Key Takeaways

- Expanding renewable capacity, rapid project turnarounds, and first-mover advantage in energy storage position JSW Energy to outperform sector growth and consensus earnings forecasts.

- Supply chain localization and operational efficiency strengthen margins, providing resilience against inflation and policy shifts while supporting superior long-term profitability.

- High leverage, execution challenges, margin pressure from competition, counterparty risk, and exposure to thermal assets threaten profitability and undermine the long-term growth outlook.

Catalysts

About JSW Energy- Generates and sells power in India.

- Analysts broadly agree that the O2 Power acquisition will add substantial renewable capacity and long-term PPA-driven revenues, but the consensus may significantly understate the value of rapid commissioning and double-digit GWh energy storage additions, positioning JSW as the dominant player able to capture surging demand for flexible renewable supply, thereby meaningfully accelerating revenue growth and enhancing margins beyond consensus estimates.

- While the consensus recognizes improved earnings from the KSK Mahanadi acquisition, it underappreciates the swift post-acquisition operational turnaround-PLF rising from 67% to 79% within 25 days-combined with ongoing cost rationalization and domestic fuel supply, which can drive outsized incremental EBITDA and cash flows, supporting faster debt reduction and improving net margins ahead of current forecasts.

- JSW Energy's first-mover advantage in large-scale energy storage and hybrid (wind/solar/storage) solutions provides a structural lead in meeting India's increasingly complex demand profile; this positions the company to attract premium tariffs and lock in higher-margin long-term corporate PPAs, materially lifting medium

- to long-term earnings visibility and net margins.

- The scale and speed of JSW Energy's rollout-targeting 30 GW of capacity and 40 GWh of storage by FY30-leverages India's unparalleled power demand growth due to rapid urbanization and industrialization, unlocking compounding multi-year revenue growth that should outstrip sector and consensus expectations.

- A focused approach on supply chain localization-such as in-house wind blade manufacturing and agile solar module procurement-will fortify margins and enhance returns on capital employed, turning potential headwinds from cost inflation or policy shifts into a competitive advantage, and driving sustained improvements in company-wide profitability.

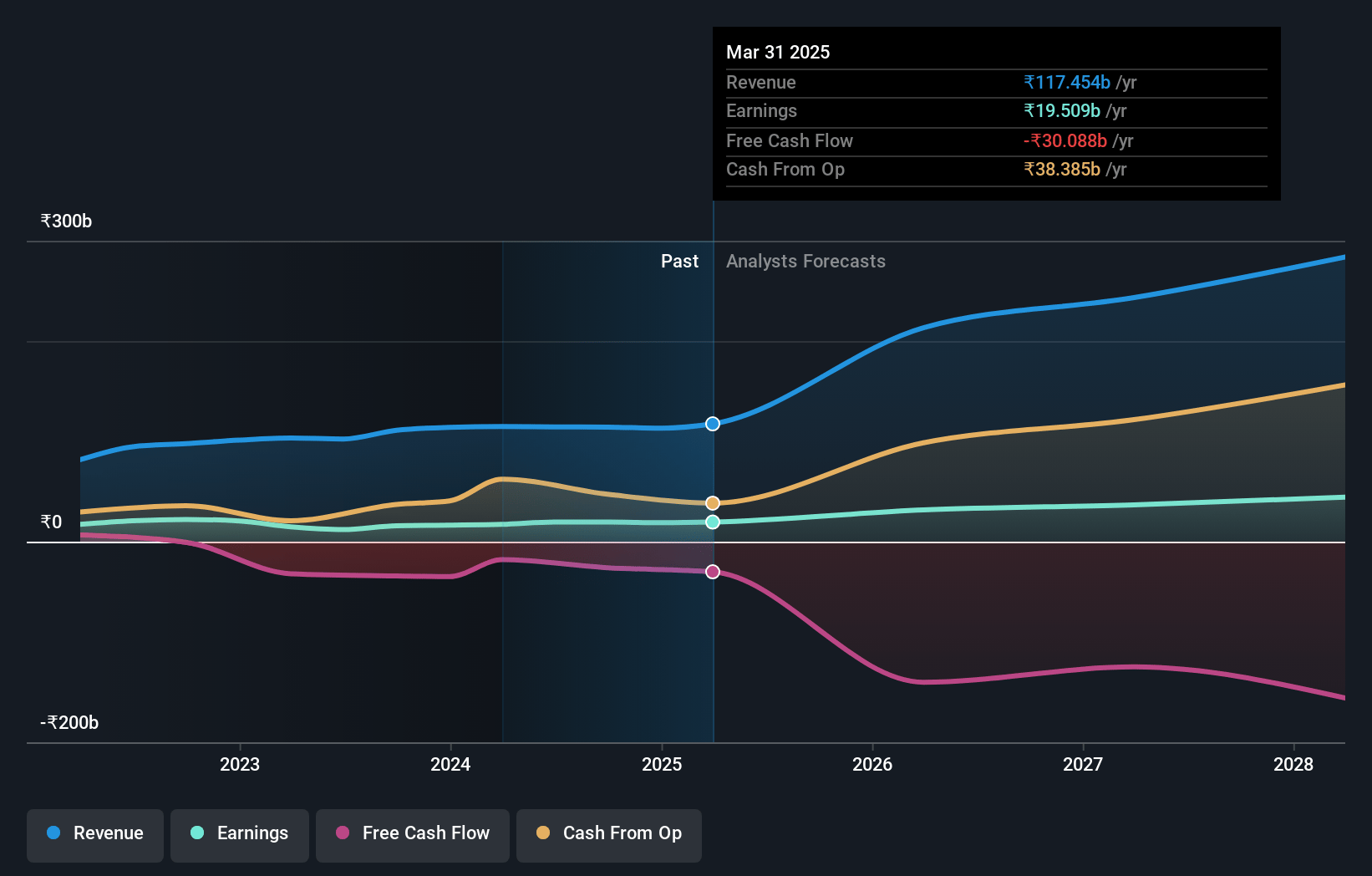

JSW Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on JSW Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming JSW Energy's revenue will grow by 40.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.6% today to 18.8% in 3 years time.

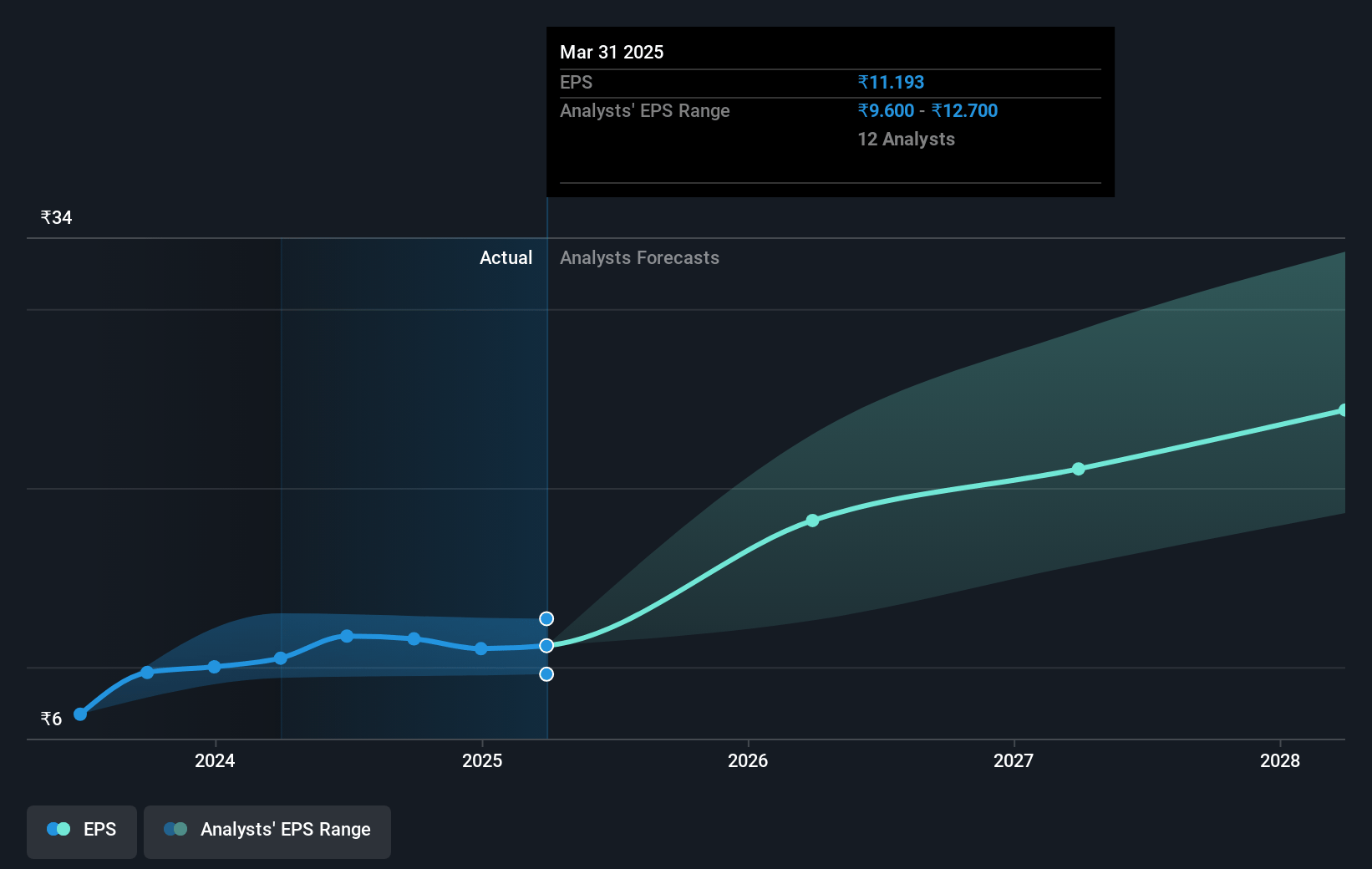

- The bullish analysts expect earnings to reach ₹61.4 billion (and earnings per share of ₹34.66) by about July 2028, up from ₹19.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 36.6x on those 2028 earnings, down from 46.8x today. This future PE is greater than the current PE for the IN Renewable Energy industry at 30.8x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.74%, as per the Simply Wall St company report.

JSW Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's strategy relies on unprecedented capital expenditure of ₹1,30,000 crores by FY30, and with net debt already at ₹44,000 crores and net debt to pro forma EBITDA near 5x, further borrowing at rising or high interest rates could pressure net margins and constrain future earnings if returns do not materialize swiftly.

- Increasing competition and oversupply in renewable equipment manufacturing, particularly from China and within India itself, could lead to lower realized tariffs and compress profit margins on new projects, negatively impacting revenue growth and returns on investment.

- Delays and execution risks in land acquisition, securing transmission connectivity, or obtaining regulatory clearances-already cited as sector challenges-could lead to project delays, cost overruns, and deferred cash flows that would hurt both topline revenue and overall profitability.

- The company faces significant counterparty risk due to heavy reliance on long-term power purchase agreements with state utilities; any payment delays, changes in policy, or financial distress at these counterparties could increase receivables, strain working capital, and adversely impact free cash flow.

- JSW Energy's legacy thermal assets, along with recent large-scale thermal acquisitions, expose the company to carbon price risks, potential stricter emissions regulations, and future declines in merchant or regulated tariffs for coal-based power-even as the global trend and policy support shift increasingly toward renewables, thereby risking revenue and margin contraction over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for JSW Energy is ₹842.75, which represents two standard deviations above the consensus price target of ₹588.29. This valuation is based on what can be assumed as the expectations of JSW Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹885.0, and the most bearish reporting a price target of just ₹420.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹326.3 billion, earnings will come to ₹61.4 billion, and it would be trading on a PE ratio of 36.6x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹523.6, the bullish analyst price target of ₹842.75 is 37.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.