Last Update30 Jul 25Fair value Decreased 23%

Despite sharply improved forecasts for revenue growth and net profit margin, Flushing Financial’s consensus price target was notably reduced from $17.83 to $13.75.

What's in the News

- Completed repurchase of 3,192,036 shares, representing 10.74% for $65.29 million, under the buyback announced in February 2018.

- No shares were repurchased from April 1, 2025 to June 30, 2025.

Valuation Changes

Summary of Valuation Changes for Flushing Financial

- The Consensus Analyst Price Target has significantly fallen from $17.83 to $13.75.

- The Consensus Revenue Growth forecasts for Flushing Financial has significantly risen from 14.7% per annum to 48.6% per annum.

- The Net Profit Margin for Flushing Financial has significantly risen from 25.89% to 52.15%.

Key Takeaways

- Expanding non-interest-bearing deposits and repricing loans are poised to improve net interest margins and drive revenue growth.

- Growing presence in Asian markets and diversifying revenue streams can enhance deposit growth and support earnings expansion.

- Flushing Financial faces profitability challenges from restructuring losses, regulatory costs, increased expenses, and competitive market pressures, potentially impacting future earnings and margins.

Catalysts

About Flushing Financial- Operates as the bank holding company for Flushing Bank that provides banking products and services primarily to consumers, businesses, and governmental units.

- The company's balance sheet restructuring and recent $70 million equity raise are expected to enhance net interest margin (NIM) by 10 to 15 basis points in the first quarter, likely improving profitability and earnings.

- The planned repricing of approximately $750 million in loans in 2025 to higher rates is anticipated to support net interest income and drive future revenue growth.

- Flushing Financial's focus on expanding non-interest-bearing deposits through revamped customer relationship strategies and incentives could reduce funding costs, thus potentially increasing net interest margins and earnings.

- The expansion of the SBA team and planned sales of SBA loans in 2025 are expected to diversify revenue streams and increase non-interest income, supporting earnings growth.

- The company’s strategy to grow its presence in Asian markets, which currently make up 18% of total deposits, by opening new branches and leveraging cultural ties is positioned to capture additional market share and boost deposit growth, supporting revenue expansion.

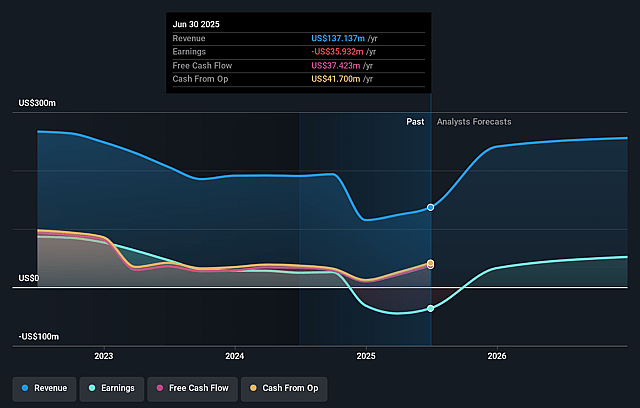

Flushing Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Flushing Financial's revenue will grow by 14.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.4% today to 25.9% in 3 years time.

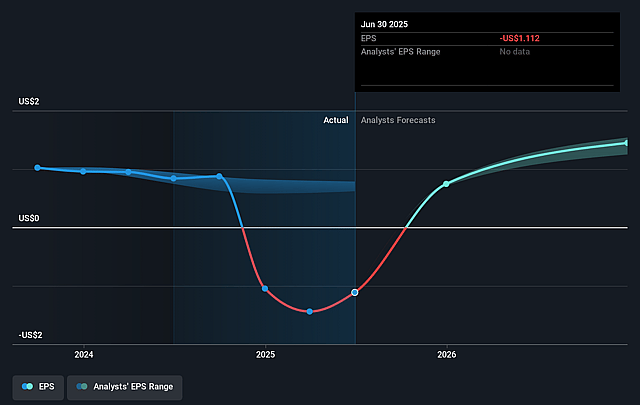

- Analysts expect earnings to reach $75.7 million (and earnings per share of $2.07) by about January 2028, up from $26.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, down from 18.5x today. This future PE is lower than the current PE for the US Banks industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 2.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Flushing Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported a GAAP loss per share of $1.61, primarily due to a $76 million pre-tax loss from balance sheet restructuring, which could affect future earnings and net margins.

- Non-interest expense is projected to increase by 5% to 8% in 2025 due to new branch openings and business investments, which could pressure net margins.

- A significant portion of deposits are in the Asian markets, where they hold only a 3% market share, implying potential market challenges that could affect revenue growth.

- The company faces competition for deposits in the New York metro market, which could impact their ability to reduce funding costs and pressure net interest margins.

- The crossing of the $10 billion asset threshold will involve regulatory challenges and costs, potentially impacting profitability and operating expenses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.83 for Flushing Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $292.6 million, earnings will come to $75.7 million, and it would be trading on a PE ratio of 10.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $14.32, the analyst's price target of $17.83 is 19.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.