Key Takeaways

- Expansion of routes and ongoing infrastructure investments are driving diversification, increased capacity, and long-term growth potential in both core and ancillary revenues.

- Growth of non-aeronautical businesses and strategic international opportunities enhance profitability, diversify income streams, and reduce business model risk.

- Regulatory, operational, and market risks threaten revenue growth, margins, and network expansion, while increased expenses and investments may pressure profitability and dividend sustainability.

Catalysts

About Grupo Aeroportuario del Pacífico. de- Develops, operates, and manages airports in Mexico and Jamaica.

- Expansion of international and domestic routes, including new services to Canada and potential routes to Madrid and South America, signals continued diversification of passenger sources and positions GAP to capture increased leisure and VFR travel; this is expected to drive sustained revenue growth and improve EBITDA as volumes rise.

- Ongoing and planned infrastructure investments-such as new terminals in Guadalajara and Puerto Vallarta, capacity enhancements, and modernization-will enable higher passenger throughput and expanded commercial space, supporting long-term growth in both aeronautical and non-aeronautical revenues as well as higher margins per passenger.

- The structural growth of Mexico and Latin America's middle class, rising disposable income, and urbanization are underpinning secular increases in air travel demand, positioning GAP's network for resilient and compounding top-line growth.

- The integration and expansion of high-margin non-aeronautical businesses (e.g., cargo, bonded warehouses, hotels, retail, parking) continue to diversify revenue streams, enhance profitability, and cushion against cyclicality in pure passenger traffic, supporting margin expansion and net income acceleration.

- Strategic pursuit of inorganic opportunities (e.g., Turks and Caicos, CCR Airports) and thoughtful capital allocation provides potential upside for both traffic growth and geographic diversification, which would be supportive for longer-term earnings growth and lower overall risk in the business model.

Grupo Aeroportuario del Pacífico. de Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Grupo Aeroportuario del Pacífico. de's revenue will grow by 18.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 28.0% today to 30.3% in 3 years time.

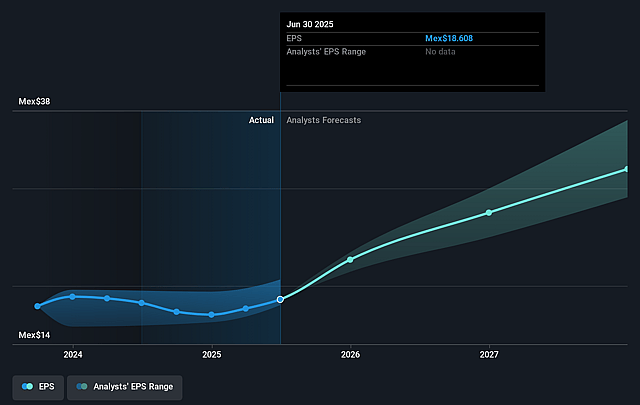

- Analysts expect earnings to reach MX$16.6 billion (and earnings per share of MX$32.99) by about August 2028, up from MX$9.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting MX$18.9 billion in earnings, and the most bearish expecting MX$13.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, down from 24.4x today. This future PE is greater than the current PE for the US Infrastructure industry at 16.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.34%, as per the Simply Wall St company report.

Grupo Aeroportuario del Pacífico. de Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing and potential future U.S. immigration enforcement and policy changes threaten key VFR (Visiting Friends and Relatives) traffic between Mexico and the U.S., with management noting that this segment represents about 38% of GAP's international passenger base; this could negatively impact international passenger revenues and overall topline growth.

- Fluctuations in the exchange rate, particularly Peso depreciation and uncertainty in future FX and inflation trends, are affecting tariff fulfillment and could limit the company's ability to fully implement tariff increases, thereby pressuring revenue growth and potentially compressing net margins.

- Rising operational and maintenance expenses, along with integration of lower-margin acquisitions (such as cargo and bonded warehouse facilities, hotels, and increased direct management of airport operations due to regulation changes), are applying downward pressure to EBITDA margins and profitability.

- Sustained high CapEx requirements for infrastructure upgrades and expansions, as well as acquisition ambitions (such as Turks and Caicos and CCR Airports), may increase leverage and strain free cash flow, potentially leading to greater reliance on debt and putting medium-term dividend sustainability at risk.

- Industry and regulatory risks-such as U.S. Department of Transportation concerns about anti-competitive behavior or changes to bilateral aviation agreements-could restrict Mexican carriers' access to U.S. routes, limit network expansion, and reduce passenger volumes, undermining longer-term revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of MX$451.3 for Grupo Aeroportuario del Pacífico. de based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MX$506.0, and the most bearish reporting a price target of just MX$371.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MX$54.8 billion, earnings will come to MX$16.6 billion, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 16.3%.

- Given the current share price of MX$446.26, the analyst price target of MX$451.3 is 1.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.