Catalysts

About Xbrane Biopharma

Xbrane Biopharma develops and commercializes biosimilar medicines, with a focus on ophthalmology and oncology products in partnership driven models.

What are the underlying business or industry changes driving this perspective?

- Resumed and expanding Ximluci shipments to STADA, combined with participation in new hospital tenders across Europe and additional geographies, can unlock higher market share in a EUR 5 billion retinal market and may support revenue growth and profit sharing from 2026 onward.

- Structural global pressure to reduce biologics treatment costs supports increasing adoption of biosimilars such as Ximluci and the future Xdivane, which could underpin multi year volume growth and improve operating leverage and earnings.

- Planned production cost reduction measures for Ximluci with STADA, as volumes scale, are likely to lower unit costs over the coming years and may support gross margin and net margin expansion despite competitive price pressure.

- A de risked manufacturing setup for Xdivane using a top tier contract manufacturer with a strong FDA track record, together with a targeted day one U.S. launch after loss of exclusivity in 2028, positions the company to participate in oncology biosimilar market share and potentially reshape annual earnings.

- Disciplined fixed cost control at roughly SEK 11 million per quarter and the use of existing Ximluci inventory to finance roughly SEK 200 million of remaining Xdivane development can limit dilution, help stabilize cash flow and support future earnings per share as new products scale.

Assumptions

How have these above catalysts been quantified?

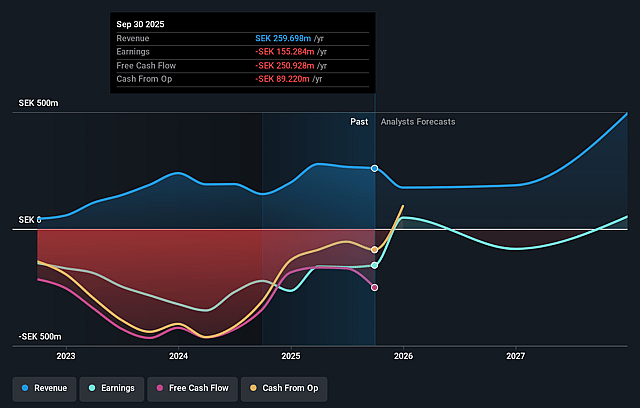

- Analysts are assuming Xbrane Biopharma's revenue will grow by 27.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -59.8% today to 5.3% in 3 years time.

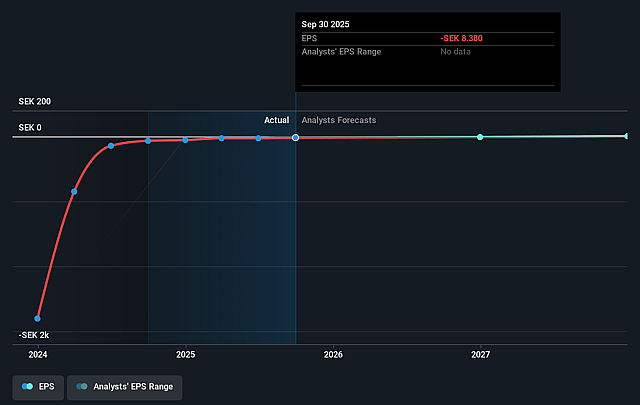

- Analysts expect earnings to reach SEK 28.7 million (and earnings per share of SEK 1.73) by about December 2028, up from SEK -155.3 million today.

- In order for the above numbers to justify the price target of the analysts, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from -1.2x today. This future PE is lower than the current PE for the SE Biotechs industry at 31.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.12%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Persistent regulatory setbacks around Ximluci in the U.S., including prolonged FDA observations at the contract manufacturing site or additional complete response letters, could delay or reduce access to the world’s largest biologics market and cap long term revenue and earnings growth.

- Intensifying competition in retinal anti VEGF therapies from new originator drugs like Vabysmo and upcoming Eylea biosimilars may structurally limit the attainable ranibizumab share for Ximluci in Europe, putting pressure on pricing, revenue scale and net margins, even if volumes grow.

- Reliance on partners and contract manufacturers for both Ximluci and Xdivane means any operational, quality or investment delays at these third parties could push back product launches, weaken bargaining power in profit splits and constrain long term earnings expansion.

- High development and capitalized R&D spend for Xdivane relative to Xbrane’s current cash balance and modest quarterly revenues raises the risk that further equity or debt financing will be required if inventory monetization or profit sharing underperform. This could dilute shareholders and weigh on earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of SEK15.5 for Xbrane Biopharma based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analysts, you'd need to believe that by 2028, revenues will be SEK540.6 million, earnings will come to SEK28.7 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 5.1%.

- Given the current share price of SEK9.41, the analyst price target of SEK15.5 is 39.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.