Key Takeaways

- Strategic digital upgrades and disciplined cost management drive efficiency, scalability, and margin improvement while reducing volatility from legacy loan issues.

- Expansion in mortgage origination and national lending initiatives strengthens non-interest revenue and positions the company for sustainable earnings growth.

- Dependence on mortgage growth, regional focus, credit risks, expense reduction execution, and Panacea deconsolidation all pose significant threats to profitability and earnings stability.

Catalysts

About Primis Financial- Operates as the bank holding company for Primis Bank that provides various financial services to individuals, and small and medium sized businesses in the United States.

- The ongoing modernization and consolidation of Primis' digital and core processing infrastructure are expected to significantly reduce technology costs (by an estimated 9%), directly improving efficiency ratios and net margins as the platform becomes more scalable and cost-effective.

- Substantial expansion in mortgage origination, fueled by strategic recruiting of top production teams and favorable seasonal trends, is anticipated to lift overall loan volumes and fee income, strengthening non-interest revenue and supporting higher earnings growth.

- Primis is leveraging its digital platform to fund national lending initiatives (such as Panacea and mortgage warehouse) at lower costs, enabling above-market yield on assets and providing a pathway for sustained ROA expansion and margin improvement.

- Continued robust loan growth pipelines in core Virginia markets, combined with disciplined cost control, position the company to capitalize on regional economic expansion and population growth, supporting future top-line revenue momentum and operational leverage.

- The resolution and runoff of the legacy consumer loan portfolio, alongside heavy provisioning and conservative reserving, are expected to remove earnings volatility and credit noise from future results, allowing normalized earnings and improved book value to be more fully reflected in reported financials.

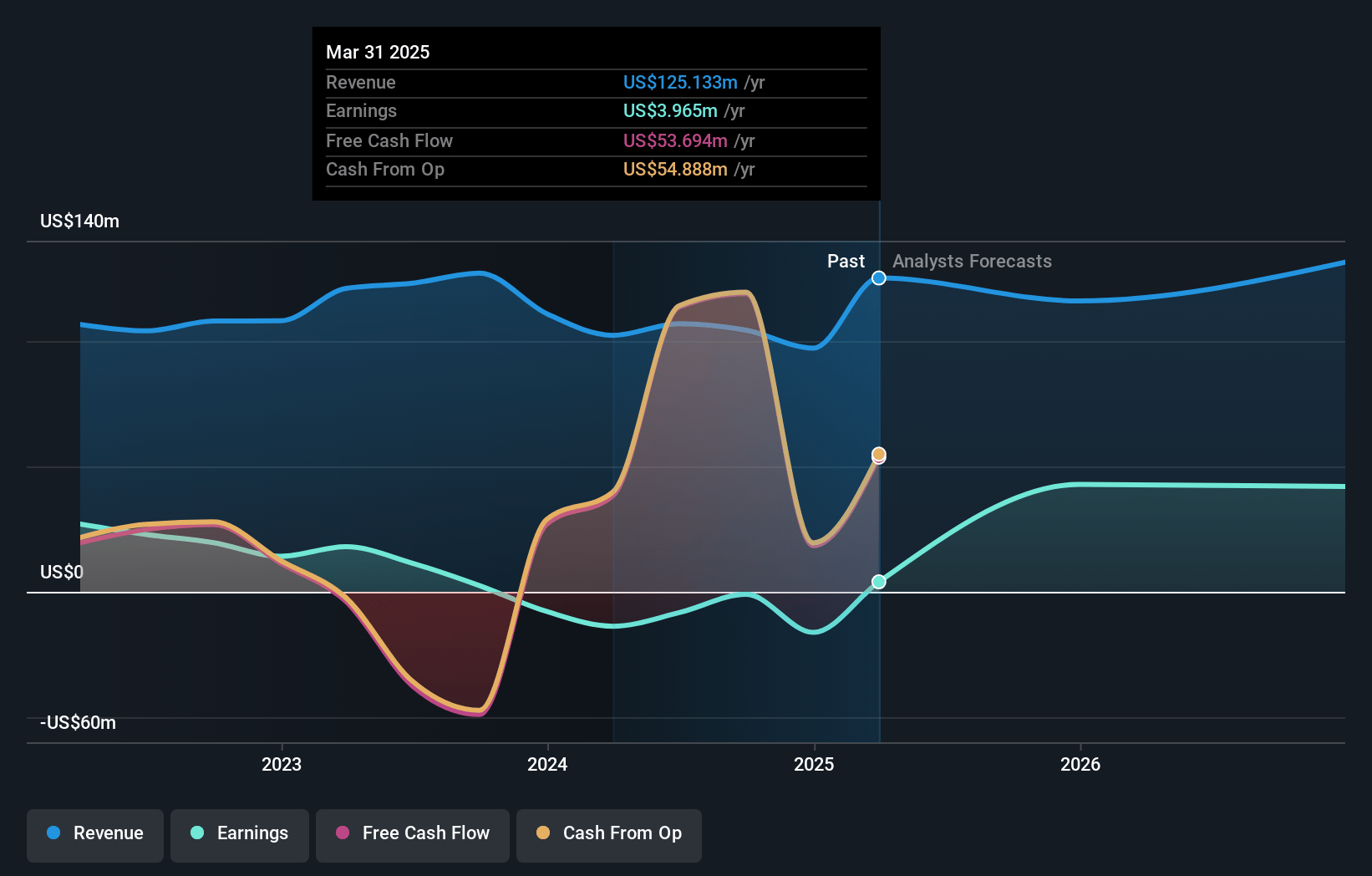

Primis Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Primis Financial's revenue will decrease by 0.8% annually over the next 3 years.

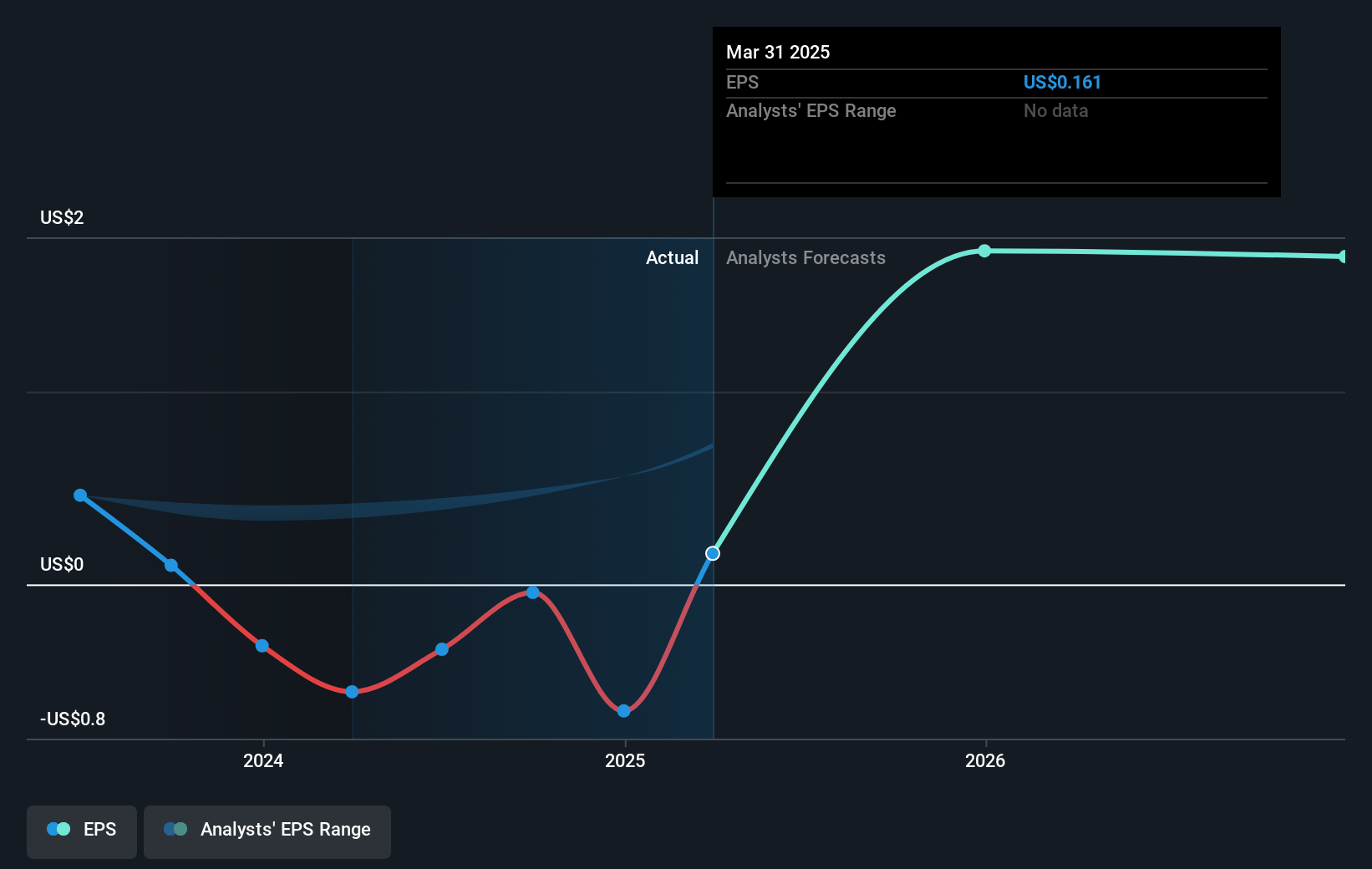

- Analysts assume that profit margins will increase from 3.2% today to 95.3% in 3 years time.

- Analysts expect earnings to reach $122.1 million (and earnings per share of $4.94) by about July 2028, up from $4.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.2x on those 2028 earnings, down from 69.1x today. This future PE is lower than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.46%, as per the Simply Wall St company report.

Primis Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on growth in mortgage volume and profitability-despite management optimism and recent recruiting-remains vulnerable to long-term shifts in interest rate environments and potential downturns in the real estate market, which could suppress loan demand, compress net interest margin, and negatively impact both revenue and earnings.

- Primis Financial continues to absorb elevated charge-offs and volatility from its consumer loan book, and while management claims reserves are adequate, there are persistent credit and runoff risks in a largely amortizing, legacy portfolio; prolonged losses or higher-than-expected charge-offs could erode net margins and pressured earnings.

- The expense reduction strategy is heavily dependent on successful core system consolidation and digital platform efficiencies, but any underexecution or technical hurdles could result in sustained high operational costs, diminishing operating leverage and negatively affecting net margins and profitability.

- The company's geographic concentration, primarily in the Mid-Atlantic and select high-growth markets, exposes it to outsized risk from regional economic slowdowns or increased competition, potentially leading to slower loan and deposit growth and jeopardizing both revenue stability and sustained earnings expansion.

- Primis is actively seeking to deconsolidate Panacea in pursuit of a near-term gain; however, this introduces accounting complexity, regulatory scrutiny, and execution risk-failure or delays could forestall anticipated efficiency improvements, while ongoing Panacea losses (if retained) would continue to drag on consolidated ROA and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.375 for Primis Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $128.1 million, earnings will come to $122.1 million, and it would be trading on a PE ratio of 3.2x, assuming you use a discount rate of 6.5%.

- Given the current share price of $11.08, the analyst price target of $13.38 is 17.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.