Key Takeaways

- AI-driven innovation and strategic acquisitions are set to make Persol the dominant leader in Japan's recruitment market with strong, sustainable margin expansion.

- Structural labor shortages and high demand for tech talent will accelerate growth and profitability across Persol's diversified business units and APAC presence.

- Wage inflation, rising tech investment, demographic shifts, competition from HR tech, and geographic concentration present significant risks to profitability, growth, and market stability.

Catalysts

About Persol HoldingsLtd- Provides human resource services under the PERSOL brand worldwide.

- Analysts broadly agree that the Career SBU's adoption of AI and generative AI will drive efficiency and revenue; however, the true transformative effect is likely understated, as AI-driven process improvements and candidate targeting could unlock exponential growth and sustainable double-digit margin expansion, positioning Persol as the unmatched market leader in Japan's recruitment market.

- While analyst consensus expects APAC facility management growth to incrementally enhance regional profitability, persistent double-digit contract growth-now backed by multi-year, system-focused investments-can drive compounding revenue acceleration and margin lift as Persol captures increasing regional market share in high-growth economies and the APAC segment becomes a major profit engine.

- Surging demand for tech and engineering talent and Persol's proven ability to grow its technology headcount by 18% year on year positions the Technology SBU to tap into long-term labor shortages and digital transformation tailwinds, fueling outperformance in revenues and sustained high double-digit EBITDA margin expansion.

- As aging demographics intensify labor shortages in Japan and across developed markets, structural demand for flexible staffing, upskilling, and HR outsourcing is set to accelerate, enabling Persol's diversified SBUs to drive robust topline growth and enhanced pricing power across its service spectrum.

- Recent strategic acquisitions, including the Fujitsu BPO subsidiary, lay the groundwork for major cross-selling synergies and service integration, further increasing recurring revenue, reducing churn, and bolstering both net margins and return on invested capital over the next several years.

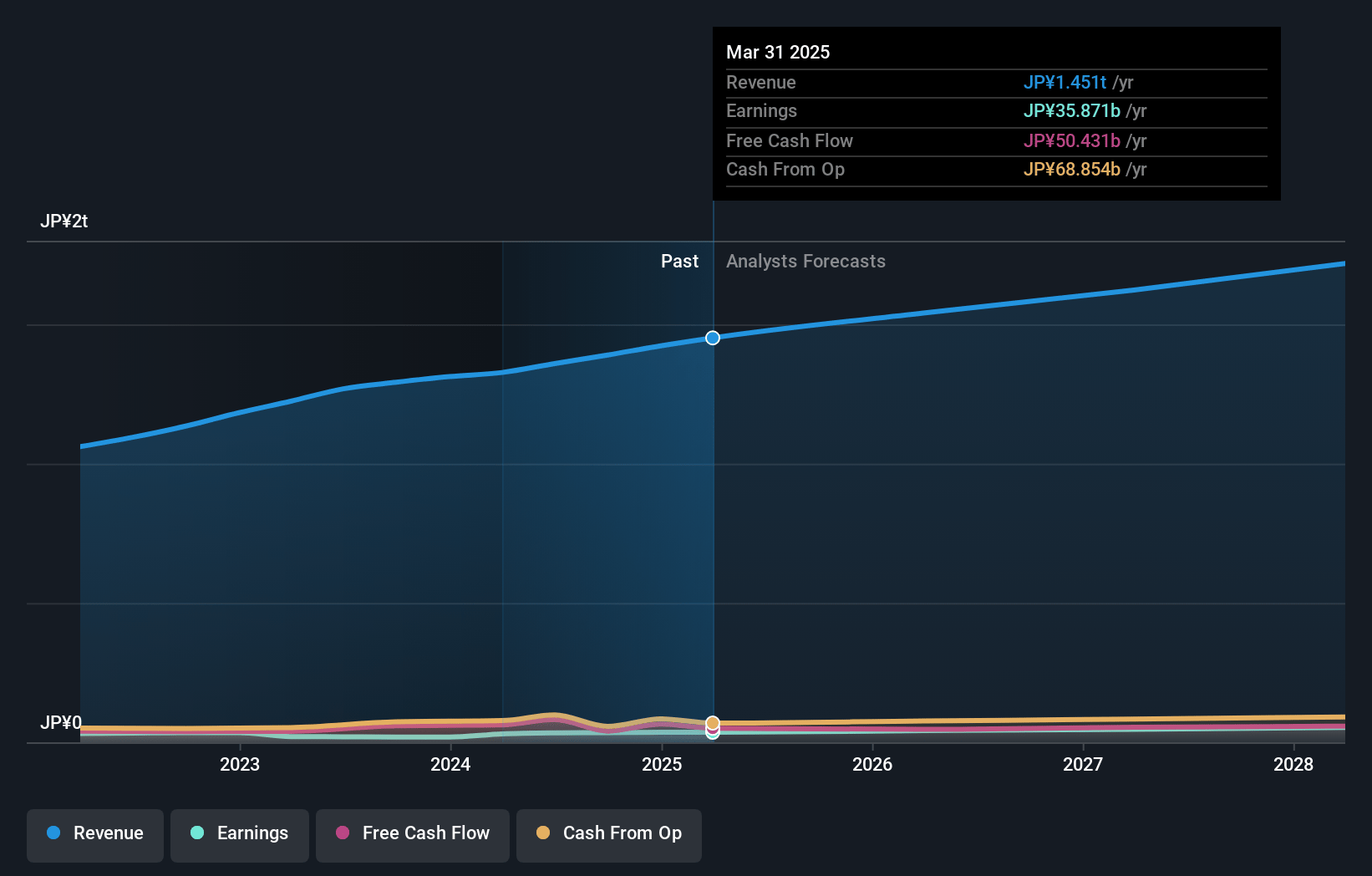

Persol HoldingsLtd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Persol HoldingsLtd compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Persol HoldingsLtd's revenue will grow by 6.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.5% today to 3.3% in 3 years time.

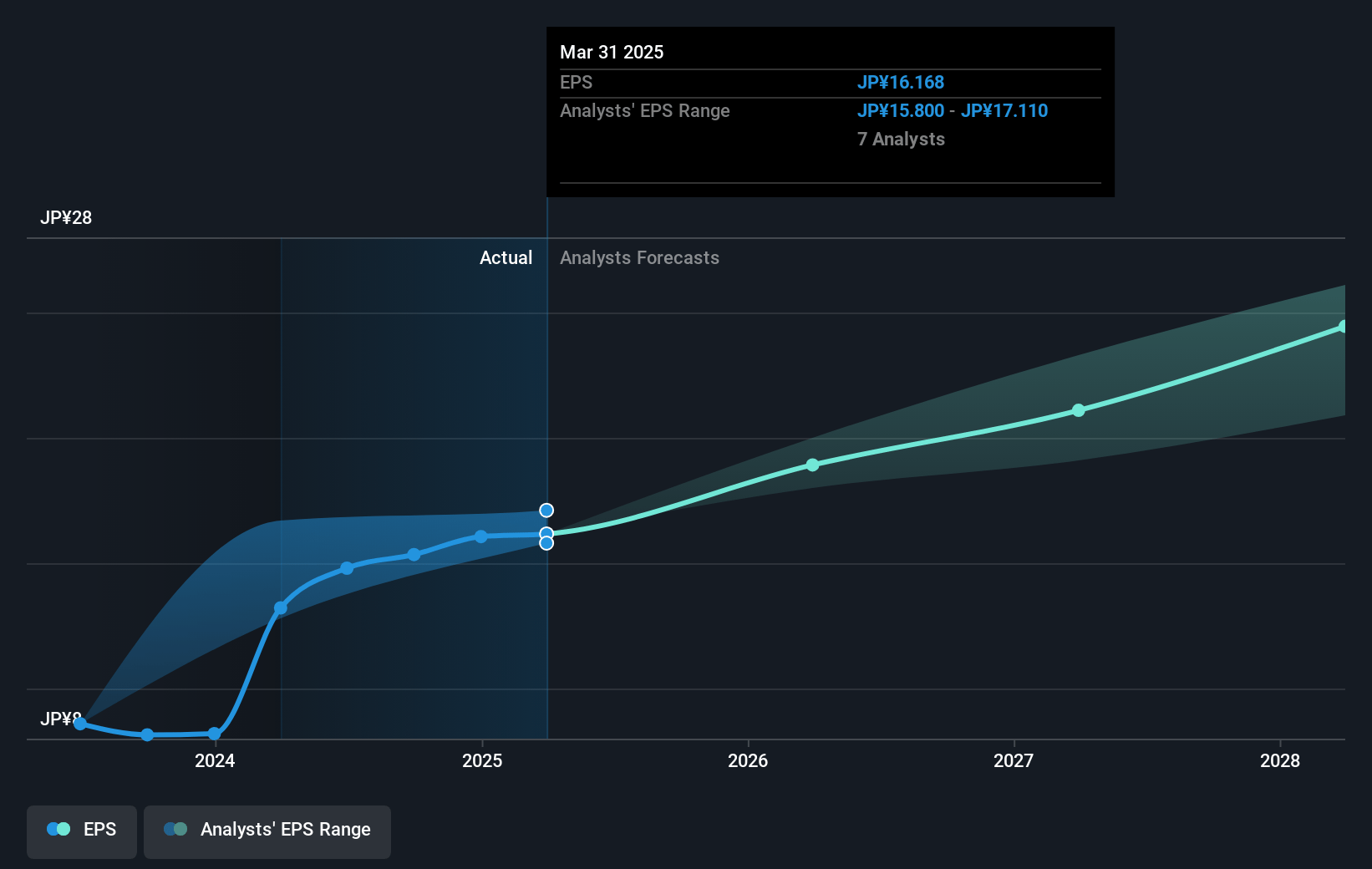

- The bullish analysts expect earnings to reach ¥58.2 billion (and earnings per share of ¥26.82) by about July 2028, up from ¥35.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.3x on those 2028 earnings, down from 17.7x today. This future PE is greater than the current PE for the JP Professional Services industry at 15.9x.

- Analysts expect the number of shares outstanding to decline by 2.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.07%, as per the Simply Wall St company report.

Persol HoldingsLtd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent margin compression due to wage inflation is already evident, as the company failed to secure certain tax deductions tied to wage increases, causing higher-than-expected taxes and pressuring net margins and near-term earnings.

- Rising investment needs in technology, systems, and digital transformation-for example, repeated multi-year capital outlays in the Asia-Pacific and Career segments-could weigh on operating expenses and limit cash flow, potentially eroding net margins if revenue growth slows.

- Demographic headwinds in Japan, with shrinking working-age populations, pose long-term risks to staffing demand, threatening to shrink Persol's domestic addressable market and thus future revenue growth.

- Growing competition from HR tech startups and freelance/gig platforms threatens to disrupt Persol's traditional business, endangering its market share and potentially driving fee deflation that would reduce both revenue and operating profit.

- The company's substantial revenue and profit reliance on Japanese and nearby Asia Pacific markets, combined with limited diversification, leaves it vulnerable to local macroeconomic shocks or regulatory changes, creating risk to both revenue and earnings stability over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Persol HoldingsLtd is ¥395.92, which represents two standard deviations above the consensus price target of ¥295.38. This valuation is based on what can be assumed as the expectations of Persol HoldingsLtd's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥410.0, and the most bearish reporting a price target of just ¥233.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ¥1773.1 billion, earnings will come to ¥58.2 billion, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 5.1%.

- Given the current share price of ¥285.6, the bullish analyst price target of ¥395.92 is 27.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.