Last Update 30 Jul 25

Fair value Decreased 12%Despite a substantial improvement in net profit margin and a sharply lower future P/E ratio indicating stronger profitability and more attractive valuation, the consensus analyst price target for CBAK Energy Technology has been reduced from $1.71 to $1.50.

What's in the News

- CBAK Energy, through its subsidiary, is partnering with Anker Innovations to build a battery cell manufacturing facility in Malaysia focused on LFP cylindrical batteries for portable energy storage, targeting the U.S. market.

- Received a follow-up order from Livguard valued at $3 million, bringing cumulative orders from Livguard to $7.9 million; Livguard uses CBAK's 32140 cylindrical lithium-ion batteries for various energy applications in India.

- Announced a share repurchase program of up to $20 million, authorized by the Board of Directors and valid until May 2026.

- Reported a delay in filing its next 10-Q with the SEC.

Valuation Changes

Summary of Valuation Changes for CBAK Energy Technology

- The Consensus Analyst Price Target has significantly fallen from $1.71 to $1.50.

- The Net Profit Margin for CBAK Energy Technology has significantly risen from 5.65% to 10.20%.

- The Future P/E for CBAK Energy Technology has significantly fallen from 10.78x to 5.97x.

Key Takeaways

- Expanded production capacity and advanced battery tech aim to capture rising global energy storage demand, with potential improvements to margins and revenues.

- Strategic diversification, vertical integration, and localization efforts target income stability, broader market access, and supply chain cost control.

- Revenue instability, operational delays, funding uncertainty, and heightened competition in large-format batteries threaten growth prospects, profitability, and access to key export markets.

Catalysts

About CBAK Energy Technology- CBAK Energy Technology, Inc., together with its subsidiaries, manufacture, commercialization, and distribution of standard and customized lithium and sodium batteries in Mainland China, Europe, and internationally.

- Completion of expanded production capacity at the Nanjing facility and the transition to larger, advanced Model 40135 battery cells are expected by year-end, positioning CBAK to capitalize on accelerating global demand for energy storage and electric mobility solutions, driving a likely rebound in revenue and potential improvement in margins.

- Continued R&D investments in next-generation, higher-capacity cylindrical battery formats (e.g., Model 40135 and upcoming Series 46) aim to provide cost advantages and address a broader range of applications in both EVs and stationary energy storage, supporting future margin expansion and revenue growth.

- Strategic realignment towards new high-value customers in Europe, the Americas, India, and the portable power supply sector, combined with full utilization of existing capacity, is anticipated to diversify revenue streams and reduce income volatility, supporting more stable overall earnings.

- The Hitrans raw materials segment is demonstrating robust growth, with expanded customer acquisition and narrowing losses; this vertical integration supports procurement stability and supply chain cost control, potentially boosting company-wide gross margins.

- Ongoing plans to localize production outside China (including ongoing U.S. manufacturing discussions), in response to global trade barriers and tariffs, could unlock new markets and expand the company's addressable customer base, bolstering long-term revenue sustainability.

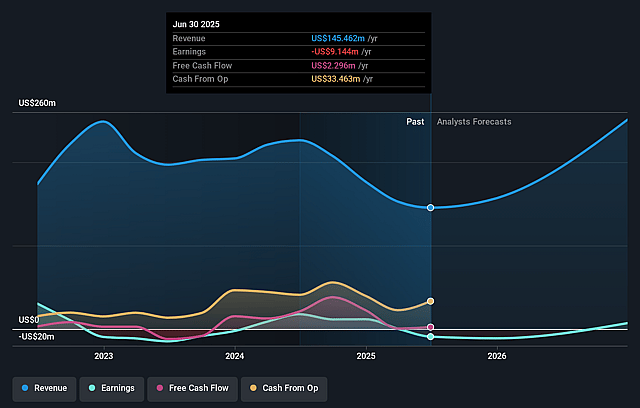

CBAK Energy Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CBAK Energy Technology's revenue will grow by 39.9% annually over the next 3 years.

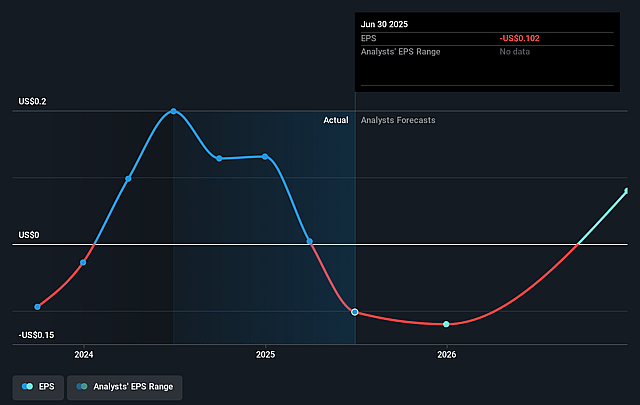

- Analysts are not forecasting that CBAK Energy Technology will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate CBAK Energy Technology's profit margin will increase from -6.3% to the average US Electrical industry of 10.2% in 3 years.

- If CBAK Energy Technology's profit margin were to converge on the industry average, you could expect earnings to reach $40.8 million (and earnings per share of $0.49) by about September 2028, up from $-9.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.2x on those 2028 earnings, up from -8.7x today. This future PE is lower than the current PE for the US Electrical industry at 33.7x.

- Analysts expect the number of shares outstanding to decline by 1.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.12%, as per the Simply Wall St company report.

CBAK Energy Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- CBAK's financial performance is currently pressured by a sharp drop in revenues and gross profits, driven by a decline in sales to the residential energy storage market and delayed transitions to larger battery formats, raising concerns about persistent revenue instability and sustained net losses if new product ramps or market shifts take longer than planned or fail to gain traction.

- The company's expansion into large-format batteries is reliant on significant capital investment, and management has indicated that costly new production lines for "series 46" batteries will not proceed without substantial customer orders or successful fundraising, presenting ongoing risks to revenue growth and operating margin improvement if funding or demand falls short.

- The delayed Nanjing facility expansion due to supplier issues highlights operational execution risk and dependence on equipment vendors, which could lead to missed sales opportunities, further postponement in capturing demand, and revenue shortfalls if such delays become recurrent.

- CBAK's plans to establish overseas manufacturing in response to global trade tensions-specifically the U.S.–China tariff situation-have been put on hold due to geopolitical uncertainty and the temporary freeze of its Malaysian project, which may restrict future access to key export markets and impact export-driven revenue streams and cost control.

- Management's repeated reference to price sensitivity in the market and increasing innovation among Chinese competitors in large-format cylindrical batteries signals intensifying price-based competition and persistent margin compression, raising the possibility that even with successful new product launches, CBAK may struggle to sustain net margin improvement or derive meaningful earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $1.5 for CBAK Energy Technology based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $398.4 million, earnings will come to $40.8 million, and it would be trading on a PE ratio of 4.2x, assuming you use a discount rate of 11.1%.

- Given the current share price of $0.9, the analyst price target of $1.5 is 40.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.