Key Takeaways

- The ongoing shift to multifunction devices and fierce competition threaten Casio's core products, limiting growth and compressing margins.

- Environmental regulations and rapid consumer shifts increase costs and revenue risks, raising concerns over earnings stability and market relevance.

- Sharpened focus on premium segments, EdTech, innovation, and digital transformation is driving higher efficiency, margin expansion, and long-term global revenue growth potential.

Catalysts

About Casio ComputerLtd- Develops, produces, and sells consumer, system equipment, and other products.

- The persistent global shift toward multifunction digital devices and smartphones continues to erode the demand for Casio's core standalone product categories such as watches and calculators, which is likely to put ongoing pressure on top-line revenue and limit future growth opportunities.

- Intensifying competition from low-cost manufacturers and established tech giants is expected to further erode Casio's pricing power and differentiation, which may result in lower gross margins and continued compression in earnings as the company struggles to defend its market share.

- Despite investments in new business areas like AI pet robots and incremental improvements to wearables, Casio faces a significant risk of product obsolescence and an inability to meaningfully penetrate high-growth premium smart wearable segments, likely leading to stagnant or declining net margins over the long term.

- Increasing global e-waste concerns and stricter environmental regulations will likely raise compliance and R&D costs, putting additional pressure on capital expenditures and further reducing operating margins.

- Shortening product life cycles and rapidly changing consumer preferences in consumer electronics will drive up research and development as well as inventory management costs, contributing to elevated risks of revenue shortfalls and unsold inventory, which could negatively impact both earnings stability and return on equity moving forward.

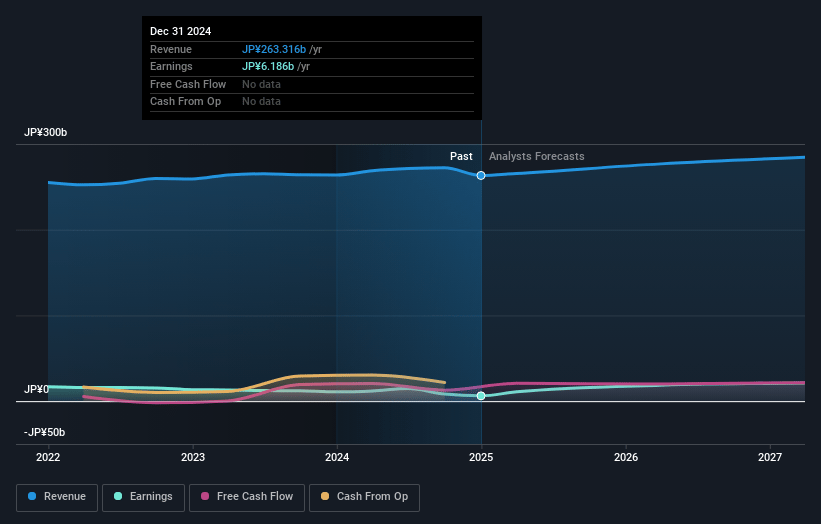

Casio ComputerLtd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Casio ComputerLtd compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Casio ComputerLtd's revenue will decrease by 0.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.1% today to 6.9% in 3 years time.

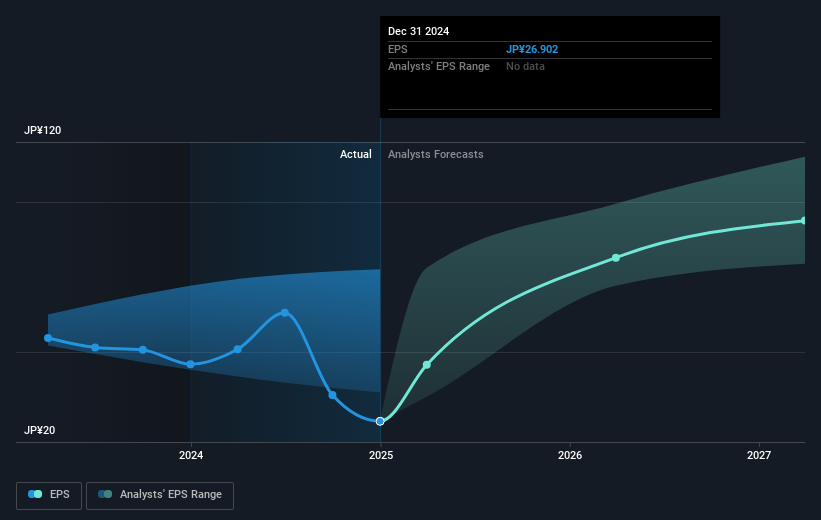

- The bearish analysts expect earnings to reach ¥18.5 billion (and earnings per share of ¥81.41) by about July 2028, up from ¥8.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, down from 32.8x today. This future PE is greater than the current PE for the JP Consumer Durables industry at 10.9x.

- Analysts expect the number of shares outstanding to decline by 0.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.54%, as per the Simply Wall St company report.

Casio ComputerLtd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Casio's strategic focus on the premium and mid-to-high price segment of G-SHOCK, expansion into higher-grade Casio watch lines, and emphasis on global brand ambassadors have the potential to grow revenues and improve gross margin, especially as demand from the global middle class and emerging markets continues to rise.

- The company is actively reallocating resources toward core businesses and growth opportunities while divesting loss-making operations, which could lead to improved capital efficiency, higher operating margins, and more robust earnings over the long term.

- Casio's investments in EdTech, including proprietary educational apps like ClassPad.net and Q.Bank, position it well to benefit from secular trends such as the proliferation of remote/hybrid learning and the global need for digital learning tools, supporting both top-line revenue and recurring revenue streams.

- The successful launch and positive market reception of the AI-powered pet robot demonstrates Casio's capacity for innovation and diversification into new high-margin domains like mental wellness, suggesting potential for new business lines to supplement long-term profit growth.

- Ongoing digital transformation across direct-to-consumer e-commerce channels and customer relationship management is likely to strengthen Casio's pricing power and support operating margin expansion if executed successfully.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Casio ComputerLtd is ¥1070.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Casio ComputerLtd's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥1700.0, and the most bearish reporting a price target of just ¥1070.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ¥267.0 billion, earnings will come to ¥18.5 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 6.5%.

- Given the current share price of ¥1158.5, the bearish analyst price target of ¥1070.0 is 8.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.