indicate that fixed costs may weigh on gross margins if product sales growth does not materialize swiftly enough to support full operating leverage.

- Heavy operational expenditure from litigation and ongoing enforcement of intellectual property, including contingency legal fees and variable legal costs, injects lumpiness into operating costs and could compress net earnings if settlement income becomes less frequent or costly enforcement persists as a core aspect of the business.

- Slow traction and lengthy qualification cycles in high-growth end markets such as automotive-where material revenue contributions are not expected until 2029–2030-raise the risk that growth from diversification initiatives may lag, raising future revenue uncertainty and exposing Vicor to ongoing volatility from customer concentration in current core markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $52.5 for Vicor based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $523.8 million, earnings will come to $45.4 million, and it would be trading on a PE ratio of 65.2x, assuming you use a discount rate of 8.6%.

- Given the current share price of $47.24, the analyst price target of $52.5 is 10.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.