Key Takeaways

- Operational efficiencies, innovative products, and strong localization enable margin gains, market share growth, and premium contract wins over global competitors.

- Robust execution, disciplined management, and rising infrastructure demand support free cash flow growth and greater shareholder returns.

- Heavy reliance on traditional cables, exposure to government spending cycles, rising competition, sustainability pressures, and volatile input costs could all threaten profitability and long-term growth.

Catalysts

About Riyadh Cables Group- Manufactures and supplies various types of wires and cables to the power transmission and communication sectors in the Kingdom of Saudi Arabia.

- Analyst consensus views Riyadh Cables' capacity expansion and diversification strategy as a short-term margin risk, but the company's relentless focus on operational efficiencies, digitalization, and a superior product mix is already delivering outsized profitability gains-evidenced by a 36% increase in gross profit per ton-suggesting meaningful margin expansion potential as new capacity comes online and economies of scale take hold.

- While consensus expects a strong backlog to exert working capital pressure, robust project execution, disciplined receivables management, and advanced hedging mechanisms are allowing Riyadh Cables to translate record SAR 5.2 billion backlog into strong free cash flow and rising dividend payouts-a dynamic likely to support higher future earnings and shareholder returns.

- The accelerating region-wide adoption of renewables and grid modernization is driving sustained, high-margin demand for advanced transmission and specialty cables, positioning Riyadh Cables as a primary beneficiary of enduring, multi-decade infrastructure cycles, and underpinning both volume growth and pricing power.

- Riyadh Cables' leadership in localization, supported by government policies favoring "Made in Saudi" products, is enabling the company to further consolidate market share, displace global competitors, and capture premium contracts in both government and private sector projects, with positive implications for long-term revenue visibility.

- Continued product innovation-including the commercialization of fiber optic and advanced cable accessories as well as turnkey project capabilities-expands Riyadh Cables' addressable market and elevates blended ASPs and margins, reinforcing an upward trajectory in both top-line growth and earnings consistency.

Riyadh Cables Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Riyadh Cables Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Riyadh Cables Group's revenue will grow by 7.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.5% today to 11.2% in 3 years time.

- The bullish analysts expect earnings to reach SAR 1.3 billion (and earnings per share of SAR 8.7) by about July 2028, up from SAR 902.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.0x on those 2028 earnings, up from 23.1x today. This future PE is greater than the current PE for the SA Electrical industry at 21.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.87%, as per the Simply Wall St company report.

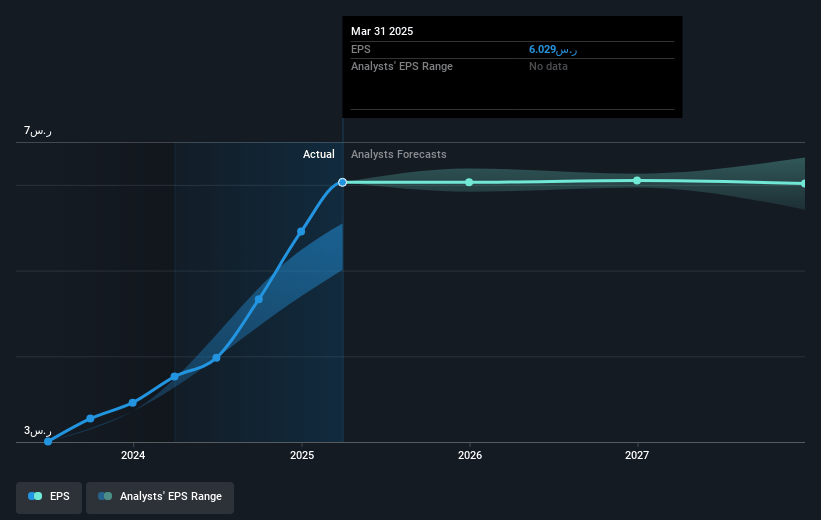

Riyadh Cables Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's continued dependence on traditional copper and aluminum cables in its product mix, combined with the global trend towards wireless solutions and substitute materials such as fiber optics and advanced polymers, could gradually reduce demand for Riyadh Cables' core products and negatively impact long-term revenue growth.

- The bulk of Riyadh Cables' revenue is driven by large-scale government and mega-project spending in Saudi Arabia and the region, exposing it to concentration risk; if government budgets shift or major projects slow down, this could lead to significant declines in both revenues and earnings.

- Heightened competitive pressure from other regional and international manufacturers, as mentioned in discussions about a "very much competitive scenario," could compress gross margins and erode earnings, particularly in the commoditized cables segment.

- With increasing emphasis on sustainability and regulatory scrutiny of energy-intensive industries, Riyadh Cables may face rising operating and compliance costs in the future, potentially reducing net margins – especially if its ESG and carbon reduction efforts lag behind industry expectations.

- Volatility in raw material costs, particularly copper and aluminum, is currently hedged but not fully neutralized by pricing strategies, which means sharp rises or prolonged supply chain disruptions in commodity markets could eventually lead to increased input costs and unpredictable impacts on gross profit and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Riyadh Cables Group is SAR149.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Riyadh Cables Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SAR149.0, and the most bearish reporting a price target of just SAR91.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SAR11.7 billion, earnings will come to SAR1.3 billion, and it would be trading on a PE ratio of 30.0x, assuming you use a discount rate of 20.9%.

- Given the current share price of SAR139.3, the bullish analyst price target of SAR149.0 is 6.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.