Key Takeaways

- Successful e-commerce expansion, product innovation, and omnichannel strategy are fueling higher-margin growth and increasing Holley’s market share amid strong demand from automotive enthusiasts.

- Operational efficiencies and domestic manufacturing give Holley a structural advantage in margin preservation and earnings growth despite volatile global trade conditions.

- Holley faces long-term risks from shrinking ICE markets, lagging innovation, regulatory costs, changing consumer trends, and limited flexibility due to financial constraints.

Catalysts

About Holley- Designs, manufactures, and distributes automotive aftermarket products to car and truck enthusiasts primarily in the United States, Canada, and Europe.

- Holley's recent success in expanding digital and direct-to-consumer channels—driven by robust e-commerce growth of more than 10 percent year-over-year and third-party marketplace sales rising over 50 percent—positions the company to capitalize on changing consumer buying patterns, providing incremental, higher-margin revenue streams and the potential for enhanced overall net margins.

- Ongoing product innovation, including frequent launches of integrated performance packages, new categories, and advanced tech-enabled solutions such as at-home flash tuning and Bluetooth fuel injection, enables Holley to tap into the growing community of automotive hobbyists and enthusiasts; this dynamic market engagement is expected to unlock stronger pricing power and sustain top-line growth.

- Holley’s omnichannel strategy, connecting with customers via national retailers, installers, direct sales, and major third-party platforms, is broadening the company’s reach and helping it rapidly gain market share from competitors—especially as the aging U.S. vehicle fleet and classic car restoration trends structurally raise end-market demand, boosting revenue opportunities over the long term.

- Strategic operational improvements, including targeted cost reductions, inventory optimization, and enhanced labor and overhead efficiency, are driving substantial margin expansion—Holley improved its gross margin to 41.9 percent, and further benefits are projected, supporting stronger free cash flow and earnings growth as the company scales.

- By leveraging its largely U.S.-based production footprint alongside a comprehensive, agile approach to tariff mitigation and competitive pricing, Holley is uniquely positioned to defend (and expand) margins even as global trade dynamics remain volatile—this structural advantage can accelerate earnings growth relative to peers who face deeper import exposure.

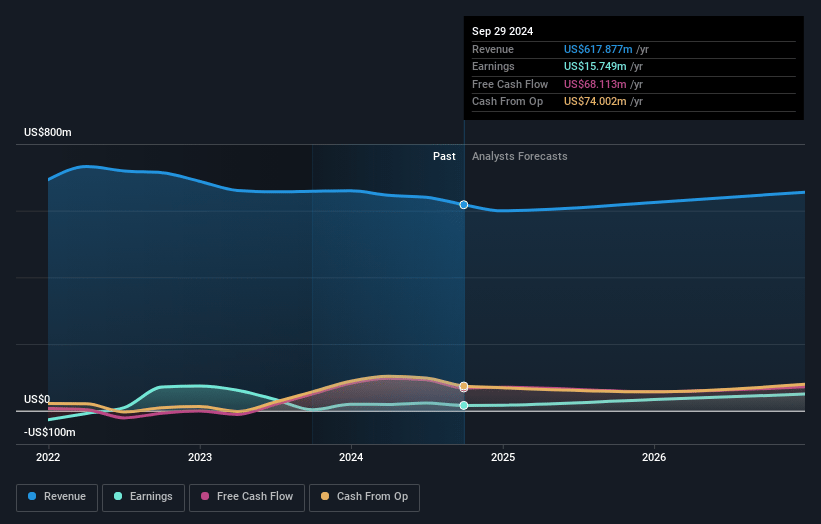

Holley Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Holley compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Holley's revenue will grow by 5.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -4.0% today to 11.3% in 3 years time.

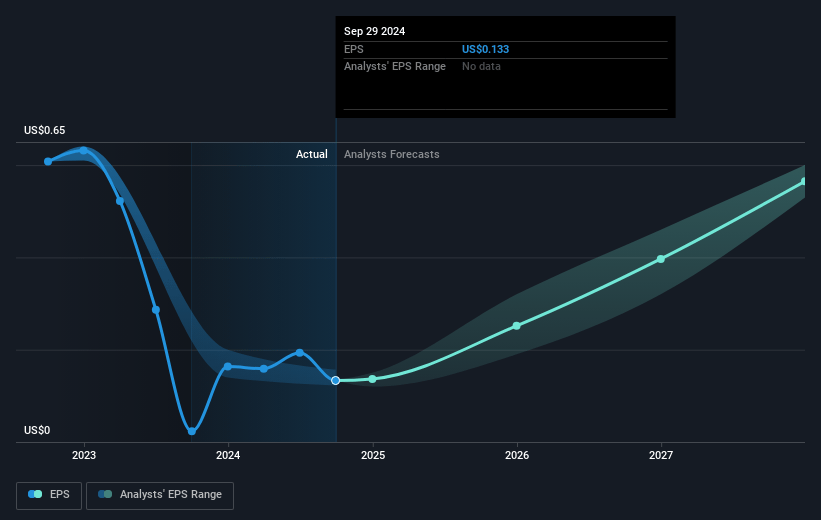

- The bullish analysts expect earnings to reach $78.0 million (and earnings per share of $0.64) by about July 2028, up from $-24.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, up from -10.6x today. This future PE is lower than the current PE for the US Auto Components industry at 14.8x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Holley Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerated global adoption of electric vehicles threatens to shrink the addressable market for Holley's core internal combustion engine aftermarket parts, which could cause a material long-term decline in revenues and earnings as demand shifts away from traditional performance products.

- Stricter environmental regulations and emissions controls, particularly in developed markets, risk making Holley’s ICE-focused modifications less compliant and more costly to sell, increasing SG&A expenses for legal and compliance and potentially suppressing net margins.

- Shifting consumer preferences, especially among younger generations who are disengaging from car culture and automotive customization, pose secular demographic headwinds that may limit future revenue growth and threaten the long-term sustainability of Holley’s business model.

- Heavy reliance on legacy ICE brands and a slow pivot toward EV or innovative technologies exposes Holley to market share losses to diversified competitors, potentially eroding long-term revenue growth and compressing margins as industry trends accelerate.

- High financial leverage and negative free cash flow in the most recent quarter reduce management’s flexibility to invest in R&D or strategic acquisitions, increasing the risk of slow adaptation to industry changes and stagnation in long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Holley is $5.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Holley's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $2.25.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $693.2 million, earnings will come to $78.0 million, and it would be trading on a PE ratio of 10.7x, assuming you use a discount rate of 11.6%.

- Given the current share price of $2.15, the bullish analyst price target of $5.0 is 57.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.