Key Takeaways

- Reliance on traditional store formats amid growing digital adoption and changing consumer preferences risks stagnating sales and long-term underperformance.

- Slow digital transformation and limited geographic diversification increase vulnerability to local economic shifts, competitive threats, and profit margin pressures.

- Gross margin expansion, digital innovation, and strategic investments strengthen Robinsons Retail's profitability and market position amid rising consumer spending and urbanization trends.

Catalysts

About Robinsons Retail Holdings- Operates as a multi-format retail company in the Philippines.

- The ongoing rapid shift of Philippine consumers to e-commerce and digital payment platforms threatens to reduce physical store footfall and cannibalize Robinsons Retail's traditional sales channels, posing a risk of stagnating or even declining revenue from the company's substantial brick-and-mortar network in the coming years.

- As urbanization continues and consumer preferences evolve, modern shoppers are increasingly favoring more convenient, specialized, and tech-driven retail formats over department stores and large supermarkets. This puts Robinsons' legacy store formats at risk of underperformance and long-term erosion of same-store sales growth.

- The company's expansion of store count, particularly in traditional formats, exposes it to intensifying wage pressures and stricter regulatory compliance-driven by rising minimum wages and labor laws-leading to structurally higher costs and squeezing net margins over the long term.

- Robinsons Retail's relatively slow digital transformation and lack of innovation in its online offerings compared to both local and global competitors make it vulnerable to losing share in high-growth channels, limiting its ability to capture future earnings growth as consumer spending shifts online.

- With minimal international diversification, Robinsons remains overexposed to the cyclical risks of the Philippine economy; any sustained local economic slowdown could result in heightened volatility in same-store sales growth, compressing earnings and putting company-wide profitability at risk.

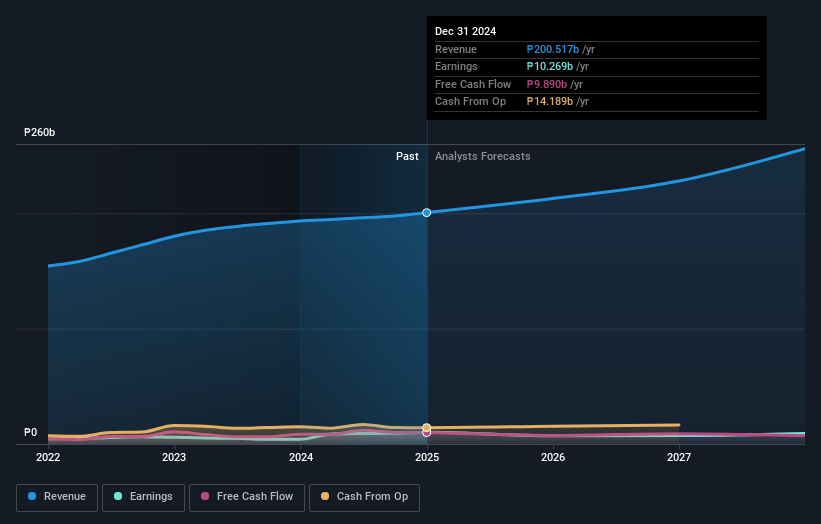

Robinsons Retail Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Robinsons Retail Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Robinsons Retail Holdings's revenue will grow by 4.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 2.9% today to 2.3% in 3 years time.

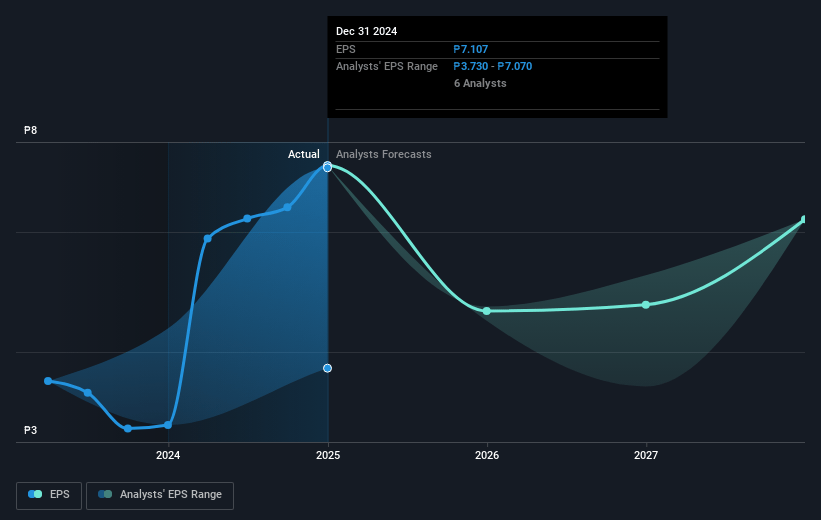

- The bearish analysts expect earnings to reach ₱5.4 billion (and earnings per share of ₱4.97) by about July 2028, down from ₱6.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.7x on those 2028 earnings, up from 7.0x today. This future PE is lower than the current PE for the PH Consumer Retailing industry at 9.9x.

- Analysts expect the number of shares outstanding to decline by 1.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.37%, as per the Simply Wall St company report.

Robinsons Retail Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robinsons Retail continues to post positive same-store sales growth in core segments such as food, drugstore, and department store, supported by increasing basket sizes and successful marketing events, which could support sustained top-line revenue growth in the long term.

- Investments in private label and house brands are driving gross margin expansion in both the food and drugstore segments, laying the groundwork for improved profitability and earnings growth over time.

- The company maintains a healthy balance sheet with a modest net debt-to-equity ratio and steady capex allocation toward store expansion across high-growth banners, positioning it to benefit from ongoing urbanization and rising consumer spending in the Philippines, thereby supporting revenue and future earnings.

- Rapid growth in digital initiatives and minority investments-such as GoTyme (a fast-growing digital bank) and O!Save (on track for over 1,100 stores by 2026)-demonstrate proactive adaptation to digital transformation trends and could boost both revenue streams and net margins in the medium to long term.

- The positive impact of sector consolidation, strong supplier relationships (evidenced by a 13% increase in vendor support), and recognition for ESG initiatives (Time Magazine and Finance Asia awards) may further strengthen market positioning, attract consumer and investor confidence, and enhance long-term profitability and valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Robinsons Retail Holdings is ₱31.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Robinsons Retail Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱86.9, and the most bearish reporting a price target of just ₱31.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₱233.6 billion, earnings will come to ₱5.4 billion, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 13.4%.

- Given the current share price of ₱37.95, the bearish analyst price target of ₱31.0 is 22.4% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.