Key Takeaways

- Expanding digital and retail channels, product innovation, and acquisitions are set to drive growth, premium pricing, and broader market reach in pet healthcare.

- Operational efficiencies from process improvements and integration are expected to enhance margins and support scalability as consumer demand continues to rise.

- Reliance on large orders, rising external costs, high debt from acquisitions, regional market weakness, and intense competition threaten growth, profitability, and margin stability.

Catalysts

About Swedencare- Develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses in North America, Europe, and internationally.

- The ramp-up of major online direct-to-consumer channels, especially the Amazon NaturVet transition and expanded digital marketing efforts in Europe (notably Germany and the UK), is expected to boost both top-line sales growth and gross margin through stronger pricing power and improved reach, capitalizing on increased consumer demand for convenient access to premium pet healthcare products.

- Distribution expansion into large US retail chains like Walmart, PetSmart, and CVS with new and existing SKUs, along with a broader customer base and reduced reliance on single large retail customers, positions Swedencare for accelerated revenue growth and operational leverage in H2 2025 and beyond.

- New product development and innovation-such as the introduction of patented soft chews, niche veterinary lines, and success with products like dental wipes on Amazon-enables Swedencare to respond to the trend of owners spending more on premium, preventive health for their pets, supporting premium pricing and margin expansion.

- Recent acquisitions (e.g., Summit Vet) and cross-selling the expanded proprietary product portfolio into new geographies and market segments are expected to drive incremental revenue and improved EBITDA margins by unlocking synergies and operational efficiencies as integration advances.

- Operational improvements (ERP roll-out, supply chain enhancements, internalization of Amazon sales, and new manufacturing capacity like the vacuum tanks in Vetio South) are expected to yield higher EBITDA margins through process efficiencies, cost reduction, and better production scalability as volumes grow with secular pet ownership and healthcare demand trends.

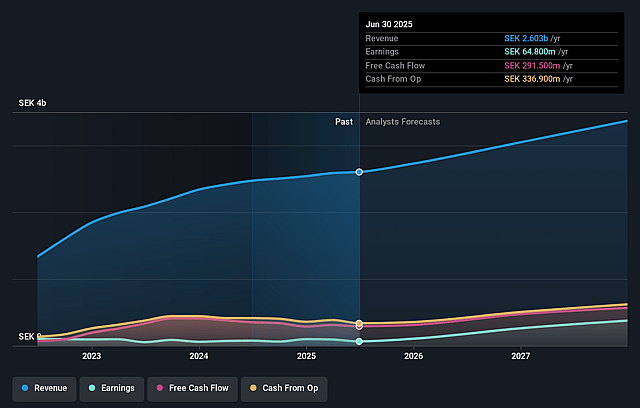

Swedencare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Swedencare's revenue will grow by 10.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.5% today to 14.7% in 3 years time.

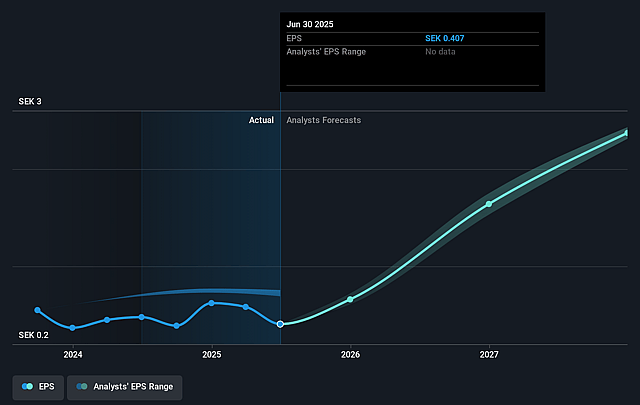

- Analysts expect earnings to reach SEK 521.8 million (and earnings per share of SEK 2.37) by about September 2028, up from SEK 64.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, down from 96.6x today. This future PE is lower than the current PE for the SE Pharmaceuticals industry at 78.2x.

- Analysts expect the number of shares outstanding to grow by 0.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.92%, as per the Simply Wall St company report.

Swedencare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slower-than-expected organic growth, persistent reliance on the timing of large orders from key clients (e.g., Walmart, big box retailers), and customer-specific delays could create ongoing revenue volatility and limit sustainable revenue growth forecasts.

- Increased external costs-especially those associated with Amazon and digital channel expansion-alongside temporarily lower margins during account transitions, may pressure overall net margins and challenge the company's ability to scale profitably as e-commerce and digital marketing investments increase.

- Elevated net debt-to-EBITDA ratios due to acquisitions and working capital needs (inventory buildup) constrain balance sheet flexibility, and continued reliance on smaller or bolt-on acquisitions to drive growth could result in integration risks and potential earnings dilution if acquired assets underperform.

- Persistent softness in the North American veterinary channel, as well as weak market growth in certain European regions (Southern Europe, France, Spain), signifies that macroeconomic and secular trends such as shifting consumer habits or price sensitivities could reduce future sales growth and earnings potential in core segments.

- Heightened competition in the fast-growing organic treats and dental categories, combined with dependence on strong brand loyalty and successful product innovation, risks gross margin compression and revenue underperformance should consumer preferences or veterinary recommendations shift or if new market entrants gain traction.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK49.667 for Swedencare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK55.0, and the most bearish reporting a price target of just SEK43.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK3.6 billion, earnings will come to SEK521.8 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 4.9%.

- Given the current share price of SEK39.15, the analyst price target of SEK49.67 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.