Last Update 21 Nov 25

Fair value Decreased 3.41%HAUTO: Future Discount Rates And Margins Will Shape Measured Outlook

Analysts have modestly reduced their fair value estimate for Höegh Autoliners from NOK 89.98 to NOK 86.91. They cite adjustments to discount rates, anticipated revenue growth, and profit margins in their updated outlook.

Valuation Changes

- Fair Value Estimate has decreased modestly from NOK 89.98 to NOK 86.91.

- Discount Rate has risen slightly from 7.08% to 7.29%.

- Revenue Growth forecast is now less negative, moving from -4.36% to -4.15%.

- Net Profit Margin projection has fallen from 16.66% to 15.54%.

- Future P/E Ratio is nearly unchanged, moving from 10.30x to 10.23x.

Key Takeaways

- Higher operating costs and regulatory pressures threaten margins and growth, while strategy shifts are undermining efficiency until new vessels are deployed.

- Industry overcapacity and accelerating market shifts toward electric vehicles and local production are set to dampen future volume growth and earnings.

- Strong fleet modernization and sustainability efforts, combined with robust contract backlogs and solid financial health, position the company for resilient growth and advantageous market standing.

Catalysts

About Höegh Autoliners- Provides ocean transportation services within the roll-on roll-off (RoRo) cargoes on deep sea and short sea markets in Norway.

- Rising tariffs, port fees, and regulatory headwinds in key export markets are expected to structurally increase Höegh's shipping costs and ultimately lower transported volumes, directly pressuring revenues and potentially compressing net margins over time.

- The global acceleration of electric vehicle adoption, combined with a trend toward more localized production, is likely to reduce long-term transoceanic car exports and diminish the addressable market, weighing on Höegh's future volume growth and top-line expansion.

- A growing global orderbook of new RoRo vessels, including advanced and more fuel-efficient ships, increases the risk of industry overcapacity in the next few years, which may trigger a sustained decline in freight rates, eroding earnings and lowering EBITDA margins.

- The current strategy to "go long" on cargo by accepting greater network imbalances and incurring higher short-term charter costs is resulting in lower operational efficiency and is likely to weigh on net margins until sufficient newbuilds are delivered and utilized.

- Persistent regulatory tightening and the introduction of carbon taxes may require significant incremental investment in fleet upgrades and alternative fuels, further increasing operational expenses and putting downward pressure on net profits and return on capital.

Höegh Autoliners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Höegh Autoliners's revenue will decrease by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 43.5% today to 20.0% in 3 years time.

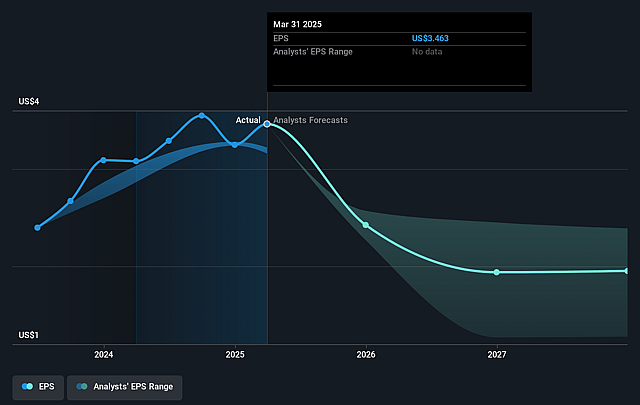

- Analysts expect earnings to reach $246.8 million (and earnings per share of $1.6) by about September 2028, down from $608.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $434.5 million in earnings, and the most bearish expecting $160 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, up from 3.4x today. This future PE is greater than the current PE for the NO Shipping industry at 4.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

Höegh Autoliners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Höegh Autoliners is demonstrating strong volume growth-particularly a 47% increase out of Asia and a rebound in Atlantic volumes-which, combined with a robust contract backlog (average duration of 3.3 years), provides significant revenue and earnings visibility in the coming years.

- Continuous fleet modernization, including the delivery of new Aurora class (fuel-efficient, low-emission, and dual fuel-capable) vessels, is expected to structurally lower per-unit costs and improve net margins as older, less efficient ships are sold.

- Environmental initiatives and sustainability leadership (modern fleet, biofuels, vessel upcycling) position the company favorably for stricter regulations, helping maintain or expand market share and potentially enabling premium pricing or contract wins, thereby supporting future revenues.

- The balance sheet remains solid (54% equity ratio, substantial cash reserves, significant undrawn credit facilities), supporting dividend capacity, funding for newbuilds, and financial resilience-helpful for both maintaining dividends and investing in profitable growth.

- Industry supply-demand fundamentals remain tight due to limited vessel ordering and slow fleet growth, which, together with Hoegh's flexible capacity management and expanding contract base, are likely to support freight rates, vessel utilization, and overall earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK94.215 for Höegh Autoliners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK107.87, and the most bearish reporting a price target of just NOK85.43.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $246.8 million, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 7.0%.

- Given the current share price of NOK108.5, the analyst price target of NOK94.21 is 15.2% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.