Key Takeaways

- Heavy reliance on global trade flows and exposure to geopolitical risks create long-term revenue instability, especially in vehicle-related shipping segments.

- Rising regulatory costs and overcapacity threaten margins, despite strategic diversification and operational expansion in maritime services and digital logistics.

- Heavy reliance on global trade, key associates, and volatile markets heightens exposure to regulatory, operational, and financial risks that threaten earnings consistency and profitability.

Catalysts

About Wilh. Wilhelmsen Holding- Provides maritime products and services worldwide.

- While Wilh. Wilhelmsen Holding has demonstrated strong EBITDA growth and resilience in Maritime Services and New Energy, the company remains highly exposed to ongoing volatility in global trade and potential disruptions from geopolitical tensions and new or intensified tariffs, which could undermine shipment volumes and future revenue growth.

- Although recurring dividend streams and associates' contributions (notably from Wallenius Wilhelmsen and Hyundai Glovis) have supported robust liquidity and shareholder returns, heavy reliance on global automotive flows, especially given the sensitivity of RoRo shipping to shifts such as regionalized manufacturing or secular declines in vehicle exports, could limit revenue stability in the medium to long term.

- While diversification into high-margin maritime services and increased activity in digital logistics may offer longer-term operational efficiencies, the company faces continual cost pressures and potential net margin compression as stricter environmental regulations accelerate requirements for costly fleet decarbonization and compliance investments.

- Although Wilh. Wilhelmsen's emphasis on strategic acquisitions and expanding its Ship Management business has increased scale, chronic overcapacity across global shipping and persistent rate pressure could suppress margins and earnings despite operational expansions.

- While the company benefits from strong balance sheet discipline and regular buybacks, persistent currency fluctuations (such as krona weakening against the dollar) and exposure to write-downs or one-offs from portfolio adjustments may cause unpredictable impacts to net profit and equity, putting longer-term financial performance at risk.

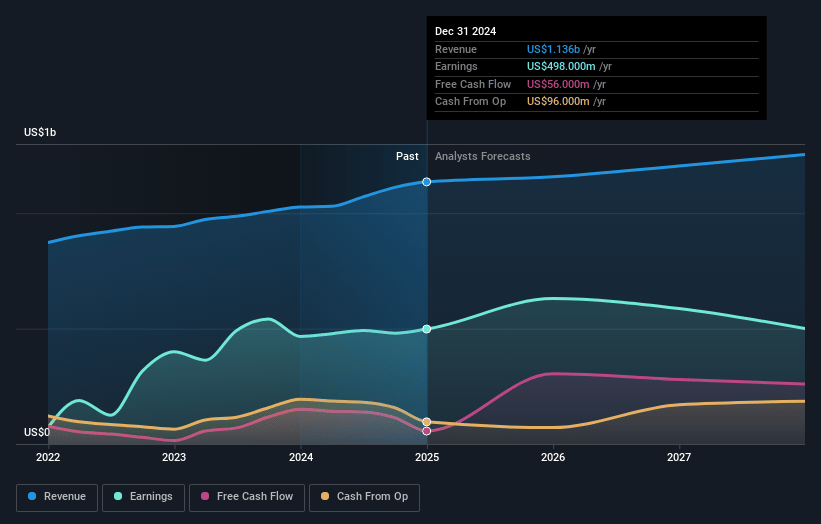

Wilh. Wilhelmsen Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Wilh. Wilhelmsen Holding compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Wilh. Wilhelmsen Holding's revenue will grow by 2.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 44.7% today to 41.4% in 3 years time.

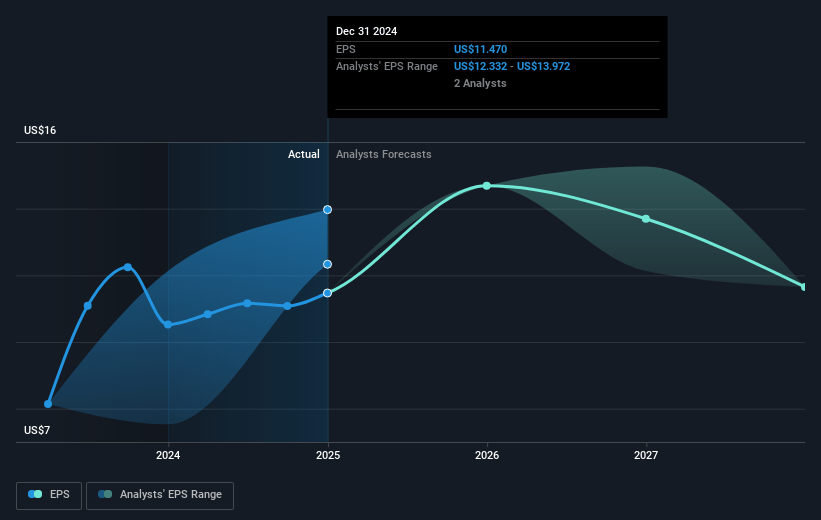

- The bearish analysts expect earnings to reach $526.2 million (and earnings per share of $12.48) by about July 2028, up from $522.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.5x on those 2028 earnings, up from 3.7x today. This future PE is greater than the current PE for the GB Shipping industry at 3.6x.

- Analysts expect the number of shares outstanding to decline by 3.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.76%, as per the Simply Wall St company report.

Wilh. Wilhelmsen Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Wilh. Wilhelmsen Holding is highly reliant on global trade volumes, making the company exposed to risks from increasing geopolitical tensions, tariff changes, and shifts in world trade patterns, which may reduce shipping demand and negatively impact revenue.

- The company's dependence on the performance of key associates like Wallenius Wilhelmsen and Hyundai Glovis means that any downturn in these partners' results or disruptions in automotive and RoRo shipping could significantly impact Wilhelmsen's net profit and overall earnings stability.

- The uncertain macroeconomic outlook and ongoing global volatility could trigger impairment losses, such as those experienced from exiting certain countries and brands, potentially leading to further write-downs and erosion of net margins in the future.

- The shipping industry is facing chronic overcapacity, and as disruptions like the Red Sea conflicts ease, a return of shipping capacity could intensify rate pressure and erode profitability for Wilh. Wilhelmsen over the longer term, directly impacting earnings.

- Strengthening environmental regulations and currency fluctuations require substantial CAPEX investments and expose the company to material FX losses, both of which could put persistent pressure on operating costs and reduce net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Wilh. Wilhelmsen Holding is NOK523.79, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wilh. Wilhelmsen Holding's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK732.32, and the most bearish reporting a price target of just NOK523.79.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $526.2 million, and it would be trading on a PE ratio of 4.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of NOK471.5, the bearish analyst price target of NOK523.79 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.