Key Takeaways

- Strong expansion in maritime and new energy, along with scale and acquisitions, positions the company for industry-leading margin and earnings growth.

- Early focus on green shipping, digitalization, and financial strength enables superior contract wins, cost efficiency, and bold M&A-driven value creation.

- Heavy dependence on global trade, regulatory pressures, and concentrated revenue sources heighten vulnerability to external shocks, margin compression, and integration risks from diversification efforts.

Catalysts

About Wilh. Wilhelmsen Holding- Provides maritime products and services worldwide.

- Analyst consensus sees robust growth in Maritime Services and New Energy, but these segments are poised for even faster and more sustained margin expansion as Wilhelmsen's scale, stable base, and recent acquisitions allow it to compound market share and pricing power well ahead of industry averages, setting up outperformance in EBITDA and net margins.

- While the consensus highlights the potential tailwind from reopened Red Sea routes and global trade normalization, an accelerating rebound in seaborne trade volumes, especially in finished vehicles and industrials, could deliver a multi-year surge in top-line revenue through both direct operations and strategic holdings like Wallenius Wilhelmsen and Hyundai Glovis.

- Wilhelmsen's early and aggressive leadership in green shipping and decarbonization investments positions it to capture a disproportionate share of high-value contracts as emissions regulations bite, directly improving revenue quality, customer retention, and net margins for years to come.

- The company's significant focus on digitalization and automation within its supply chain and ship management offerings sets the stage for dramatic reductions in operating costs and highly sticky, tech-enabled client relationships, boosting both future earnings and EBITDA margin resilience.

- Extraordinary financial flexibility from a robust balance sheet and large, recurring dividends from associates enables Wilhelmsen to act as a consolidator amid ongoing industry M&A, driving accelerated EPS and book value growth through opportunistic acquisitions and buybacks beyond market expectations.

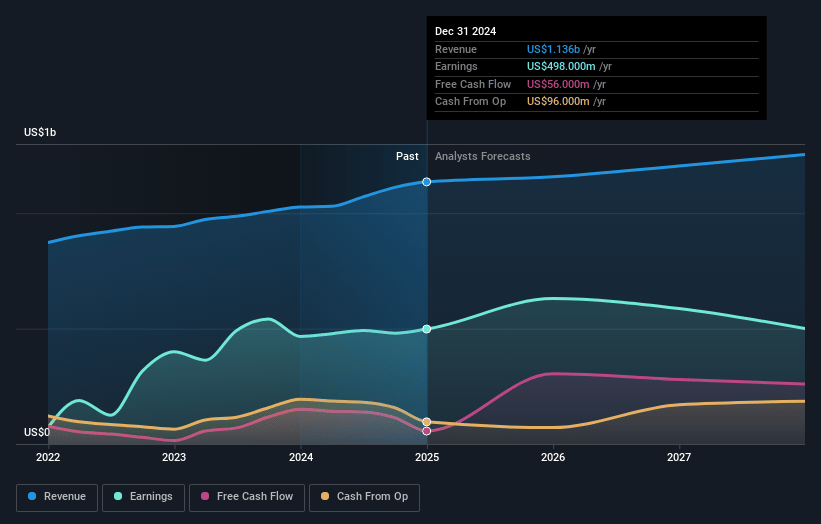

Wilh. Wilhelmsen Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Wilh. Wilhelmsen Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Wilh. Wilhelmsen Holding's revenue will grow by 2.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 44.7% today to 41.4% in 3 years time.

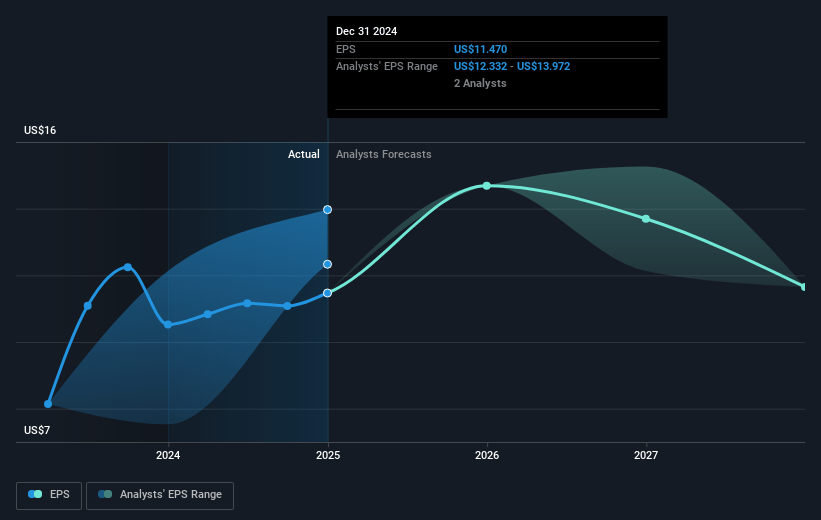

- The bullish analysts expect earnings to reach $526.2 million (and earnings per share of $12.47) by about July 2028, up from $522.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.3x on those 2028 earnings, up from 3.7x today. This future PE is greater than the current PE for the GB Shipping industry at 3.7x.

- Analysts expect the number of shares outstanding to decline by 3.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.76%, as per the Simply Wall St company report.

Wilh. Wilhelmsen Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on global trade and exposure to geopolitical turmoil, such as ongoing trade wars, tariffs, and disruptions in the Red Sea, introduces persistent uncertainty that risks reducing shipping volumes and impacting both revenue and earnings across Wilh. Wilhelmsen's core business segments.

- Increasing regulatory pressure related to decarbonization and ESG requirements will likely drive up compliance and retrofit costs for the company's large fleet, putting pressure on margins and reducing free cash flow as significant capital expenditure becomes necessary over time.

- Overcapacity risks in shipping, combined with the potential return of capacity to the market after temporary disruptions, could structurally depress freight rates, leading to lower topline growth and margin compression for the group, especially in its car carrier and RoRo operations.

- The group's financial performance is strongly linked to major associates like Wallenius Wilhelmsen and Hyundai Glovis, creating revenue concentration risk that leaves it highly vulnerable to downturns in the global automotive market or to cyclical volatility, which could seriously threaten both revenue stability and dividend flows.

- Execution risk around diversification and acquisitions is elevated, as efforts to grow through new segments such as digital services or via recent deals like the Zeaborn acquisition may result in integration challenges, one-off impairment losses, or margin dilution, impacting the quality of earnings and long-term return on invested capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Wilh. Wilhelmsen Holding is NOK732.32, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wilh. Wilhelmsen Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK732.32, and the most bearish reporting a price target of just NOK523.79.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $526.2 million, and it would be trading on a PE ratio of 6.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of NOK461.5, the bullish analyst price target of NOK732.32 is 37.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.