Last Update27 Aug 25Fair value Increased 1.55%

AeroVironment’s price target was raised as analysts point to rising global demand for unmanned systems, enhanced growth potential from the BlueHalo acquisition, capital optimization, and strong operational execution—driving the consensus analyst price target up from $282.57 to $286.94.

Analyst Commentary

- Bullish analysts cited the accelerating multi-year supercycle in the domestic and global unmanned aerial systems market, with AeroVironment uniquely positioned due to market share gains, expanded manufacturing capacity, and a portfolio aligned to unprecedented defense spending.

- The strategic BlueHalo acquisition has significantly enhanced AeroVironment's product breadth, providing further exposure to munitions, counter-UAS, directed energy, and other high-growth defense tech segments; analysts expect robust sales and margin expansion as a result.

- Recent capital optimization (notably the share and convertible debt issuance with subsequent debt paydown) is expected to boost EPS through reduced interest expense, despite share dilution.

- Hawkish geopolitical trends, especially lessons from the Ukraine conflict and the transformational use of inexpensive drone technology, have validated AeroVironment’s offerings (such as Switchblade and Puma) and are driving increased global demand.

- Strong recent quarters, improved guidance, and stable funded backlog—even amid high sales and temporary unfunded backlog volatility—are reinforcing confidence in sustained double-digit growth and the company’s leadership in next-gen defense solutions.

What's in the News

- AeroVironment has successfully delivered its new P550™ small UAS to the U.S. Army for the Long-Range Reconnaissance program, emphasizing rapid deployment, modular upgrades, and advanced autonomy for battlefield adaptability; the initial rollout included comprehensive equipment and operator training (Key Developments).

- The company continues to progress on multiple innovation fronts, notably advancing its Wildcat Group 3 VTOL UAS for DARPA’s EVADE program, and unveiling the “Skyfall” Mars Helicopters concept with NASA JPL aimed at future human Mars missions (Key Developments).

- Strategic alliances have expanded, with a new partnership announced with ISS to deliver a secure, standards-based V2X platform for real-time connected vehicle data; AeroVironment is also collaborating with SNC to develop next-generation, open-architecture air and missile defense solutions for the Golden Dome for America initiative (Key Developments).

- Recent commercial activity includes the successful completion of an $875 million follow-on equity offering and addition to the S&P 400, as well as a shift in underwriters for a $650 million fixed-income offering; several classes of stock remain subject to a lock-up until September 30, 2025 (Key Developments).

- Government support remains robust as the FY26 U.S. defense budget plans to sustain high-tech drone procurement; AeroVironment’s platforms continue to secure contracts such as support for the U.S. Space Force SCAR program and expansion of ISR services deployed with the U.S. Navy’s 4th Fleet (Reuters, Key Developments).

Valuation Changes

Summary of Valuation Changes for AeroVironment

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from $282.57 to $286.94.

- The Future P/E for AeroVironment has significantly fallen from 89.22x to 74.26x.

- The Net Profit Margin for AeroVironment has significantly risen from 9.03% to 10.15%.

Key Takeaways

- Rising global demand for advanced unmanned and autonomous systems is fueling AeroVironment's growth, diversification, and expansion into new high-value sectors.

- Strategic acquisitions and favorable government policies are enhancing product breadth, margin prospects, and long-term contract opportunities for sustained earnings momentum.

- Heavy dependence on government contracts, integration challenges, concentrated product risk, international regulatory headwinds, and capital-heavy growth efforts threaten profitability and long-term financial stability.

Catalysts

About AeroVironment- Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

- The surge in international defense spending, especially among NATO and allied countries, is driving record orders for AeroVironment's advanced unmanned systems (e.g., Switchblade, Puma, JUMP 20), as global conflicts underscore the urgency for rapid UAS deployment-this is building a robust multi-year pipeline and supporting double-digit forward revenue growth.

- Accelerating adoption of autonomous, AI-enabled, and software-defined aerial and ground platforms (e.g., Red Dragon, P550, MacCready Works technologies) is expanding AeroVironment's addressable market beyond traditional military use into multi-domain operations and adjacent sectors, providing a catalyst for diversification and sustained margin expansion.

- The successful, transformative acquisition of BlueHalo significantly broadens AeroVironment's product portfolio into high-priority areas such as space communication, directed energy, electronic warfare, and cybersecurity-enhancing customer lock-in and providing opportunities for cross-segment revenue synergies and increased visibility for long-term earnings.

- Growing policy focus on minimizing risk to human soldiers is accelerating the transition toward unmanned and autonomous solutions, which benefits AeroVironment due to its scalable manufacturing capacity and established reputation for battle-proven reliability, likely enabling faster conversion of backlog to revenues and improved operating leverage.

- Favorable regulatory momentum and near-term government initiatives (such as the U.S. Army's drone transformation and multibillion-dollar modernization programs) increase AeroVironment's likelihood of securing incremental, high-margin contracts in FY26 and beyond, directly impacting backlog growth and supporting higher forward earnings expectations.

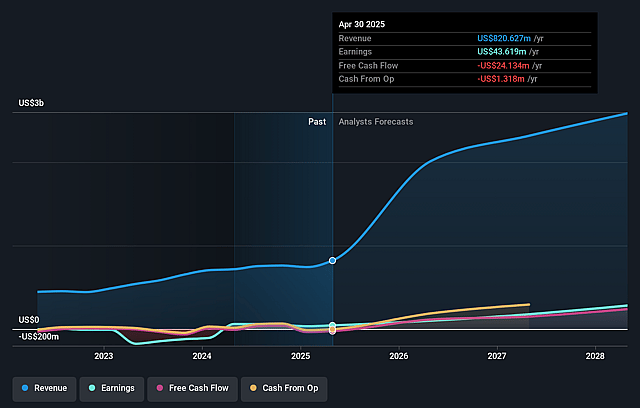

AeroVironment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AeroVironment's revenue will grow by 47.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.3% today to 10.1% in 3 years time.

- Analysts expect earnings to reach $264.5 million (and earnings per share of $6.26) by about August 2028, up from $43.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $348.3 million in earnings, and the most bearish expecting $135.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 81.0x on those 2028 earnings, down from 280.2x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

AeroVironment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AeroVironment's heavy reliance on U.S. government and Department of Defense funding and the timing of congressional budget approvals introduces ongoing revenue uncertainty and volatility, as delays or shifts in government fiscal priorities could reduce or postpone contract awards and impact topline growth. (Likely to impact revenue and earnings visibility)

- Post-acquisition integration with BlueHalo brings elevated SG&A expenses and deal-related integration costs ($40–$45 million), creating near

- to mid-term pressure on operating margins, with risk that anticipated synergies or cross-selling opportunities may not materialize as expected. (May compress net margins and dampen profitability)

- The company's product portfolio remains concentrated in loitering munitions, small UAS, and related defense technologies, exposing AeroVironment to technology obsolescence, rapid competitive innovation, and the risk that emerging counter-drone/anti-UAS systems could reduce demand or erode market share. (Could threaten future revenue streams and operating margins)

- Increased international expansion, while supporting revenue growth, also exposes AeroVironment to heightened regulatory scrutiny, potential export restrictions (especially on new products like Red Dragon as policies or ITAR evolve), and fluctuating geopolitical alliances that could suddenly curtail addressable markets or contract opportunities. (Risk to future international revenues)

- Ongoing investment in manufacturing scale-up, R&D, and capital expenditures to chase growth opportunities raises concerns about sustained pressure on free cash flow and return on invested capital, particularly if revenue growth does not meet elevated projections or if operational execution falls short. (Could reduce net margins and strain long-term earnings/cash generation)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $286.939 for AeroVironment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $335.0, and the most bearish reporting a price target of just $157.27.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $264.5 million, and it would be trading on a PE ratio of 81.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of $245.9, the analyst price target of $286.94 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.