Last Update 28 Nov 25

DRS: Expanding Defense Contracts And Upcoming Leadership Change Will Drive Future Gains

Leonardo DRS's analyst price target remains unchanged at $47.30. Analysts cite only minimal adjustments to discount rates and forward assumptions, which do not materially impact the company's valuation outlook.

What's in the News

- Announced contract with Chaiseri Defense Systems to modernize the Royal Thai Army's Stryker situational awareness capabilities with advanced Battle Management System and integration support services (Client Announcements)

- Forming a strategic partnership with Hofmann Engineering to explore joint development of advanced allied navy electric and hybrid propulsion solutions and strengthen the AUKUS alliance (Client Announcements)

- Completed repurchase of 600,728 shares, totaling $24.05 million under its previously announced buyback program (Buyback Tranche Update)

- Leadership transition: William J. (Bill) Lynn will retire as CEO, with John Baylouny appointed Chief Executive Officer effective January 1, 2026 (Executive Changes, CEO)

- Raised 2025 earnings guidance, with expected revenue now between $3,550 million and $3,600 million (Corporate Guidance, Raised)

Valuation Changes

- Consensus Analyst Price Target remains unchanged at $47.30 per share.

- Discount Rate has decreased slightly, from 7.61% to 7.59%.

- Revenue Growth projection remains virtually unchanged at 5.67%.

- Net Profit Margin shows no significant change and is holding steady near 9.32%.

- Future P/E ratio has declined marginally, from 40.55x to 40.23x.

Key Takeaways

- Alignment with defense modernization and geopolitical trends supports premium contracts, expanded programs, and diverse international growth opportunities.

- Increased R&D and proprietary technologies drive innovation, margin improvement, and competitive positioning in high-value defense sectors.

- Raw material constraints, rising costs, and reliance on key government contracts create margin, revenue, and growth risks amid intensifying competition and challenging M&A conditions.

Catalysts

About Leonardo DRS- Provides defense electronic products and systems, and military support services worldwide.

- Anticipated increases in U.S. and allied defense budgets-with substantial front-loaded funding and new NATO commitments-are expected to drive persistent and potentially accelerating demand for advanced defense technologies, positioning Leonardo DRS for strong multiyear revenue growth and increasing backlog.

- The company's strategic alignment with national priorities-including investments in naval modernization, next-generation air and missile defense (such as the Golden Dome initiative), and counter-UAS capabilities-sets the stage for premium contract awards and program expansions, benefiting both revenue and net margins over the next several years.

- Leonardo DRS is increasing its R&D investment to accelerate innovation in critical areas such as space sensing, advanced infrared technologies, and force protection, which should support the company's competitive positioning and allow for participation in higher-margin, next-generation defense programs-improving long-term earnings and margin trajectories.

- Global increases in digitization and modernization of military forces are benefiting DRS's proprietary solutions in network computing, electronic warfare, and electric propulsion, supporting higher average selling prices and expanded platform content, which is expected to enhance net margins and drive operational leverage.

- The company's growing international exposure-particularly in response to NATO's elevated defense spending targets and geopolitical tensions-presents a catalyst for above-average international sales growth and greater revenue diversification, mitigating dependency on the U.S. budget cycle and increasing total addressable market.

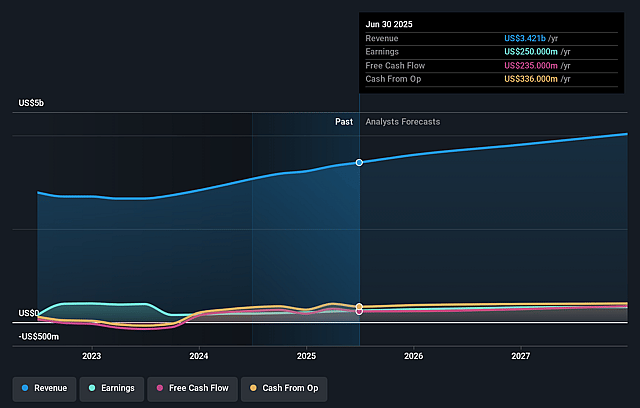

Leonardo DRS Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Leonardo DRS's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.3% today to 8.5% in 3 years time.

- Analysts expect earnings to reach $351.1 million (and earnings per share of $1.3) by about September 2028, up from $250.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.2x on those 2028 earnings, up from 42.9x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 0.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.69%, as per the Simply Wall St company report.

Leonardo DRS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened germanium supply constraints and escalating raw material costs, driven by Chinese export restrictions and slow ramp-up of alternative sources, are compressing margins in the Advanced Sensing and Computing business; prolonged supply issues or cost inflation could negatively affect program execution, delay deliveries, and reduce net margins.

- Increasing R&D intensity (from 2.8% to 3.5% of revenue) in response to evolving customer demands and market competition is creating a sustained headwind to operating margins, and if these investments do not result in contract wins or product adoption, long-term earnings growth and margin expansion could be impaired.

- The company's revenue streams are highly concentrated in large, long-term U.S. government contracts (e.g., Columbia-class), making them vulnerable to future shifts in federal defense budgets, delayed appropriations, or shifting administration priorities, which could suppress both revenue growth and backlog visibility.

- Rising valuations in the defense sector are making accretive M&A more difficult, while ongoing or future integration of acquired businesses and potential expansion into partnerships present ongoing execution and margin risks-missteps could result in increased SG&A costs and jeopardize projected EPS growth.

- Government and customer hesitancy over greater European defense industrial base investments and an emerging preference for indigenous capabilities may limit Leonardo DRS's ability to fully capitalize on NATO and European defense spending increases, potentially restricting international revenue growth despite favorable macro trends.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $49.0 for Leonardo DRS based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $351.1 million, and it would be trading on a PE ratio of 47.2x, assuming you use a discount rate of 7.7%.

- Given the current share price of $40.33, the analyst price target of $49.0 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Leonardo DRS?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.