Key Takeaways

- Rapid technology shifts and limited R&D investment may erode market position as demand grows for advanced, efficient cable solutions.

- Increasing supply chain risks and environmental regulations threaten profitability, while over-dependence on regional mega-projects heightens revenue volatility.

- Strong order backlog, robust volume growth, operational efficiency, and diversification position the company to benefit from sustained regional infrastructure and renewable energy investment trends.

Catalysts

About Riyadh Cables Group- Manufactures and supplies various types of wires and cables to the power transmission and communication sectors in the Kingdom of Saudi Arabia.

- Riyadh Cables faces significant long-term risk from the shift toward advanced wireless and fiber-optic communication technologies, which could lead to gradual obsolescence of conventional power and transmission cables and a sustained decline in the company's core revenues as adoption accelerates over the next decade.

- The increasing global focus on supply chain localization and protectionism may disrupt Riyadh Cables' raw material sourcing, resulting in heightened input cost volatility and supply insecurity that could erode gross margins and compress net earnings over the coming years.

- Heavy reliance on large-scale mega and giga infrastructure projects in Saudi Arabia and the GCC leaves future revenues exposed to government budget cycles, geopolitical instability, and the eventual completion or delay of these projects after the Vision 2030 surge, setting up the company for considerable revenue and earnings volatility once cyclicality returns.

- A lack of sustained, industry-leading investment in research and development puts Riyadh Cables at a disadvantage compared to global innovation leaders, causing the company's product offerings to become less competitive over time and risking ongoing contraction in market share and margin compression as end users increasingly demand technologically advanced, energy-efficient and smart cable solutions.

- The cable industry is facing mounting environmental and regulatory pressures globally, which will drive up long-term compliance costs and necessitate higher ongoing capital expenditure. For Riyadh Cables, this means direct financial pressure on operating profit and possibly lower free cash flow available for growth investments and dividends.

Riyadh Cables Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Riyadh Cables Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Riyadh Cables Group's revenue will grow by 3.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 9.5% today to 8.6% in 3 years time.

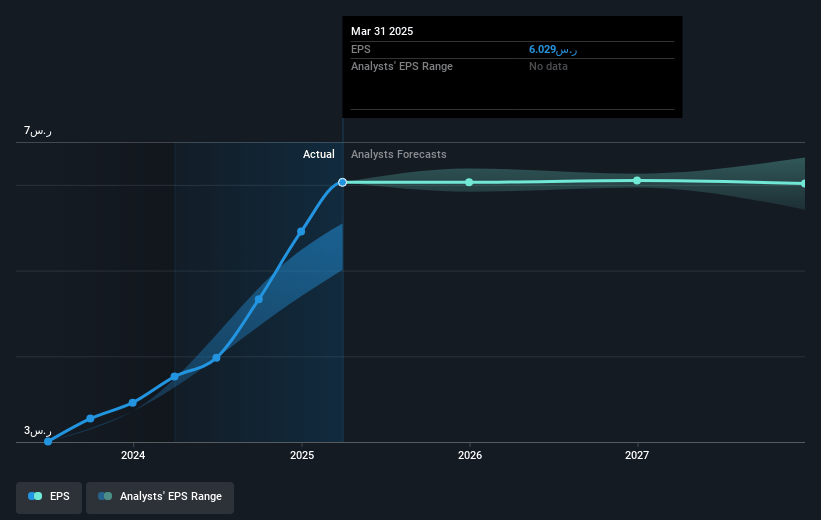

- The bearish analysts expect earnings to reach SAR 886.1 million (and earnings per share of SAR 5.9) by about July 2028, down from SAR 902.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 27.0x on those 2028 earnings, up from 22.6x today. This future PE is greater than the current PE for the SA Electrical industry at 21.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.89%, as per the Simply Wall St company report.

Riyadh Cables Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported a record high confirmed order backlog of SAR 5.2 billion covering 139,000 tons, supported by advanced payments, letters of credit, and fully hedged metals, offering strong near-term revenue visibility and reducing the risk of revenue declines.

- Volume growth remains robust, with sales volume increasing by 8% year-on-year and solid demand observed across domestic, export, and high-value segments like transmission and renewables, sustaining or potentially growing top-line revenues.

- Riyadh Cables Group maintains high operational efficiency, as shown by a 95% utilization rate and continuous investments in modernizing plants and expanding capacity, supporting stable or improving operational profit margins and earnings.

- The company is diversifying beyond commodity cable sales by rolling out value-added offerings such as cable accessories and turnkey solutions, which are likely to support higher average selling prices and net margins over time.

- Macro trends such as accelerated infrastructure, renewable energy expansion, and mega-projects in Saudi Arabia and the region, in line with Vision 2030, are expected to drive persistent demand for power cables and transmission products, bolstering both revenue and earnings growth for established players like Riyadh Cables Group.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Riyadh Cables Group is SAR91.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Riyadh Cables Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SAR149.0, and the most bearish reporting a price target of just SAR91.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SAR10.4 billion, earnings will come to SAR886.1 million, and it would be trading on a PE ratio of 27.0x, assuming you use a discount rate of 20.9%.

- Given the current share price of SAR136.3, the bearish analyst price target of SAR91.0 is 49.8% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.