Key Takeaways

- Positioned to capitalize on rising demand for alternative assets and open-architecture investing, fueling transformative growth in high-margin platform revenues and market share.

- Ongoing investments in proprietary technology and data solutions set to drive significant operating leverage, with strategic M&A enhancing earnings and long-term competitive advantage.

- Structural industry shifts toward passive investing, digital disintermediation, and rising regulatory and competitive pressures threaten Allfunds' growth, pricing power, and long-term revenue stability.

Catalysts

About Allfunds Group- Operates as a B2B WealthTech company that connects fund houses and distributors in the United Kingdom and internationally.

- While analyst consensus recognizes growth potential from the shift to alternative assets and ETPs, it underestimates the exponential upside as Allfunds is at the very beginning of a multi-year asset mix transformation; with only 11% of its private bank and wealth manager clients currently invested in alternatives, even modest penetration rates could unlock a massive surge in revenues and recurring high-margin fees as the platform becomes the standard gateway for private markets and ETPs.

- Analysts broadly agree the client migration pipeline is significant, but the true opportunity is likely far greater as Allfunds' ongoing market share gains, exceptional distributor win rate (up 40% year-on-year), and consistently conservative guidance signal a structural shift in net flow momentum, supporting sustained double-digit platform revenue growth and a much higher long-term revenue base than currently forecast.

- Allfunds is uniquely positioned to benefit from the accelerating global trend toward open-architecture, multi-asset investing and cross-border fund distribution, enabling it to capture outsize asset flows in both established and underpenetrated regions, thereby driving higher assets under administration, market share, and durable top-line growth.

- The company's aggressive investments in proprietary FundTech, data analytics, and AI-powered solutions have not yet been fully reflected in current valuations; as its digital product suite (including Nextportfolio 4.0 and Allfunds Navigator) takes hold, subscription-based, non-asset-driven revenues are set to rise sharply, leading to a step change in operating leverage and net margin expansion.

- With a growing excess capital buffer, robust free cash flow generation (up 24% in 2024), and a leadership position in an industry primed for consolidation, Allfunds has the strategic flexibility to accelerate earnings and revenue through transformative M&A and bolt-on tech acquisitions while simultaneously executing sizable buybacks-amplifying near

- and long-term earnings per share growth well beyond current consensus expectations.

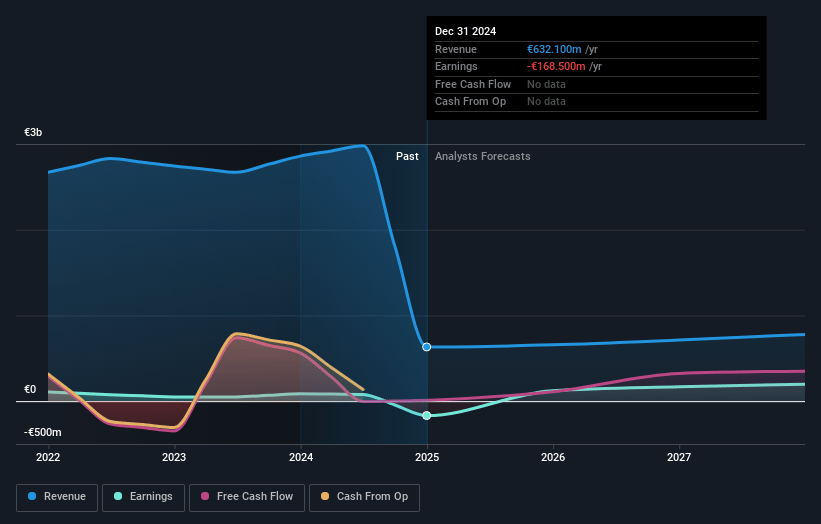

Allfunds Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Allfunds Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Allfunds Group's revenue will grow by 11.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -25.6% today to 34.8% in 3 years time.

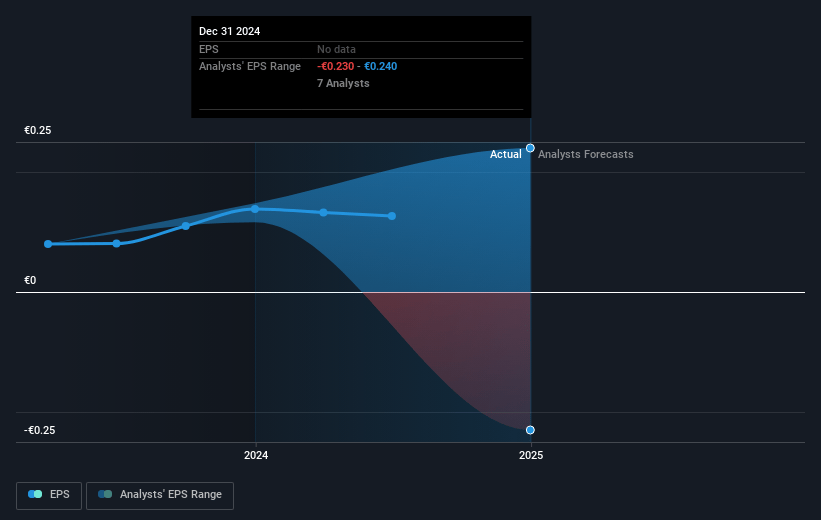

- The bullish analysts expect earnings to reach €317.3 million (and earnings per share of €0.61) by about July 2028, up from €-168.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.4x on those 2028 earnings, up from -25.5x today. This future PE is greater than the current PE for the NL Capital Markets industry at 13.2x.

- Analysts expect the number of shares outstanding to decline by 1.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.24%, as per the Simply Wall St company report.

Allfunds Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Allfunds' core business remains heavily reliant on the distribution of actively managed mutual funds, a segment facing long-term headwinds from investor migration to low-cost passive funds and direct indexing, which threatens to compress its future revenue growth and shrink its addressable market.

- The company operates in a highly regulated, cross-border environment, and rising global regulatory scrutiny-as well as growing complexity and costs of compliance-may increase operational risks and pressure net margins over time.

- The accelerating trend of digital disintermediation in asset management, where asset managers and investors increasingly connect directly via technology, could erode the relevance of wholesale platforms like Allfunds, reducing future transaction volumes and revenues.

- Intensifying competition from both fintech startups and established custodians building their own advanced distribution technology is likely to pressure Allfunds' pricing power and net revenue margins, especially as the margin mix is already impacted by geographic and asset-class shifts toward lower-margin segments such as the UK.

- Although the firm has diversified its client base, it remains exposed to revenue concentration risks from top clients like Santander and Intesa, meaning the loss, renegotiation, or weakening of any key client relationships could create earnings volatility or hurt revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Allfunds Group is €9.4, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Allfunds Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €9.4, and the most bearish reporting a price target of just €5.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €911.7 million, earnings will come to €317.3 million, and it would be trading on a PE ratio of 21.4x, assuming you use a discount rate of 7.2%.

- Given the current share price of €7.05, the bullish analyst price target of €9.4 is 25.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.