Key Takeaways

- Large capital investment and rising debt increase vulnerability to interest rate hikes, threatening profitability and shareholder returns if new projects underperform.

- Aggressive expansion in renewables heightens risks from technological disruption, counterparty reliability issues, and margin compression amid potential industry oversupply.

- Strategic expansion in renewables, strong risk management, and prudent financial discipline position JSW Energy for sustained growth, revenue stability, and enhanced profitability.

Catalysts

About JSW Energy- Generates and sells power in India.

- JSW Energy's ambitious plan to invest around 130,000 crores in capital expenditure over the next five years compounds exposure to rising global interest rates. As long-term debt already stands at about 44,000 crores with net debt to pro forma EBITDA at five times, continued rate hikes and higher financing costs will erode profitability, create sustained pressure on net margins, and reduce shareholder returns, especially if incremental returns on new projects fail to exceed the rising cost of capital.

- The company's aggressive shift towards utility-scale renewable and storage projects puts it at risk from rapid technological disruption. If distributed energy systems or more advanced storage technologies become more cost-effective, projected demand and pricing power for JSW's large-scale green assets could be undermined, resulting in revenue and EBITDA forecasts falling materially short of current expectations.

- JSW Energy's heavy reliance on long-term power purchase agreements, particularly with financially strained state distribution companies (DISCOMs), significantly increases counterparty risk. Payment delays or regulatory changes impacting these contracts could lead to substantial receivable buildups, thereby straining cash flows and limiting the company's ability to self-fund future expansion.

- Persistent execution risk, including cost overruns and delays across its massive multi-gigawatt construction pipeline, may cause operating expenses to balloon and planned capacity additions to fall short, compressing return on invested capital and dragging down overall earnings growth.

- The accelerating pace of renewable capacity addition across India is likely to result in industry-wide oversupply, triggering tariff wars that will compress margins and directly limit JSW Energy's ability to achieve the elevated revenue and margin expectations being priced in currently.

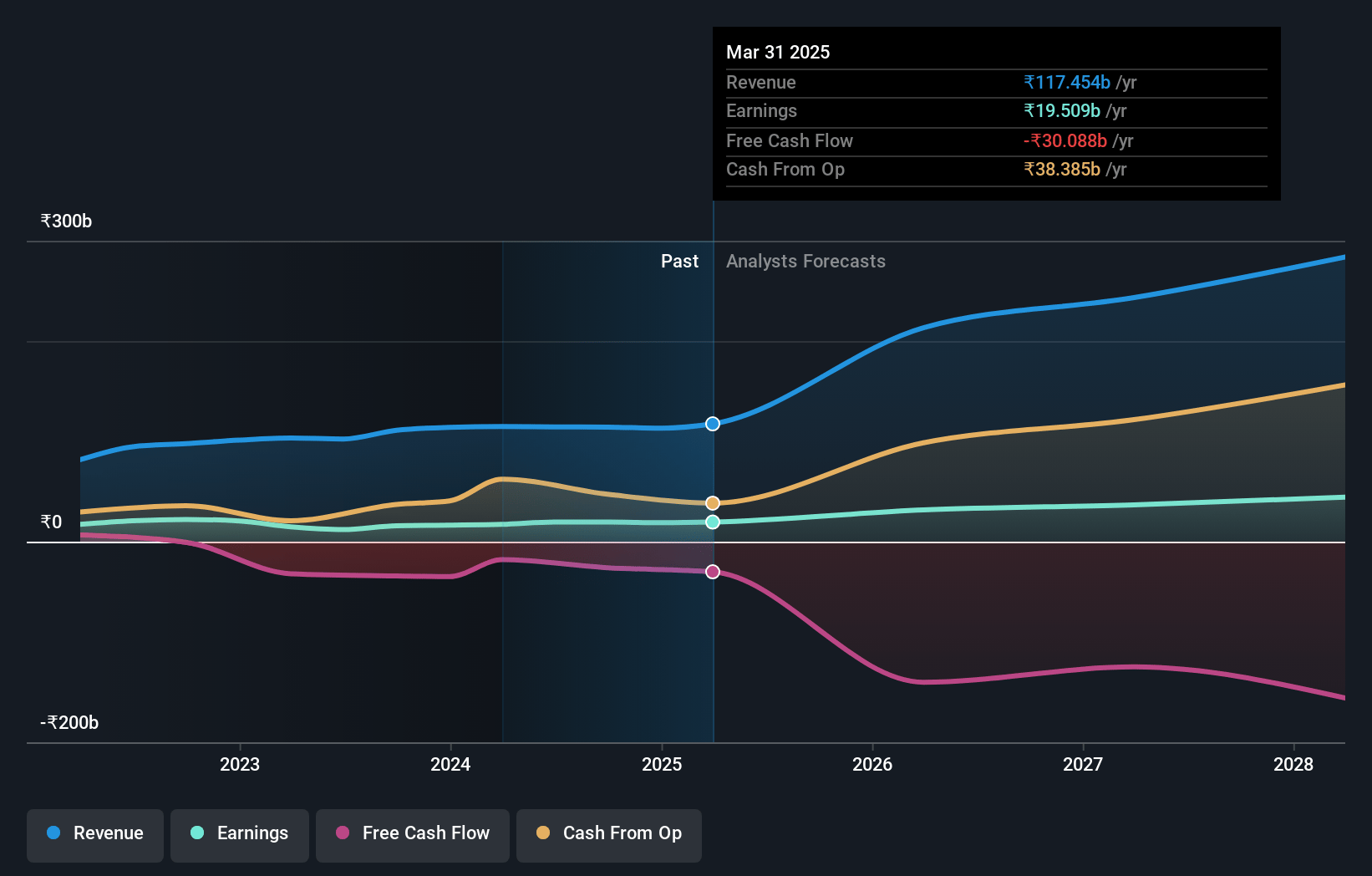

JSW Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on JSW Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming JSW Energy's revenue will grow by 32.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 16.6% today to 12.7% in 3 years time.

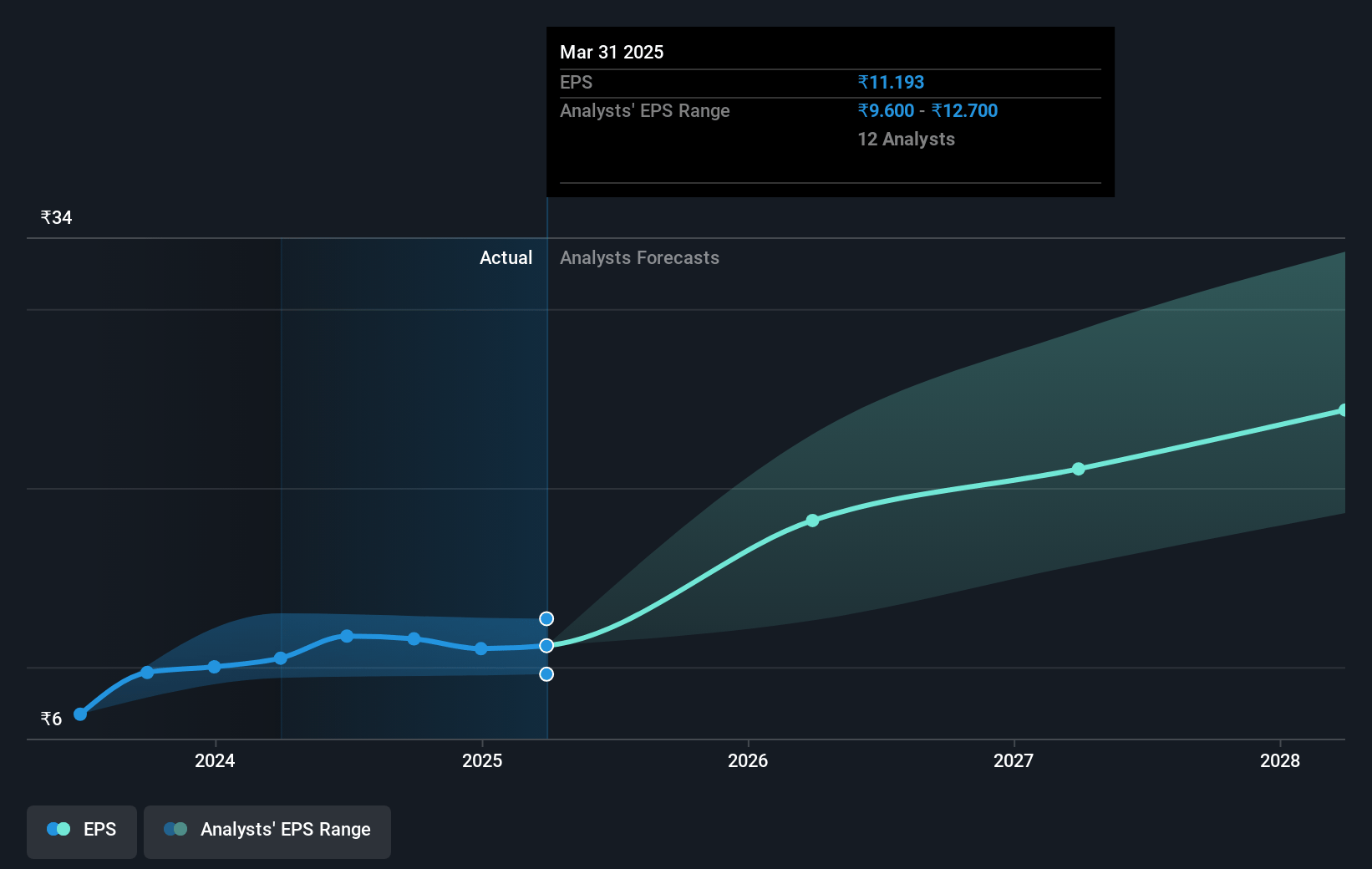

- The bearish analysts expect earnings to reach ₹34.4 billion (and earnings per share of ₹19.44) by about July 2028, up from ₹19.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 32.5x on those 2028 earnings, down from 47.6x today. This future PE is greater than the current PE for the IN Renewable Energy industry at 31.7x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.71%, as per the Simply Wall St company report.

JSW Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust long-term power demand growth in India, driven by economic expansion, urbanization, and an increase in baseload as well as peak loads, provides a strong tailwind for JSW Energy's volume growth, supporting topline revenue expansion in the years ahead.

- Aggressive and successful execution of both organic and inorganic capacity additions, especially in renewables and energy storage, positions JSW Energy to capture growing market share and ensures long-term scalability, which is likely to enhance both revenue and future net earnings.

- Comprehensive portfolio de-risking, with a high proportion of capacity under long-term power purchase agreements and a deliberate shift towards domestic coal supply, significantly enhances revenue stability and reduces fuel cost volatility, which protects and may improve net profit margins.

- Focused investments in energy storage and grid stabilization (with 28.3 GWh logged-in and more to come), combined with ambitions to stay at the forefront of grid modernization, create new ancillary revenue streams with higher margin potential, supporting both earnings growth and margins in the long term.

- Track record of financial prudence, selective bidding, and strong project execution capabilities allows for calibrated leverage despite large capital expenditure plans; this, together with a healthy pipeline and internal cash generation, could support balance sheet health and sustain earnings growth through FY 2030.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for JSW Energy is ₹420.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of JSW Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹885.0, and the most bearish reporting a price target of just ₹420.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹270.4 billion, earnings will come to ₹34.4 billion, and it would be trading on a PE ratio of 32.5x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹531.75, the bearish analyst price target of ₹420.0 is 26.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.