Key Takeaways

- International expansion and evolving business models are broadening market reach, diversifying revenue streams, and driving operational efficiency across key regions.

- Innovation in protective solutions and disciplined cost management are enhancing margins, supporting premium pricing, and strengthening long-term earnings potential.

- Shifts in automotive technology, regulations, and competition threaten XPEL’s demand, margins, and future growth by undermining the need and marketability for its aftermarket products.

Catalysts

About XPEL- Manufactures, installs, sells, and distributes protective films, coatings and related services.

- The expanding global vehicle base, especially in emerging markets, is increasing the total number of vehicles on the road, which directly expands XPEL’s addressable market and sets the stage for sustained multi-year revenue growth as international regions like China, Europe, and the Middle East continue to deliver record revenue and gain momentum.

- Greater consumer focus on protecting and personalizing vehicles is driving higher adoption rates for products that preserve assets and enhance resale value, supporting ongoing demand for XPEL’s proprietary paint protection films and window products, thereby increasing customer lifetime value and leading to robust top line growth.

- The company is executing on international expansion by building out in-country distribution and shifting to more direct business models, such as its evolving approach in China, which can both diversify and accelerate revenue growth while improving operational leverage across multiple geographies.

- Ongoing product innovation, including new colored films, windshield protection, and entry into architectural applications, leverages heightened awareness around sustainability and longevity, positioning XPEL’s differentiated product suite to command premium pricing and drive long-term gross margin and earnings expansion.

- XPEL’s operational improvements, such as disciplined SG&A control and investment in higher-margin recurring service businesses and installation networks, are expected to enable further EBITDA and net income margin growth, increasing earnings predictability and future cash flow for reinvestment or capital returns.

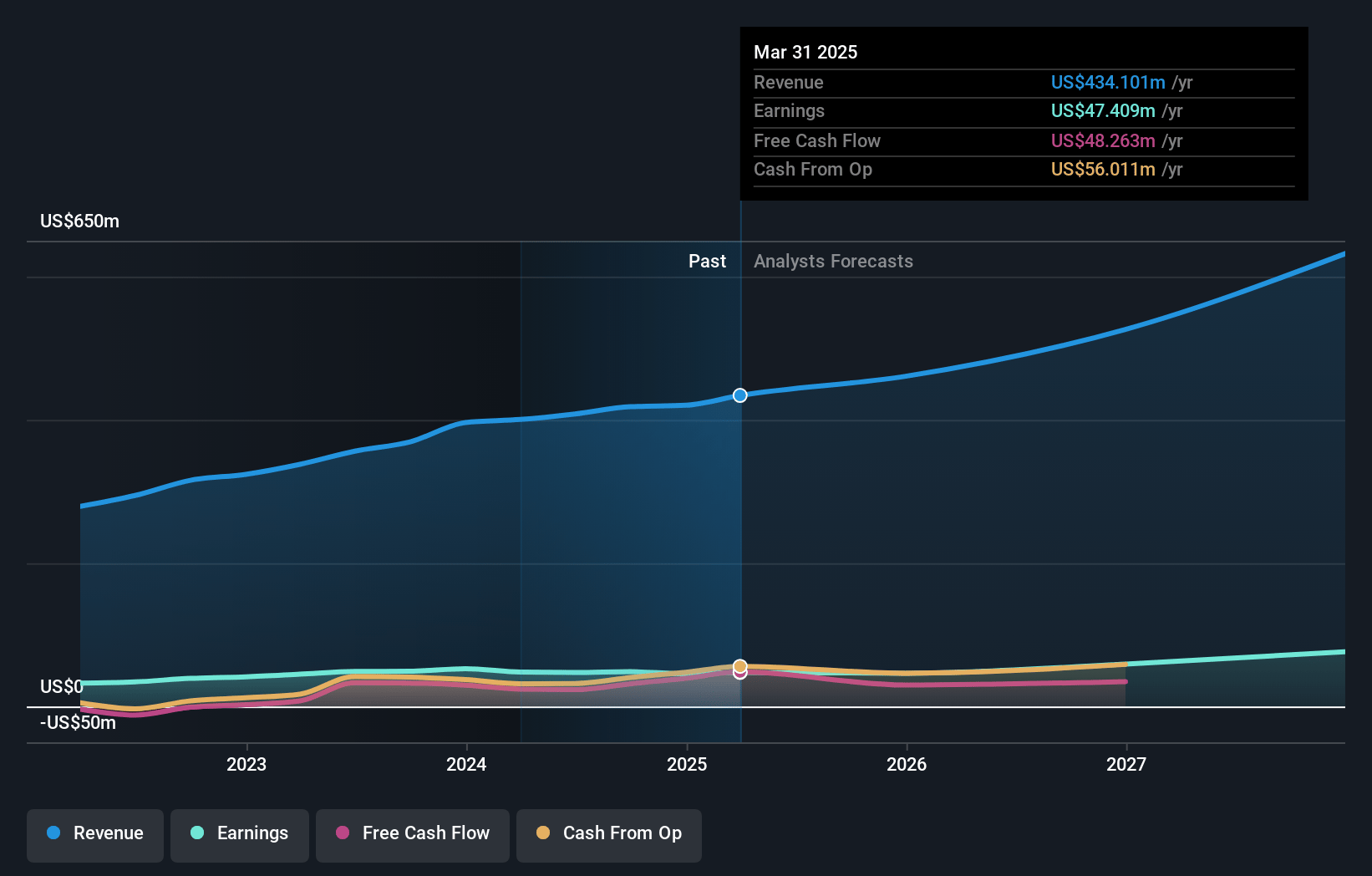

XPEL Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on XPEL compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming XPEL's revenue will grow by 15.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.9% today to 12.3% in 3 years time.

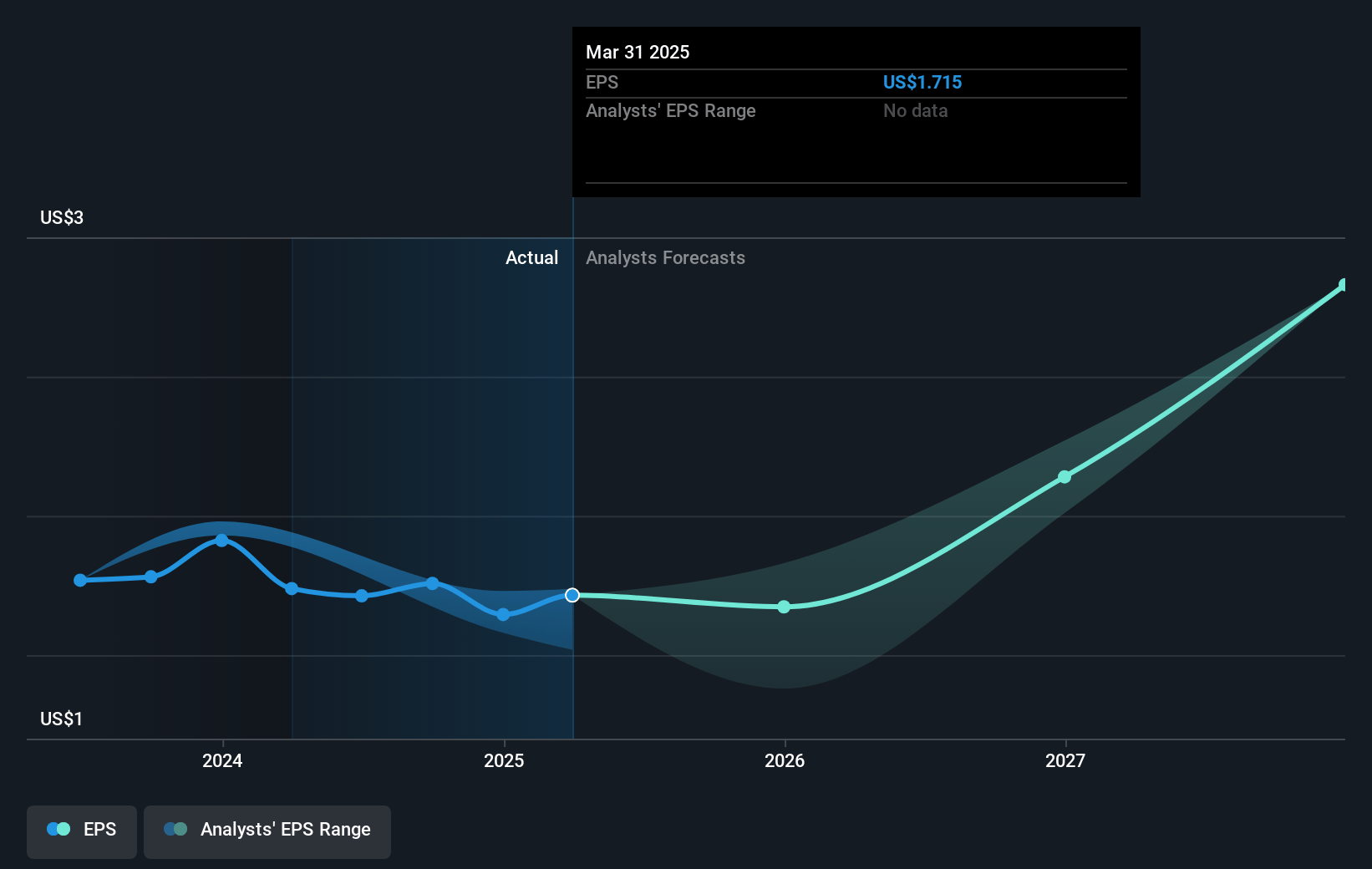

- The bullish analysts expect earnings to reach $82.7 million (and earnings per share of $3.07) by about July 2028, up from $47.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, up from 20.7x today. This future PE is greater than the current PE for the US Auto Components industry at 14.8x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.18%, as per the Simply Wall St company report.

XPEL Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growing trend toward autonomous vehicles and shared mobility may reduce the need for personal vehicle ownership, decreasing long-term demand for XPEL’s aftermarket protective products, which would put downward pressure on XPEL’s future revenue growth.

- Rising environmental and regulatory pushback against synthetic polymer-based products could increase scrutiny and potential costs for XPEL, threatening the adoption and marketability of its films and exposing the company to regulatory headwinds that may negatively impact revenue and margins.

- A stagnant or declining global auto sales environment, driven by urbanization and shifting transportation preferences, could shrink the pool of new vehicles requiring XPEL’s films, limiting the company’s ability to maintain or grow its revenue base over the long term.

- Expanding competition from lower-cost manufacturers, especially in Asia, may force XPEL to compete on price internationally, leading to potential gross margin compression and ultimately reducing net earnings over time.

- Heightened risk of OEMs integrating protective films at the factory level or the emergence of advanced automotive paint and glass technologies could bypass the need for aftermarket solutions like those XPEL offers, sharply reducing market share, revenue, and future growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for XPEL is $55.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of XPEL's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $38.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $671.8 million, earnings will come to $82.7 million, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 7.2%.

- Given the current share price of $35.46, the bullish analyst price target of $55.0 is 35.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.