Last Update 06 Nov 25

Fair value Decreased 0.42%BOKF: Improved Deposit Mix And Loan Growth Expected In Key Regional Markets

Analysts have slightly lowered their price target for BOK Financial from $119.20 to $118.70. They cite improved revenue growth prospects and deposit mix, supported by strong regional loan performance and a solid capital position.

Analyst Commentary

Market watchers have provided fresh insights into BOK Financial's outlook following the recent price target adjustment. Their evaluations reflect both confidence in the bank’s growth prospects and consideration of ongoing sector headwinds.

Bullish Takeaways

- Bullish analysts anticipate a stronger non-interest-bearing deposit mix, which is expected to enhance overall profitability and support margin expansion.

- The bank is positioned for above-average loan growth, particularly due to its significant exposure in robust regional markets such as Texas and Oklahoma.

- BOK Financial’s strong capital base is considered supportive of shareholder-friendly actions, including stock buybacks and organic growth initiatives.

- Improved revenue growth prospects, aided by stable regional loan performance, are seen as key factors justifying a higher valuation.

Bearish Takeaways

- Bearish analysts remain cautious about the sustainability of the improved deposit mix, especially if market competition for deposits intensifies.

- There are ongoing risks tied to any regional economic slowdowns, which could impact loan growth and asset quality.

- The incremental price target increase reflects only moderate upside potential, which suggests some skepticism about aggressive expansion expectations.

What's in the News

- BOK Financial announced a quarterly dividend of $0.63 per share, payable on November 26, 2025. The ex-date and record date are November 12, 2025. (Company Announcement)

- The company provided earnings guidance for 2025, expecting net interest income between $1.325 billion and $1.35 billion, and projecting mid-single-digit total revenue growth compared to the prior year. (Company Guidance)

- Between July 29, 2025 and September 30, 2025, BOK Financial repurchased 365,547 shares for $40.58 million, completing a tranche under its ongoing buyback program. (Buyback Update)

- No shares were repurchased from July 1, 2025 to July 29, 2025, concluding a separate tranche under a previous buyback authorization. (Buyback Update)

- The company reported net charge-offs totaling $3,627,000 for the third quarter ending September 30, 2025. (Quarterly Results)

Valuation Changes

- Consensus Analyst Price Target has reduced slightly from $119.20 to $118.70, reflecting a more measured outlook despite improved revenue prospects.

- Discount Rate has edged lower from 7.17% to 7.13%, suggesting a marginal decrease in perceived risk or required return.

- Revenue Growth is forecast to rise modestly, increasing from 5.86% to 6.07%.

- Net Profit Margin is expected to dip slightly from 23.95% to 23.80%, indicating a minor adjustment in profitability assumptions.

- Future P/E is projected to decrease marginally from 14.70x to 14.63x, which implies a slightly lower market valuation of future earnings.

Key Takeaways

- Strategic expansion into growth regions and enhanced digital banking drive operational efficiencies, increased loan activity, and resilient earnings diversification.

- Robust wealth management fueled by demographic trends and strong fee income streams supports sustained, stable growth amid shifting economic conditions.

- Concentrated loan risk, regional dependence, margin pressure, rising costs, and competitive threats could hinder growth, earnings, and profitability for BOK Financial over time.

Catalysts

About BOK Financial- Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

- Sustained population and economic growth in the Sun Belt and Midwest regions are driving strong demand for lending, commercial real estate, and wealth management-reflected in accelerating loan growth in core C&I, CRE, and new mortgage finance initiatives-supporting ongoing revenue expansion.

- Broader adoption of digital banking, combined with BOK Financial's continued investments in technology and customer experience, is expected to yield long-term operational efficiencies, reduce operating costs, and enhance net margins.

- Rising intergenerational wealth transfers and an increased focus on retirement planning are fueling robust growth in the wealth management and fiduciary business, as seen in record asset management revenue and consistent high-single-digit growth rates, strengthening diversified fee-based income streams.

- BOK Financial's strategic expansion into fast-growing markets like Texas and Arizona, alongside talent acquisition in key markets, positions the company to capitalize on secular migration and economic trends, propelling above-peer loan and revenue growth.

- The company's diversified fee income-including trading, wealth management, and treasury services-provides resilience against interest rate fluctuations and contributes to a more stable and growing earnings base.

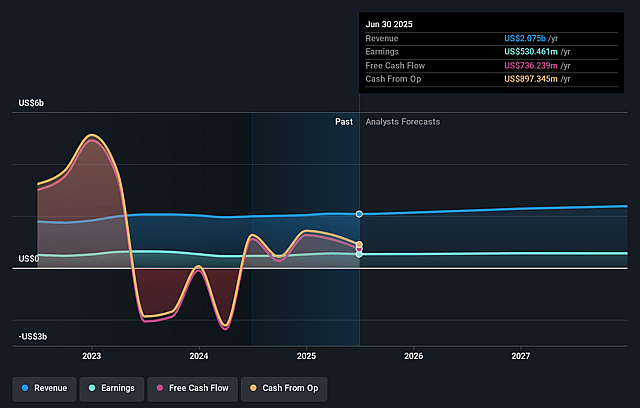

BOK Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BOK Financial's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.6% today to 23.5% in 3 years time.

- Analysts expect earnings to reach $579.1 million (and earnings per share of $9.36) by about September 2028, up from $530.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, up from 13.3x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.27%, as per the Simply Wall St company report.

BOK Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Overconcentration in the commercial real estate (CRE) and energy loan portfolios presents elevated credit risk, especially as recent growth in CRE could expose BOK Financial to sector-specific downturns; this may result in higher-than-expected loan losses, negatively impacting net income and earnings over the long term.

- BOK Financial remains heavily dependent on the economic health of the Midwest and Southwest regions, so any localized economic downturns or demographic stagnation could disproportionately hamper deposit and loan growth, limiting revenue expansion and overall earnings potential.

- The company acknowledged ongoing "hypercompetitive" market conditions in its core regions, which may continue to drive spread and margin compression in C&I lending, limiting net interest margin and net interest income growth in the coming years.

- Rising technology and operational costs, such as those related to the build-out of the new mortgage finance business and ongoing digital investments, could pressure expense growth relative to revenue if scale benefits fail to materialize, weakening net margins and return on equity.

- Heightened regulatory focus and increasing compliance/technology demands, alongside the persistent threat from fintech and non-bank competitors, may raise structural costs and make it more difficult to attract younger, digitally native customers-potentially resulting in lower deposit growth, reduced fee income, and long-term margin dilution.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.1 for BOK Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.5 billion, earnings will come to $579.1 million, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of $110.58, the analyst price target of $116.1 is 4.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.